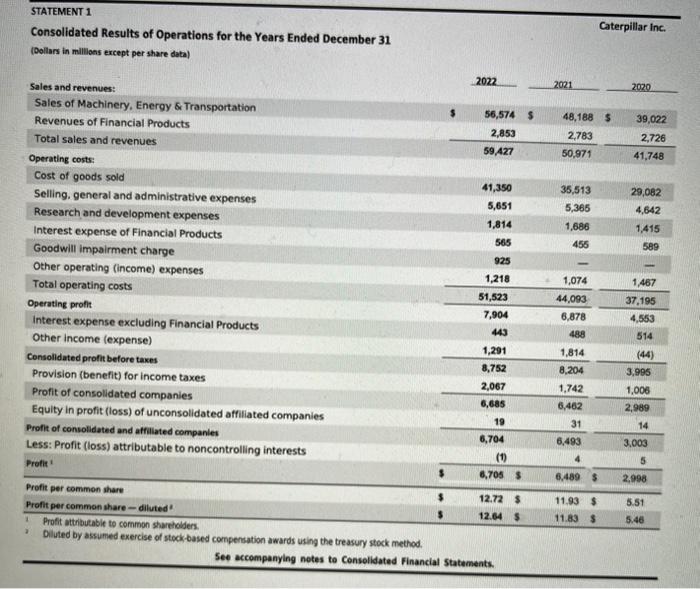

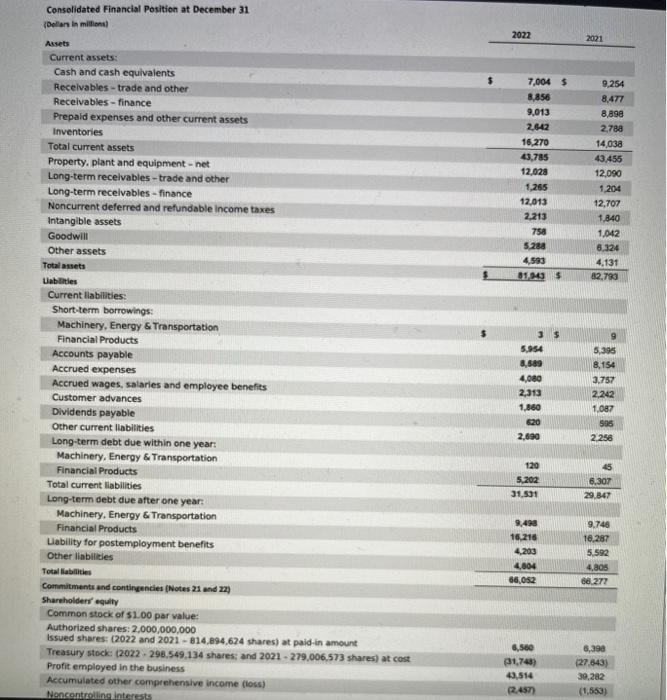

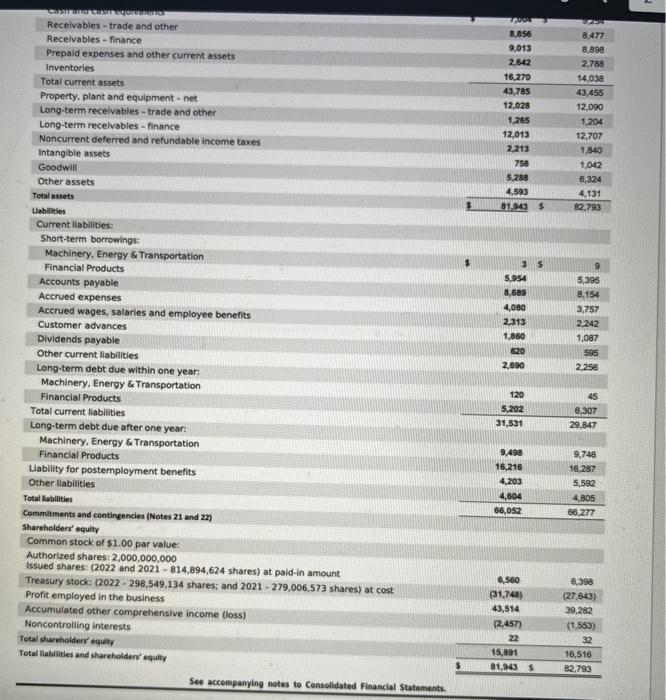

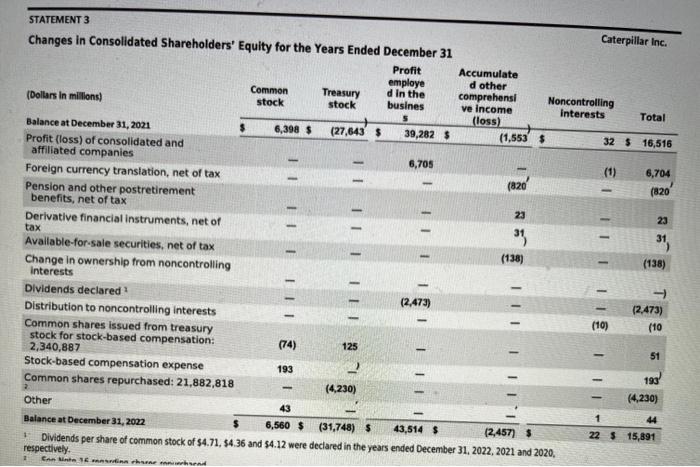

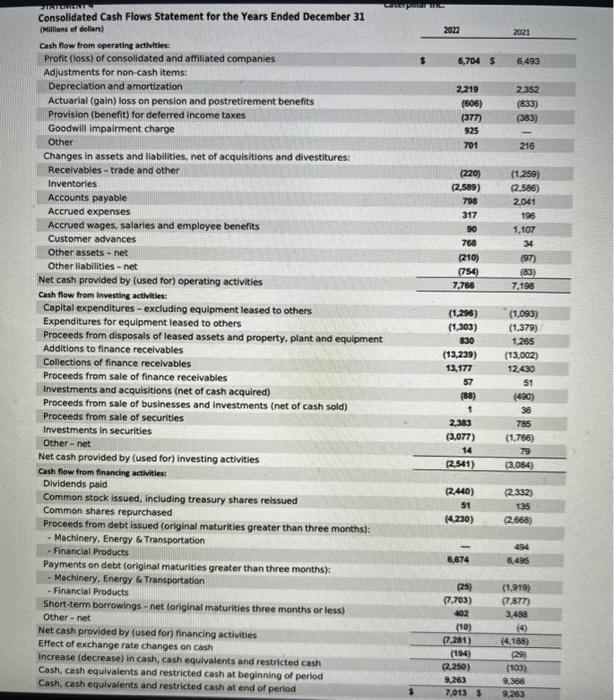

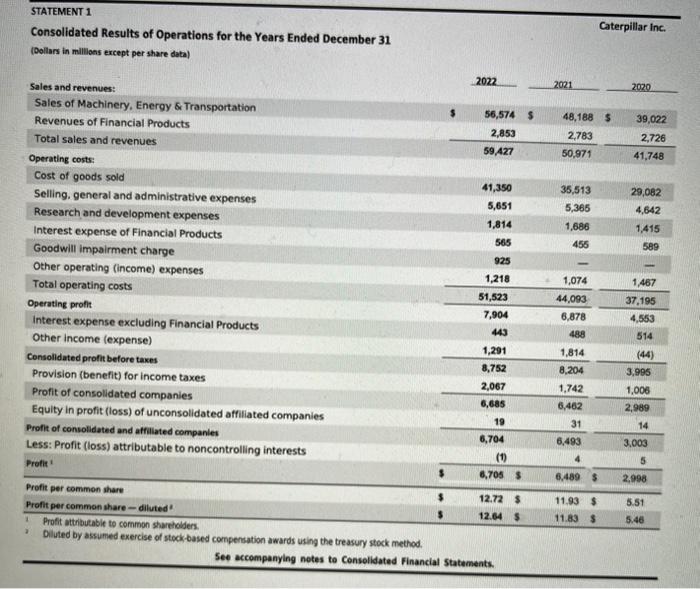

