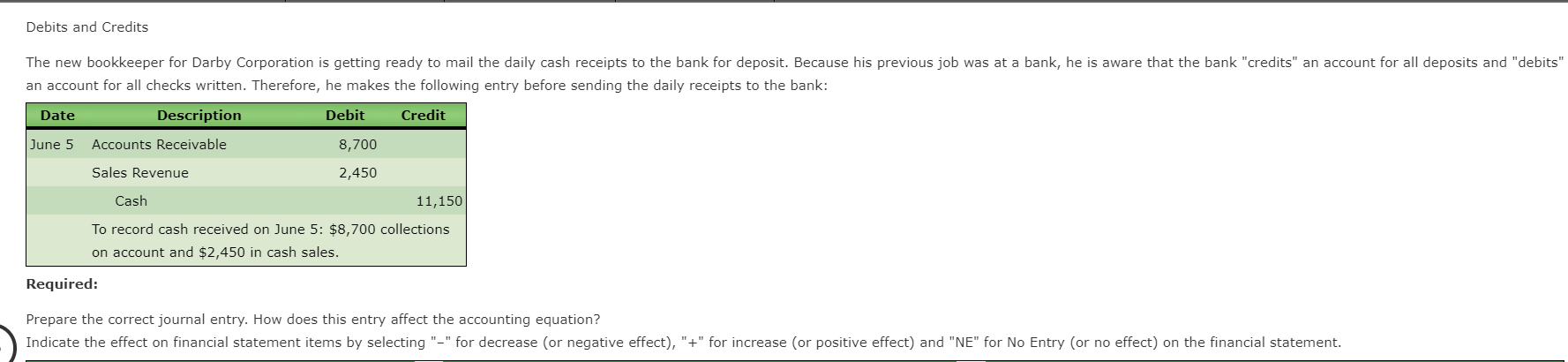

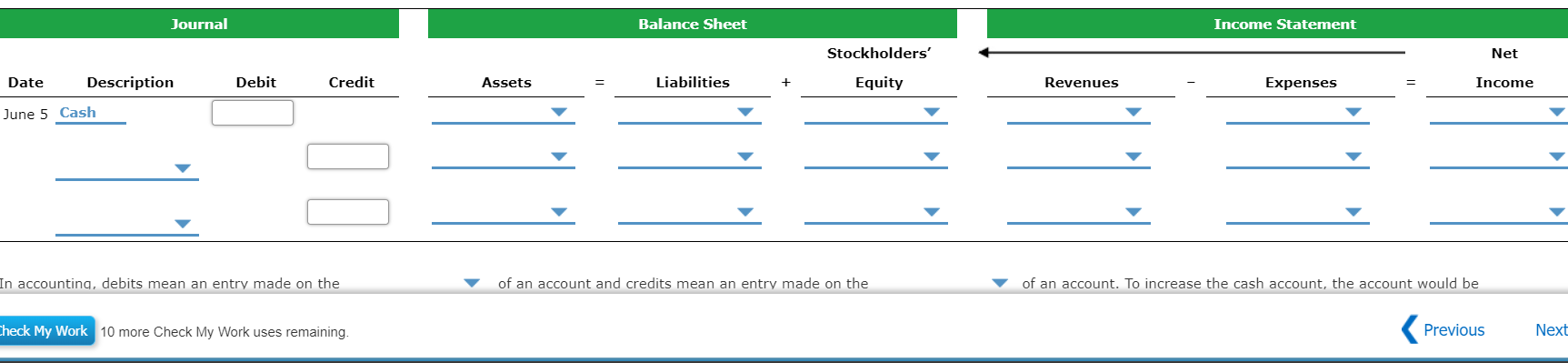

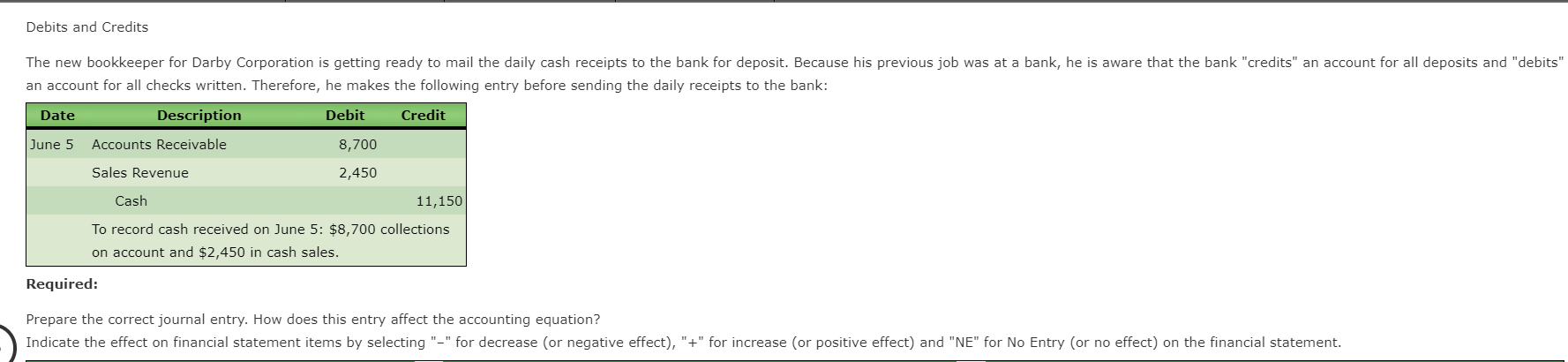

Q1: Debits and Credits The new bookkeeper for Darby Corporation is getting ready to mail the daily cash receipts to the bank for deposit. Because his previous job was at a bank, he is aware that the bank "credits" an account for all deposits and "debits" an account for all checks written. Therefore, he makes the following entry before sending the daily receipts to the bank:

Q2:

Q2:

Journal Entries, Trial Balance, and Financial Statements

Blue Jay Delivery Service is incorporated on January 2 and enters into the following transactions during its first month of operations.

