Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Divya failed the accounting exam in school and ran away from home. She started working as a building assistant earning between INR 10,000 and

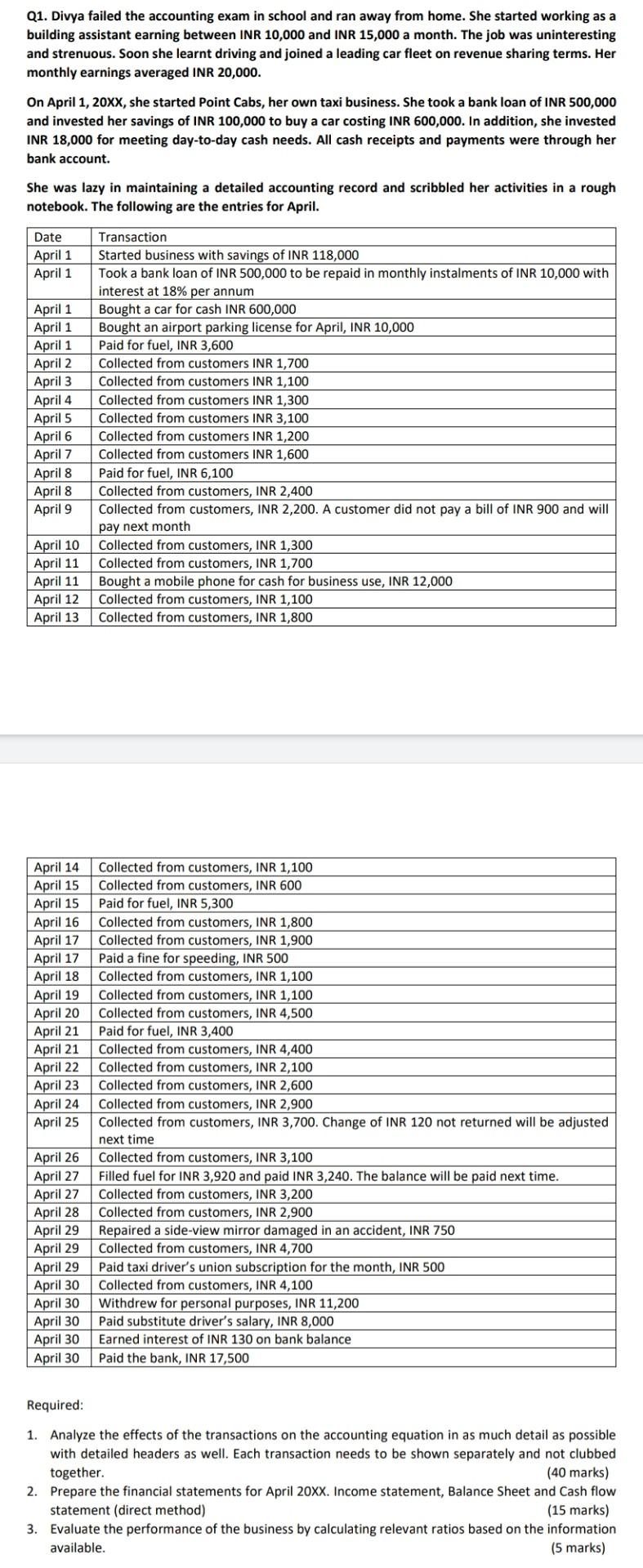

Q1. Divya failed the accounting exam in school and ran away from home. She started working as a building assistant earning between INR 10,000 and INR 15,000 a month. The job was uninteresting and strenuous. Soon she learnt driving and joined a leading car fleet on revenue sharing terms. Her monthly earnings averaged INR 20,000. On April 1, 20XX, she started Point Cabs, her own taxi business. She took a bank loan of INR 500,000 and invested her savings of INR 100,000 to buy a car costing INR 600,000. In addition, she invested INR 18,000 for meeting day-to-day cash needs. All cash receipts and payments were through her bank account. She was lazy in maintaining a detailed accounting record and scribbled her activities in a rough notebook. The following are the entries for April. Date April 1 April 1 April 1 April 1 April 1 April 2 April 3 April 4 April 5 April 6 April 7 April 8 April 8 April 9 Transaction Started business with savings of INR 118,000 Took a bank loan of INR 500,000 to be repaid in monthly instalments of INR 10,000 with interest at 18% per annum Bought a car for cash INR 600,000 Bought an airport parking license for April, INR 10,000 Paid for fuel, INR 3,600 Collected from customers INR 1,700 Collected from customers INR 1,100 Collected from customers INR 1,300 Collected from customers INR 3,100 Collected from customers INR 1,200 Collected from customers INR 1,600 Paid for fuel, INR 6,100 Collected from customers, INR 2,400 Collected from customers, INR 2,200. A customer did not pay a bill of INR 900 and will pay next month Collected from customers, INR 1,300 Collected from customers, INR 1,700 Bought a mobile phone for cash for business use, INR 12,000 Collected from customers, INR 1,100 Collected from customers, INR 1,800 April 10 April 11 April 11 April 12 April 13 April 14 Collected from customers, INR 1,100 April 15 Collected from customers, INR 600 April 15 Paid for fuel, INR 5,300 April 16 Collected from customers, INR 1,800 April 17 Collected from customers, INR 1,900 April 17 Paid a fine for speeding, INR 500 April 18 Collected from customers, INR 1,100 April 19 Collected from customers, INR 1,100 April 20 Collected from customers, INR 4,500 April 21 Paid for fuel, INR 3,400 April 21 Collected from customers, INR 4,400 April 22 Collected from customers, INR 2,100 April 23 Collected from customers, INR 2,600 April 24 Collected from customers, INR 2,900 April 25 Collected from customers, INR 3,700. Change of INR 120 not returned will be adjusted next time April 26 Collected from customers, INR 3,100 April 27 Filled fuel for INR 3,920 and paid INR 3,240. The balance will be paid next time. April 27 Collected from customers, INR 3,200 April 28 Collected from customers, INR 2,900 April 29 Repaired a side-view mirror damaged in an accident, INR 750 April 29 Collected from customers, INR 4,700 April 29 Paid taxi driver's union subscription for the month, INR 500 April 30 Collected from customers, INR 4,100 April 30 Withdrew for personal purposes, INR 11,200 April 30 Paid substitute driver's salary, INR 8,000 April 30 Earned interest of INR 130 on bank balance April 30 Paid the bank, INR 17,500 Required: 1. Analyze the effects of the transactions on the accounting equation in as much detail as possible with detailed headers as well. Each transaction needs to be shown separately and not clubbed together. (40 marks) 2. Prepare the financial statements for April 20XX. Income statement, Balance Sheet and Cash flow statement (direct method) (15 marks) 3. Evaluate the performance of the business by calculating relevant ratios based on the information available

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started