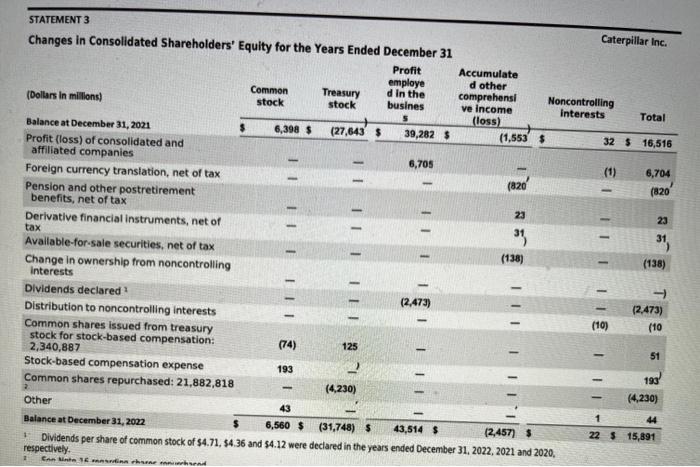

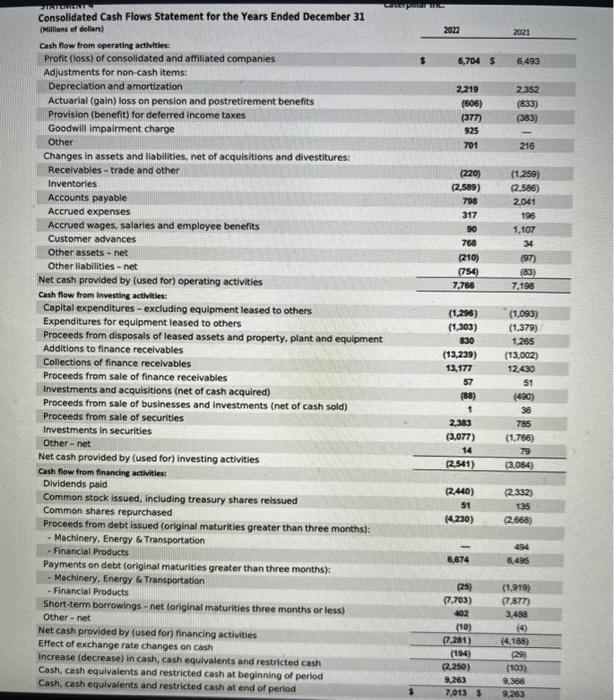

Q1. did the company declare any difference in fiscal year 2022? did it pay for all these dividends in cash during the fiscal year of 2022?

Q2. how much cash was paid to re-purchase common stock during the school year 2022. What was the average price paid per share?

Q3. if the company had not declared dividends for fiscal year 2022, Wood net income have been higher lower or the same as reported?

