Answered step by step

Verified Expert Solution

Question

1 Approved Answer

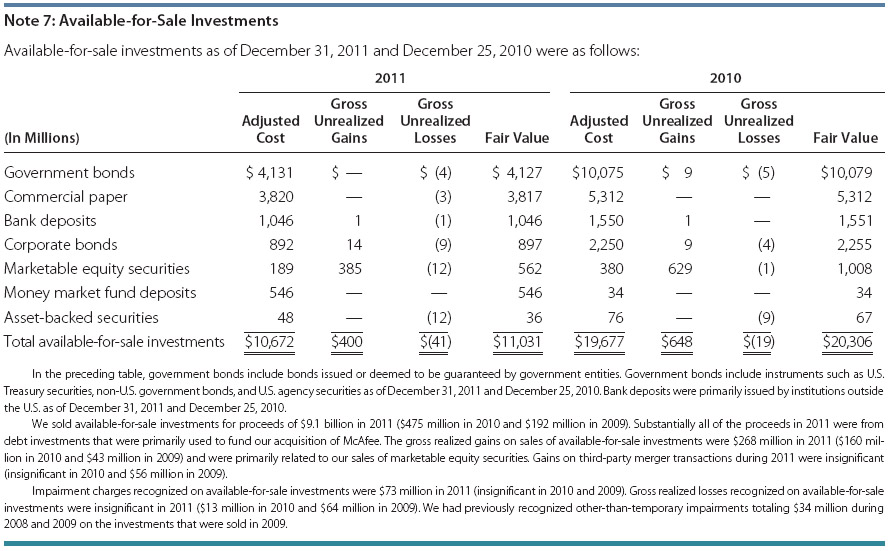

The following notes was taken form Intel's 2011 annual report. 1. What amount of gains and losses on available-for-sale securities is reported in Intels 2011

The following notes was taken form Intel's 2011 annual report.

1. What amount of gains and losses on available-for-sale securities is reported in Intels 2011 income statement? How much is realized? How much is unrealized?

2. After looking at the table and the related note disclosure, describe what happened with Intels marketable equity securities during 2011.

Please explain how to get the above answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started