Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q-1: During Tax Year 2020, following persons have taxable income from different heads of income, detail of which is as follows: 1. ABC (Pvt.) Ltd.

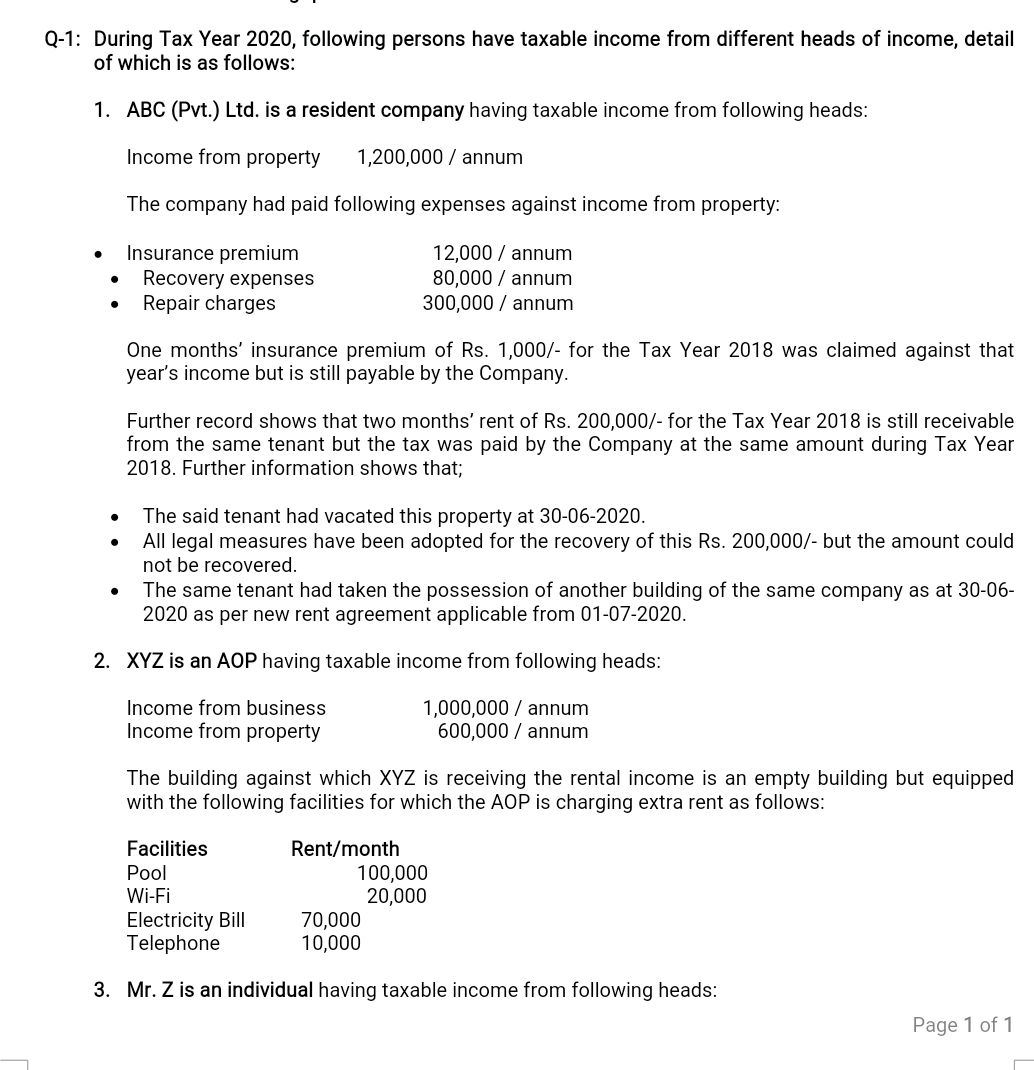

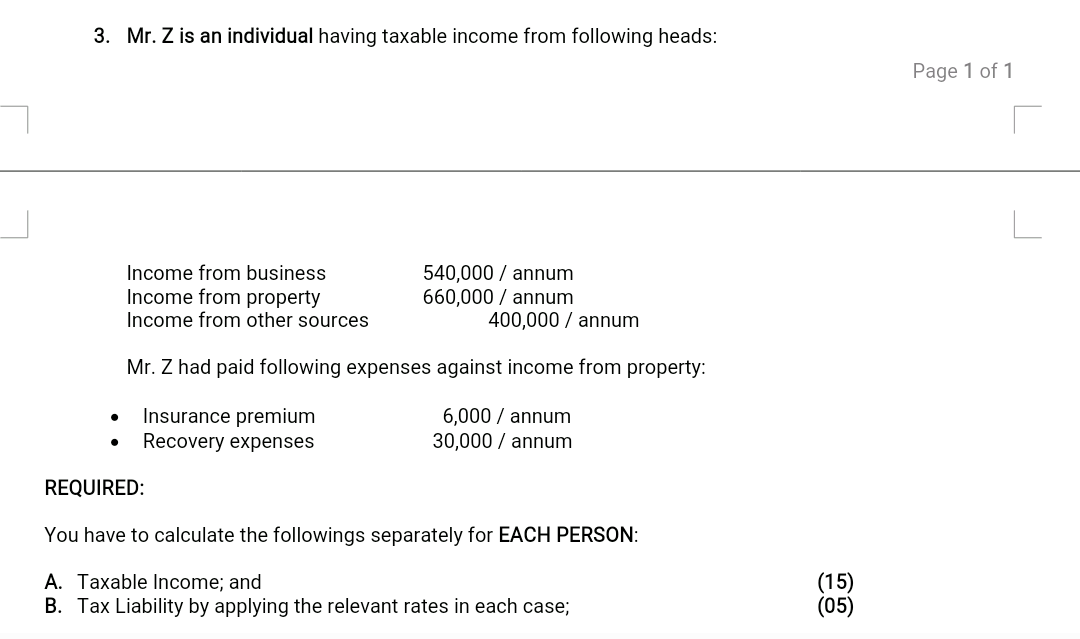

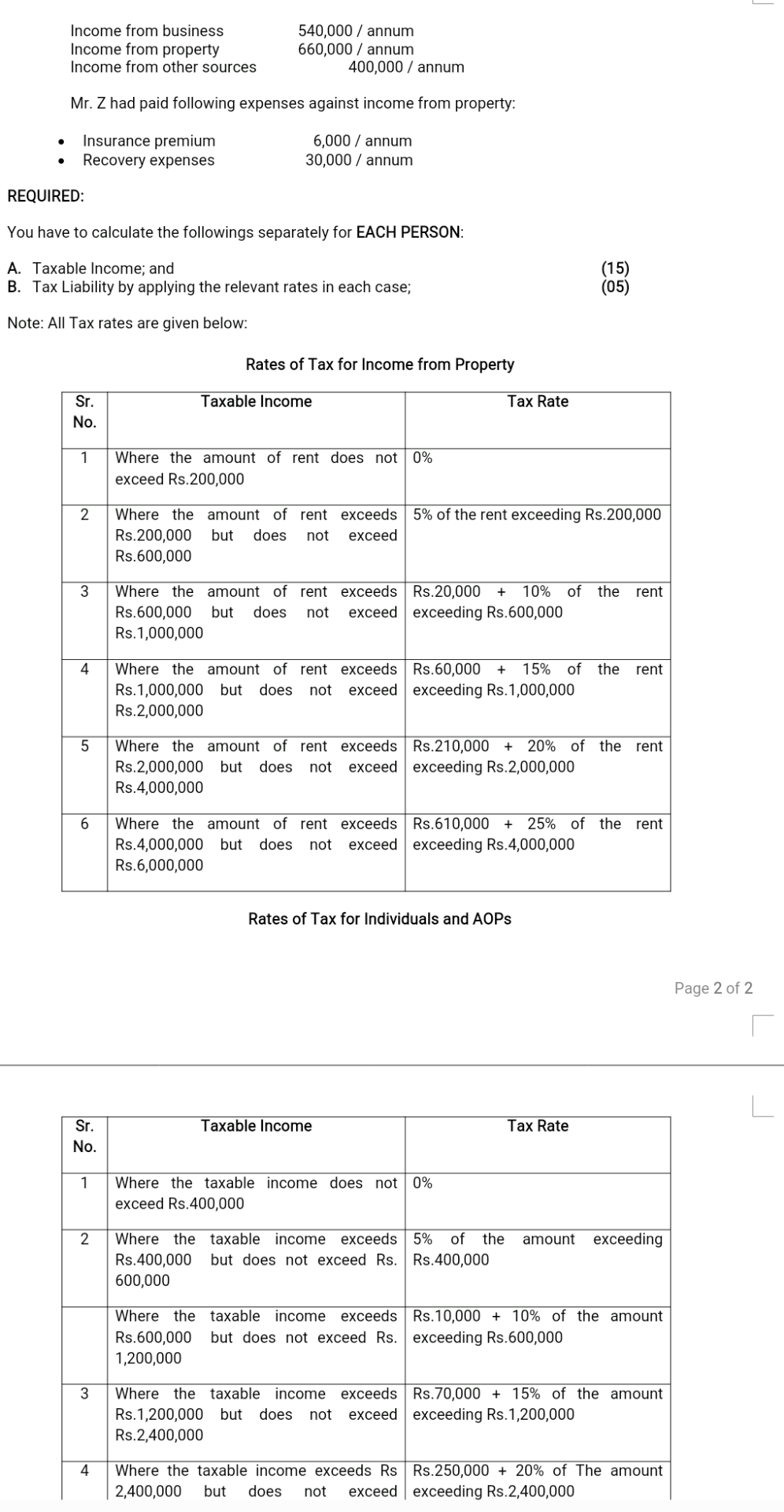

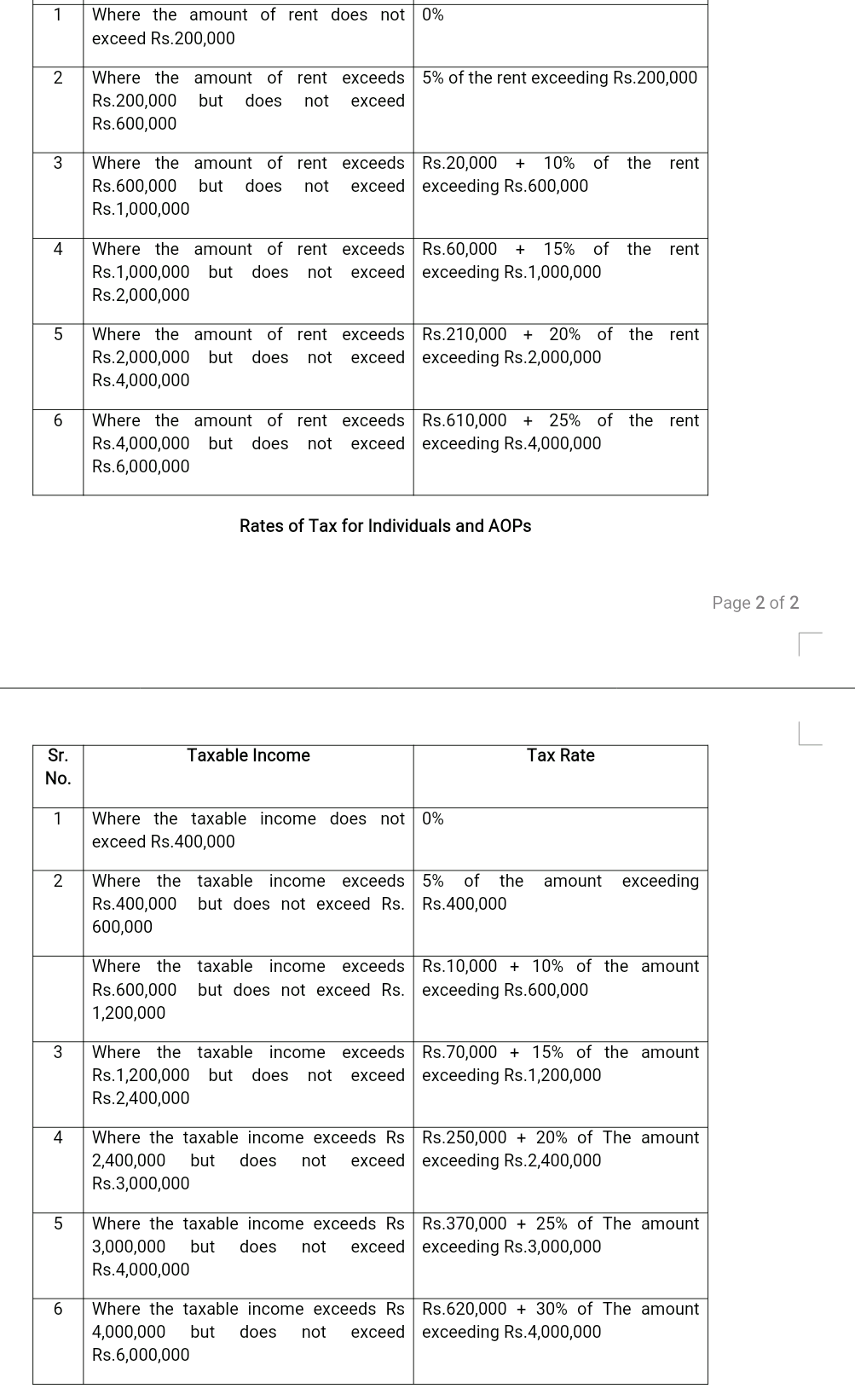

Q-1: During Tax Year 2020, following persons have taxable income from different heads of income, detail of which is as follows: 1. ABC (Pvt.) Ltd. is a resident company having taxable income from following heads: Income from property 1,200,000 / annum The company had paid following expenses against income from property: 0 Insurance premium Recovery expenses Repair charges 12,000 / annum 80,000 / annum 300,000 / annum One months' insurance premium of Rs. 1,000/- for the Tax Year 2018 was claimed against that year's income but is still payable by the Company. Further record shows that two months' rent of Rs. 200,000/- for the Tax Year 2018 is still receivable from the same tenant but the tax was paid by the Company at the same amount during Tax Year 2018. Further information shows that; . The said tenant had vacated this