This was all the information provided. any answer is appreciated

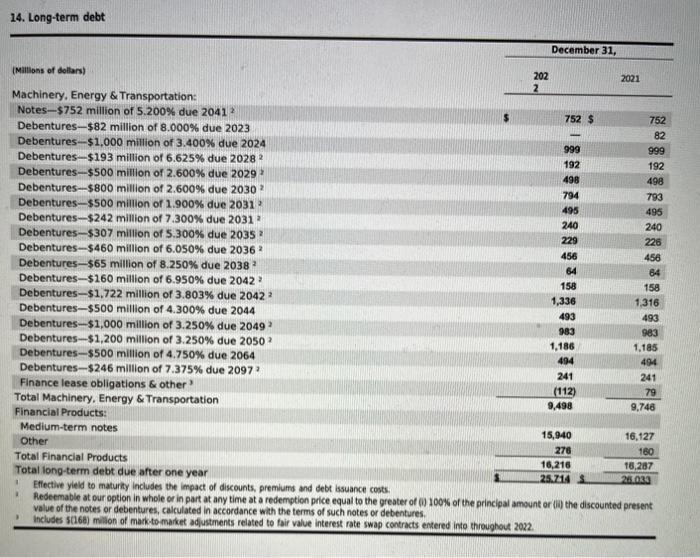

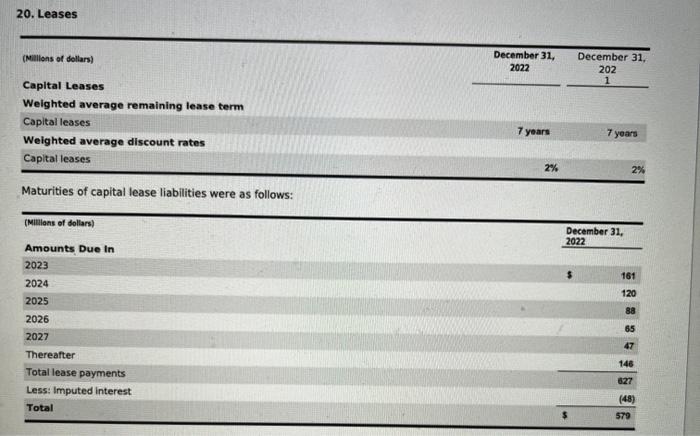

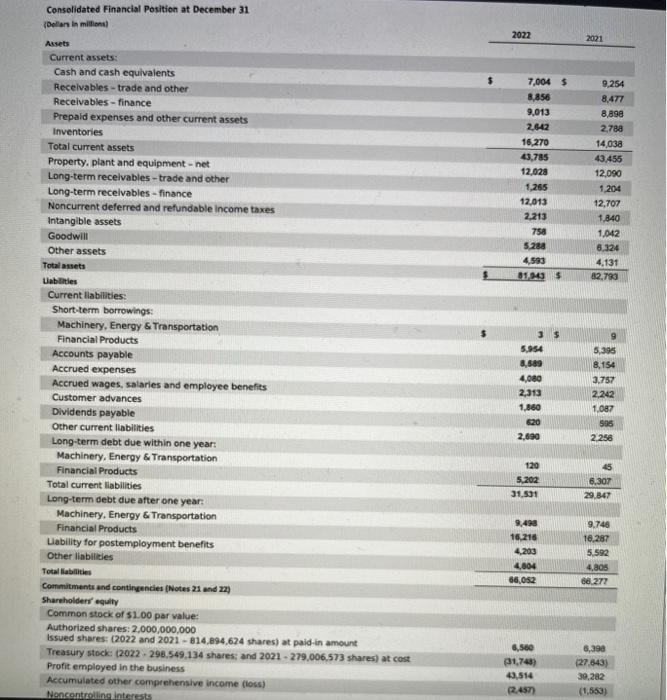

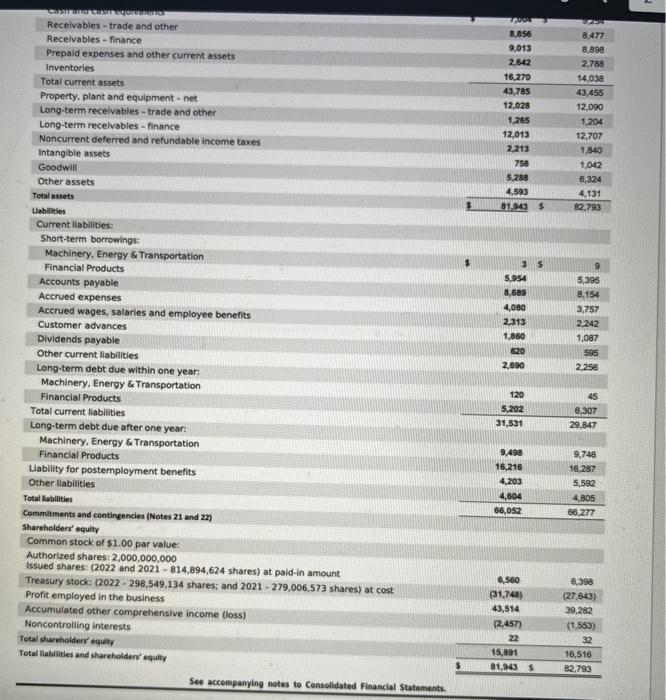

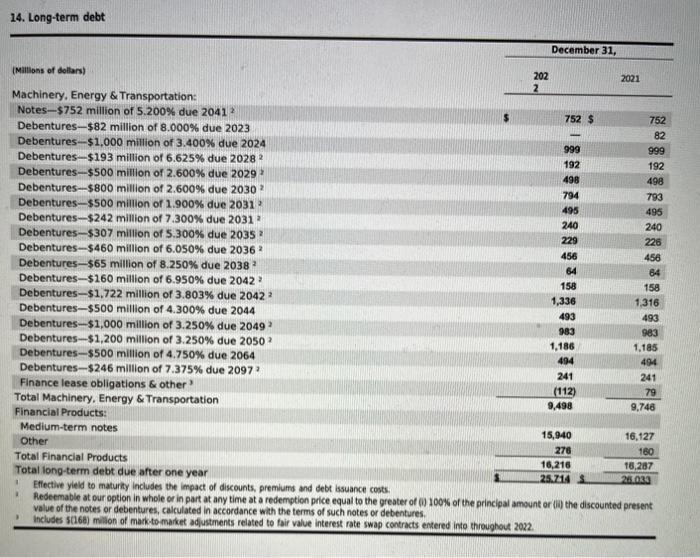

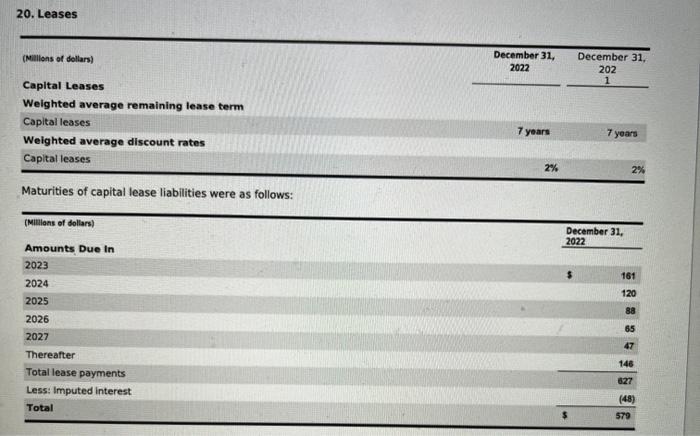

14. Long-term debt Consolidated Financial Position at December 31 (Dollan in miltiona) Assets 2022 2001 Current assets: Cash and cash equivalents Recelvables - trade and other Receivables - finance Prepaid expenses and other current assets inventories Total current assets Property. plant and equipment - net Long-term recelvables - trade and other Long-term recelvables - finance Noncurrent deferred and refundable income taxes Intangible assets Goodwill Other assets Total assets Uablaties Current liabilities: Short-term borrowings: Machinery, Energy \& Transportation Financial Products Accounts payable Accrued expenses Accrued wages, salaries and employee benefits Customer advances Dividends payable Other current liabilities Long-term debt due within one year: Machinery, Energy \& Transportation Financial Products Total current liabilities Long-term debt due after one year: Machinery, Energy \&. Transportation Financial Products Liability for postemployment benefits Other liabilicies Total Laballities Commitments and contingencies (Notes 21 and 27 ) 5 Shareholden' equity Common stock of $1.00 par value: Authorized shares: 2,000,000,000 Issued shares: (2022 and 2021 - 814,894,624 shares) at paid-in amount Treasury stock: (2022+298,549,134 shares; and 2021+279,006.573 shares) at cost Profit employed in the business Accumulated other comprehensive income (loss) Noncontrolling interests Consolidated Results of Operations