Required:

1. Prepare journal entries on the books of Blue Jay to record the transactions entered into during the month.

Indicate the effect on financial statement items by selecting "" for decrease (or negative effect), "+" for increase (or positive effect) and "NE" for No Entry (or no effect) on the financial statement.

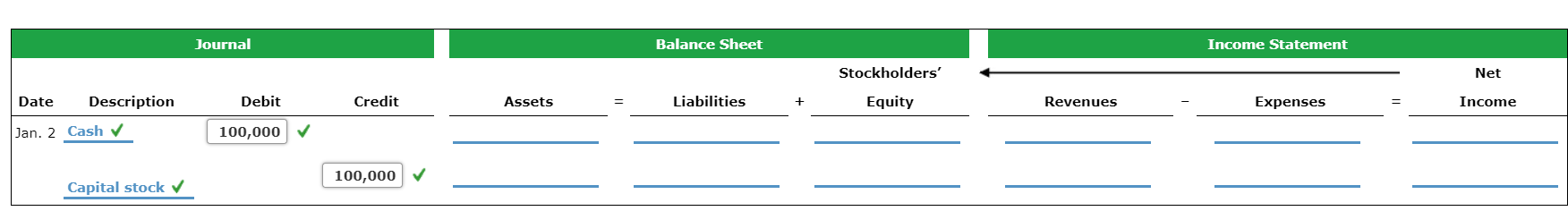

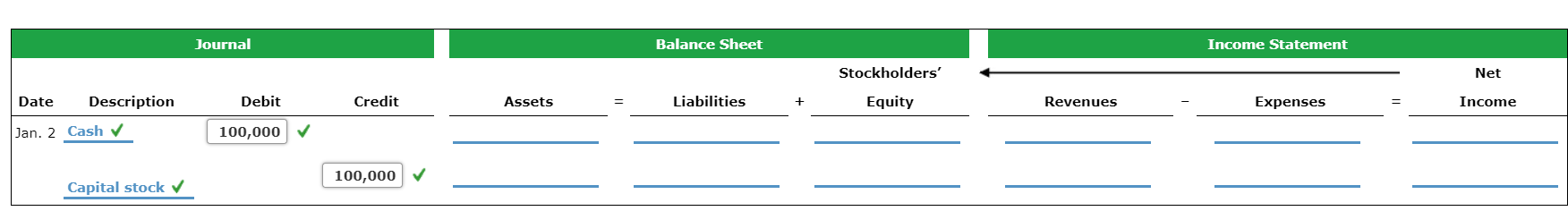

January 2: Filed articles of incorporation with the state and issued 100,000 shares of capital stock. Cash of $100,000 is received from the new owners for the shares.