property at 30-06-2020. All legal measures have been adopted for the recovery of this Rs. 200,000/- but the amount could not be recovered. The same tenant had taken the possession of another building of the same company as at 30-06- 2020 as per new rent agreement applicable from 01-07-2020. 2. XYZ is an AOP having taxable income from following heads: Income from business Income from property 1,000,000 / annum 600,000 / annum The building against which XYZ is receiving the rental income is an empty building but equipped with the following facilities for which the AOP is charging extra rent as follows: Facilities Pool Wi-Fi Electricity Bill Telephone Rent/month 100,000 20,000 70,000 10,000 3. Mr. Z is an individual having taxable income from following heads: Page 1 of 1 3. Mr. Z is an individual having taxable income from following heads: Page 1 of 1 Income from business Income from property Income from other sources 540,000 / annum 660,000 / annum 400,000 / annum Mr. Z had paid following expenses against income from property: . Insurance premium Recovery expenses 6,000 / annum 30,000 / annum REQUIRED: You have to calculate the followings separately for EACH PERSON: A. Taxable income; and B. Tax Liability by applying the relevant rates in each case; (15) (05) Income from business Income from property Income from other sources 540,000 / annum 660,000 / annum 400,000 / annum Mr. Z had paid following expenses against income from property: Insurance premium Recovery expenses 6,000 / annum 30,000 / annum . REQUIRED: You have to calculate the followings separately for EACH PERSON: A. Taxable Income; and B. Tax Liability by applying the relevant rates in each case; (15) (05) Note: All Tax rates are given below: Rates of Tax for Income from Property Taxable income Tax Rate Sr. No. 1 Where the amount of rent does not 0% exceed Rs.200,000 2 Where the amount of rent exceeds 5% of the rent exceeding Rs.200,000 Rs.200,000 but does not exceed Rs.600,000 3 + rent Where the amount of rent exceeds Rs.20,000 10% of the Rs.600,000 but does not exceed exceeding Rs.600,000 Rs.1,000,000 4 rent Where the amount of rent exceeds Rs.60,000 + 15% of the Rs. 1,000,000 but does not exceed exceeding Rs.1,000,000 Rs. 2,000,000 5 Where the amount of rent exceeds Rs.210,000 + 20% of the rent Rs. 2,000,000 but does not exceed exceeding Rs.2,000,000 Rs.4,000,000 6 Where the amount of rent exceeds Rs.610,000 + 25% of the rent Rs.4,000,000 but does not exceed exceeding Rs.4,000,000 Rs.6,000,000 Rates of Tax for Individuals and AOPs Page 2 of 2 Taxable income Tax Rate Sr. No. 1 Where the taxable income does not 0% exceed Rs.400,000 2 amount exceeding Where the taxable income exceeds 5% of the Rs.400,000 but does not exceed Rs. Rs.400,000 600,000 Where the taxable income exceeds Rs. 10,000 + 10% of the amount Rs.600,000 but does not exceed Rs. exceeding Rs.600,000 1,200,000 3 Where the taxable income exceeds Rs.70,000 + 15% of the amount Rs.1,200,000 but does not exceed exceeding Rs.1,200,000 Rs. 2,400,000 4 Where the taxable income exceeds Rs Rs.250,000 + 20% of the amount 2,400,000 but does not exceed exceeding Rs. 2,400,000 1 Where the amount of rent does not 0% exceed Rs.200,000 2 Where the amount of rent exceeds 5% of the rent exceeding Rs.200,000 Rs.200,000 but does not exceed Rs.600,000 3 + Where the amount of rent exceeds Rs.20,000 10% of the rent Rs.600,000 but does not exceed exceeding Rs.600,000 Rs.1,000,000 4 + Where the amount of rent exceeds Rs.60,000 15% of the rent Rs.1,000,000 but does not exceed exceeding Rs.1,000,000 Rs. 2,000,000 5 Where the amount of rent exceeds Rs.210,000 + 20% of the rent Rs.2,000,000 but does not exceed exceeding Rs.2,000,000 Rs.4,000,000 6 Where the amount of rent exceeds Rs.610,000 + 25% of the rent Rs.4,000,000 but does not exceed exceeding Rs.4,000,000 Rs.6,000,000 Rates of Tax for Individuals and AOPs Page 2 of 2 Sr. Taxable income Tax Rate No. 1 Where the taxable income does not 0% exceed Rs.400,000 2 amount exceeding Where the taxable income exceeds 5% of the Rs.400,000 but does not exceed Rs. Rs.400,000 600,000 Where the taxable income exceeds Rs.10,000 + 10% of the amount Rs.600,000 but does not exceed Rs. exceeding Rs.600,000 1,200,000 3 Where the taxable income exceeds Rs.70,000 + 15% of the amount Rs.1,200,000 but does not exceed exceeding Rs.1,200,000 Rs.2,400,000 4 Where the taxable income exceeds Rs Rs.250,000 + 20% of The amount 2,400,000 but does not exceed exceeding Rs. 2,400,000 Rs.3,000,000 5 Where the taxable income exceeds Rs Rs.370,000 + 25% of the amount 3,000,000 but does not exceed exceeding Rs.3,000,000 Rs.4,000,000 6 Where the taxable income exceeds Rs Rs.620,000 + 30% of The amount 4,000,000 but does not exceed exceeding Rs.4,000,000 Rs.6,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started