for the Years Ended December 31 STATEMENT 3 Changes in Consolidated Shareholders' Equity for the Years Ended Deramher 21 20. Leases (Mallions of dollars) Capital Leases Weighted average remaining lease term Capital leases Weighted average discount rates December 31, December 31 , 2022 202 Capital leases 2% 2% Maturities of capital lease liabilities were as follows: \begin{tabular}{|c|c|c|c|} \hline \multirow{3}{*}{(Millionsofdollars)AmountsDueIn2023} & & & 31 \\ \hline & & & \\ \hline & & 5 & 161 \\ \hline & & & 120 \\ \hline 2025 & * & & 88 \\ \hline 2026 & & z & 65 \\ \hline 2027 & & & 47 \\ \hline Thereafter & & & 146 \\ \hline Total lease payments & & & 627 \\ \hline Less: Imputed interest & & & (48) \\ \hline Total & & s & 579 \\ \hline \end{tabular} Consolidated Cash Flows Statement for the Years Ended December 31 (Niilions of dollan) 2022 2001 Cash flow from operatine actlvities: Profit (loss) of consolidated and affiliated companies Adjustments for non-cash items: Depreciation and amortization Actuarial (gain) loss on pension and postretirement benefits Provision (benefit) for delerred income taxes Goodwill impairment charge Other Changes in assets and liabilities, net of acquisitions and divestitures: Receivables - trade and other Inventories Accounts payable Accrued expenses Accrued wages, salaries and employee benefits Customer advances Other assets - net Other liabilities - net Net cash provided by (used for) operating activities Cash flow from investine actlvitin: Capital expenditures - excluding equipment leased to others Expenditures for equipment leased to others Proceeds from disposals of leased assets and property, plant and equipment Additions to finance receivables Collections of finance receivables