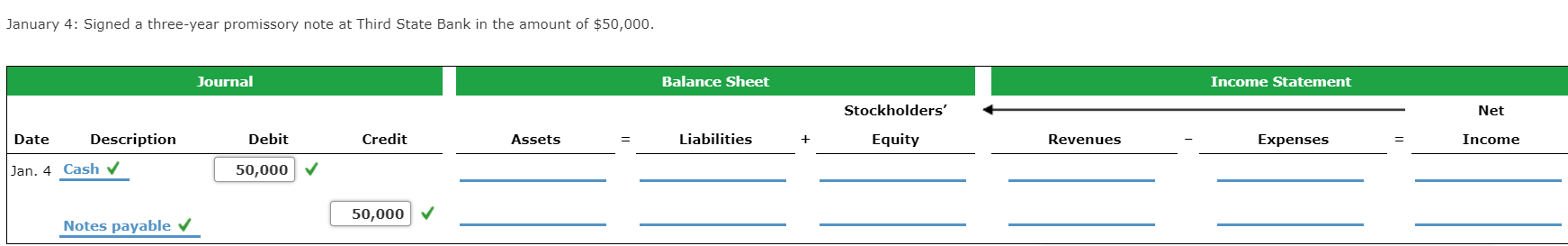

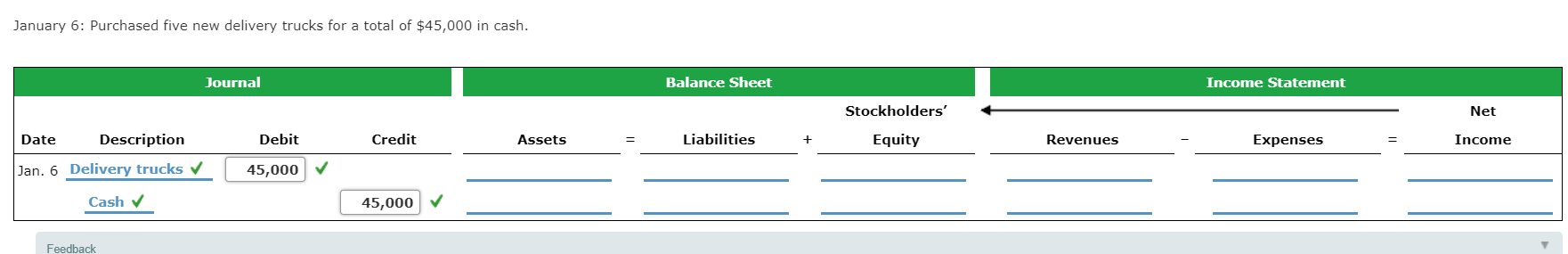

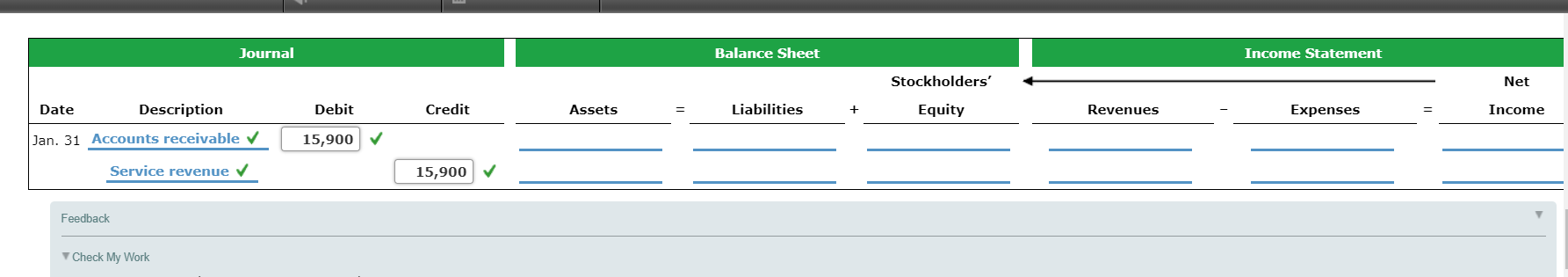

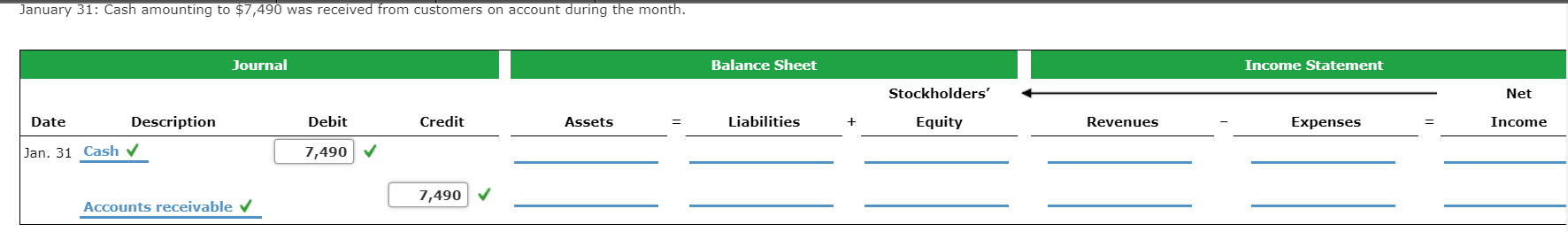

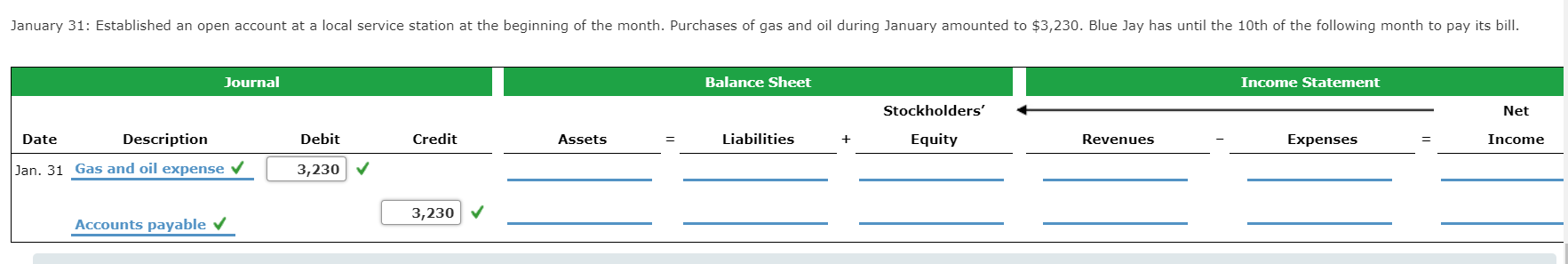

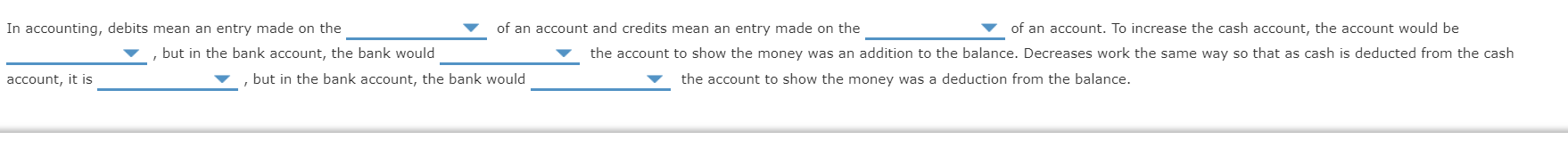

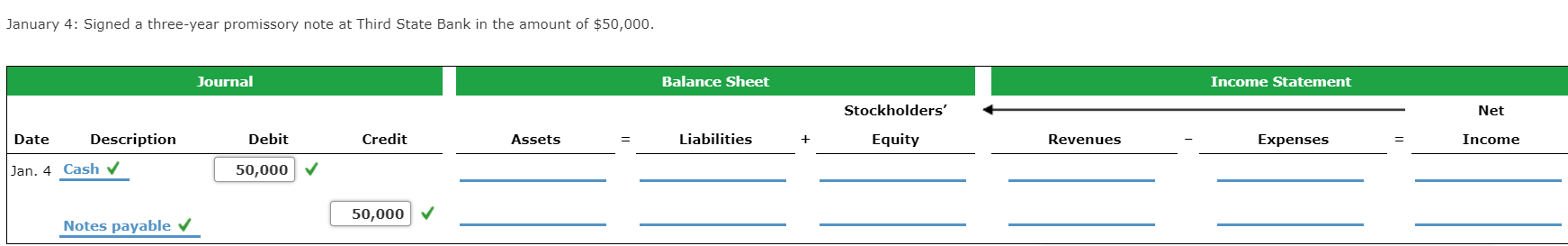

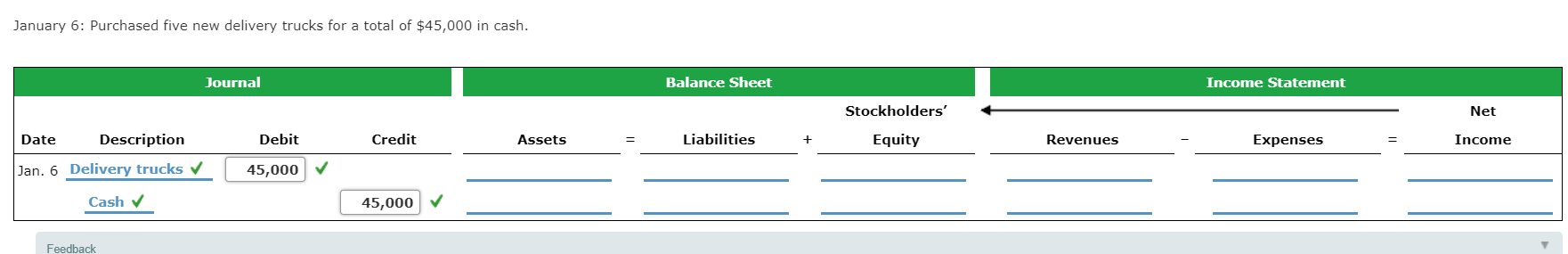

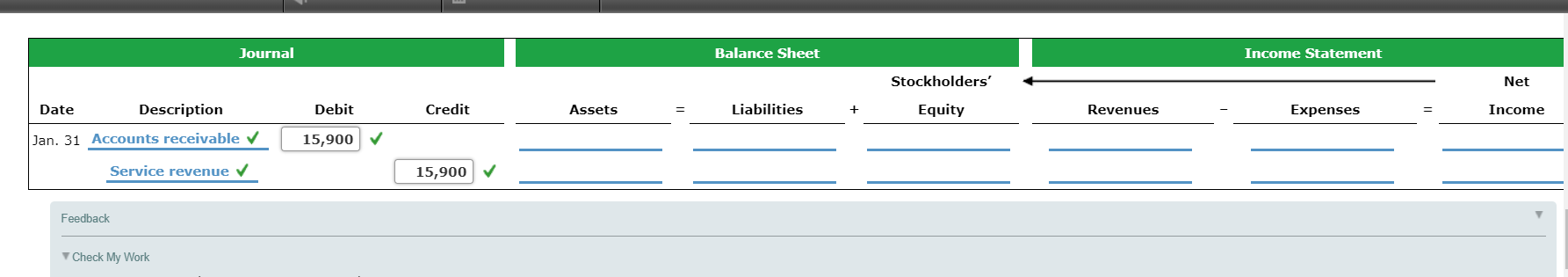

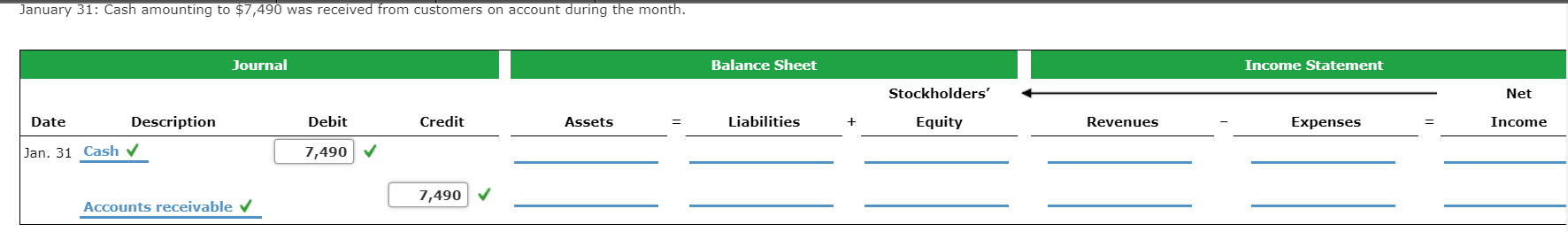

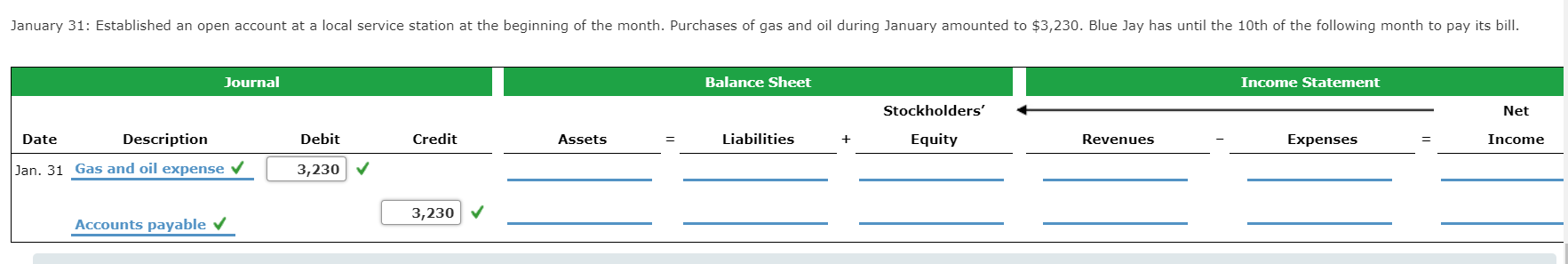

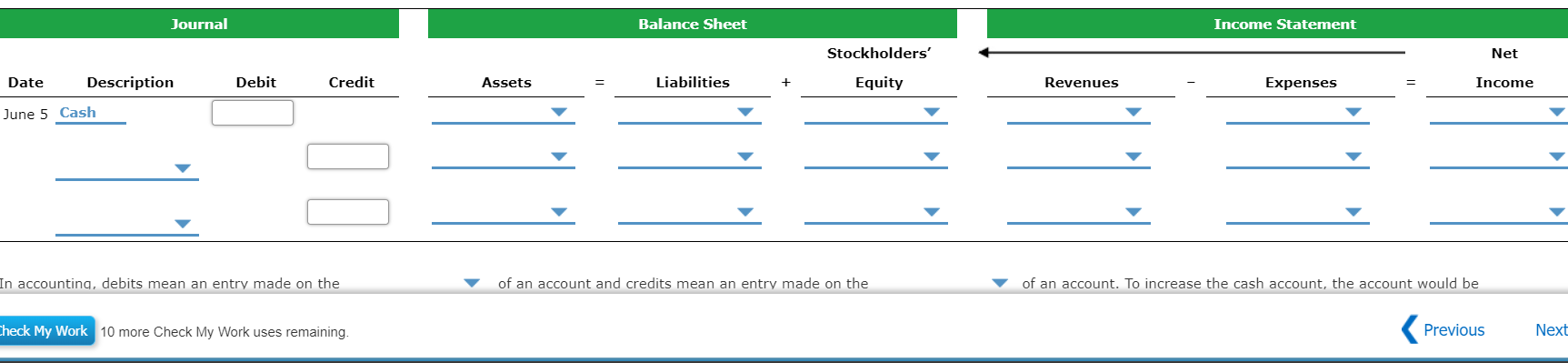

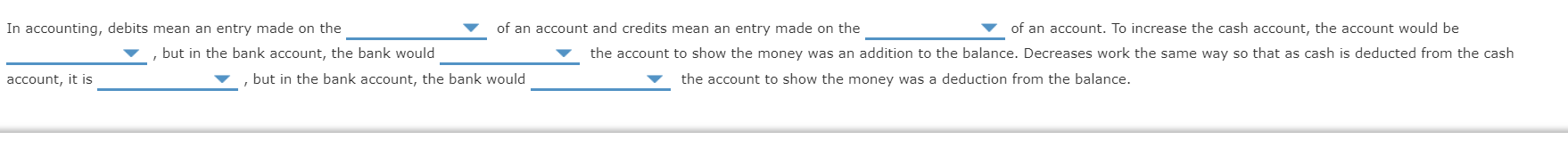

Debits and Credits The new bookkeeper for Darby Corporation is getting ready to mail the daily cash receipts to the bank for deposit. Because his previous job was at a bank, he is aware that the bank "credits" an account for all deposits