Proceeds from sale of finance receivabies Investments and acquisitions (net of cash acquired) Proceeds from sale of businesses and investments (net of cash sold) Proceeds from sale of securities Investments in securities Other - net Net cash provided by (used for) investing activities Cash fiow from financing acthities: Dividends paid Common stock issued, including treasury shares reissued Common shares repurchased Proceeds from debt issued (original maturities greater than three months): - Machinery, Energy 6.Transportation - Financial Products Payments on debt (original maturities greater than three months): 5 6,7045 6.499 - Machinery, Energy G Transportation - Financial Products Short-term borrowings - net (original maturities three months or less) Other - net Net cash provided by (used for) financing activities Effect of exchange rate changes on cash Increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of period Cash, cash equivalents and restricted cash at end of period 2219 (606) (37) 925 701 (220) (2,589) 79 317 90 768 (210) (754) 7,766 (1,296) (1,303) 830 (13,239) 13,177 57 (B) 1 2,383 (3.077) 14 (2541) (2,440) 51 (4,230) 2.352 (833) (383) 216 \begin{tabular}{|r|} (1,259) \\ (2,596) \\ 2,041 \\ 196 \\ 1,107 \\ 34 \\ (97) \\ (89) \\ \hline 7,196 \\ \hline \end{tabular} (1,093) (1,379) 1,265 (13,002) 12,430 51 (490) 36 785 \begin{tabular}{|c|} \hline 1.265 \\ \hline(13,002) \\ \hline 12,430 \\ \hline 51 \\ \hline(490) \\ \hline 36 \\ \hline 785 \\ \hline (1.766) \\ \hline 79 \\ \hline(3.084) \\ \hline (2332) \\ \hline 135 \\ \hline(2.668) \\ \hline 494 \\ \hline 6.496 \\ \hline (1.919) \\ \hline r.sm \\ \hline 3,488 \\ \hline (4) \\ \hline(4.188) \\ \hline (29) \\ \hline (103) \\ \hline 9.368 \\ \hline \end{tabular}