and "debits" an account for all checks written. Therefore, he makes the following entry before sending the daily receipts to the bank: Date Description Debit Credit June 5 Accounts Receivable 8,700 Sales Revenue 2,450 Cash 11,150 To record cash received on June 5: $8,700 collections on account and $2,450 in cash sales. Required: Prepare the correct journal entry. How does this entry affect the accounting equation? Indicate the effect on financial statement items by selecting "-" for decrease or negative effect), "+" for increase (or positive effect) and "NE" for No Entry (or no effect) on the financial statement. Journal Balance Sheet Income Statement Stockholders' Net Debit Credit Assets Liabilities + Equity Revenues Expenses Income Date Description June 5 Cash In accounting, debits mean an entry made on the of an account and credits mean an entry made on the of an account. To increase the cash account, the account would be Check My Work 10 more Check My Work uses remaining. Previous Next In accounting, debits mean an entry made on the of an account and credits mean an entry made on the of an account. To increase the cash account, the account would be but in the bank account, the bank would the account to show the money was an addition to the balance. Decreases work the same way so that as cash is deducted from the cash account, it is , but in the bank account, the bank would the account to show the money was a deduction from the balance. Journal Balance Sheet Income Statement Stockholders' Net Date Description Debit Credit Assets Liabilities Equity Revenues Expenses Income Jan. 2 Cash 100,000 100,000 Capital stock January 4: Signed a three-year promissory note at Third State Bank in the amount of $50,000. Journal Balance Sheet Income Statement Stockholders' Net Date Description Debit Credit Assets Liabilities + Equity Revenues Expenses Income Jan. 4 Cash 50,000 50,000 Notes payable January 6: Purchased five new delivery trucks for a total of $45,000 in cash. Journal Balance Sheet Income Statement Stockholders' Net Date Description Debit Credit Assets Liabilities + Equity Revenues Expenses Income Jan. 6 Delivery trucks 45,000 Cash 45,000 Feedback Journal Balance Sheet Income Statement Stockholders' Net Date Description Debit Credit Assets Liabilities + Equity Revenues Expenses Income Jan. 31 Accounts receivable 15,900 Service revenue 15,900 Feedback Check My Work January 31: Cash amounting to $7,490 was received from customers on account during the month. Journal Balance Sheet Income Statement Stockholders' Net Date Description Debit Credit Assets Liabilities + Equity Revenues Expenses Income Jan. 31 Cash 7,490 7,490 Accounts receivable January 31: Established an open account at a local service station at the beginning of the month. Purchases of gas and oil during January amounted to $3,230. Blue Jay has until the 10th of the following month to pay its bill. Journal Balance Sheet Income Statement Stockholders' Net Debit Credit Assets Liabilities Equity Revenues Expenses Income Date Description Jan. 31 Gas and oil expense 3,230 3,230 Accounts payable

Q2:

Q2: