Question

Q1. Kramer claims that the standard deviation of return for the 50-50 portfolio of Groupon and Kinross Gold is lower than the standard deviation of

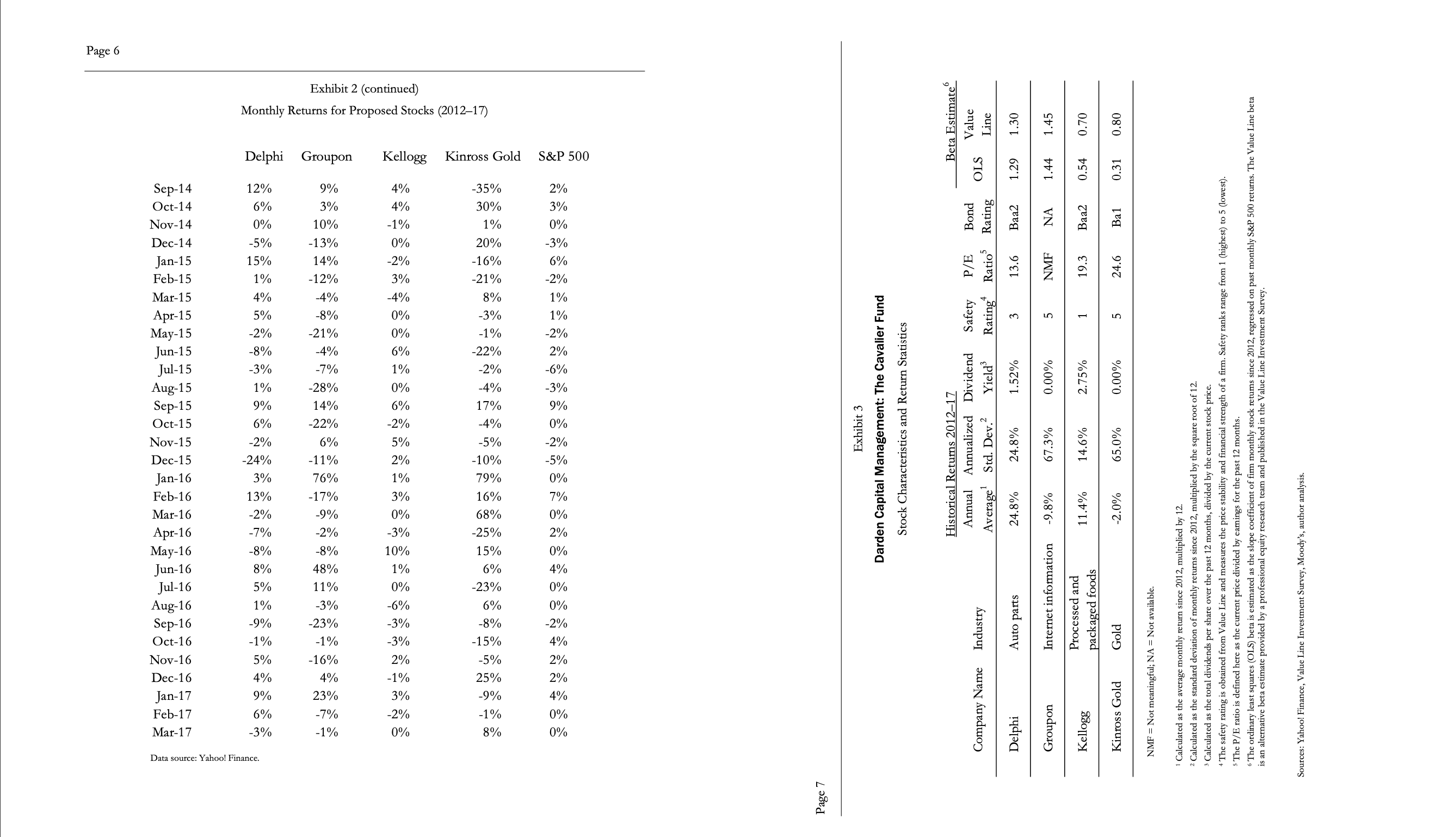

Q1.Kramer claims that the standard deviation of return for the 50-50 portfolio of Groupon and Kinross Gold is lower than the standard deviation of returns of a pure position in either Groupon or Kinross Gold stock alone. Compute the standard deviation and the expected return of the 50-50 portfolio. Do you agree with Kramer's argument?

Q2.Exhibit 3 shows that Groupon and Kinross Gold have a similar annualized standard deviation. But why is Kinross Gold's beta so small compared to Groupon's?

Q3.Which of the four stocks should the Cavalier Fund pick? Explain answer.

might even argue that the Cavalier Fund should not add any stocks at all. willing to accept any answers as long as provide good support for argument. However, recall that the Sharpe ratio is not the best benchmark for performance because it uses the total risk as a measure of the security risk.

- Compute the standard deviation

- The expected return of proposed portfolio investment

- Show understanding of the diversifiable risk by making a recommendation on the stock investment

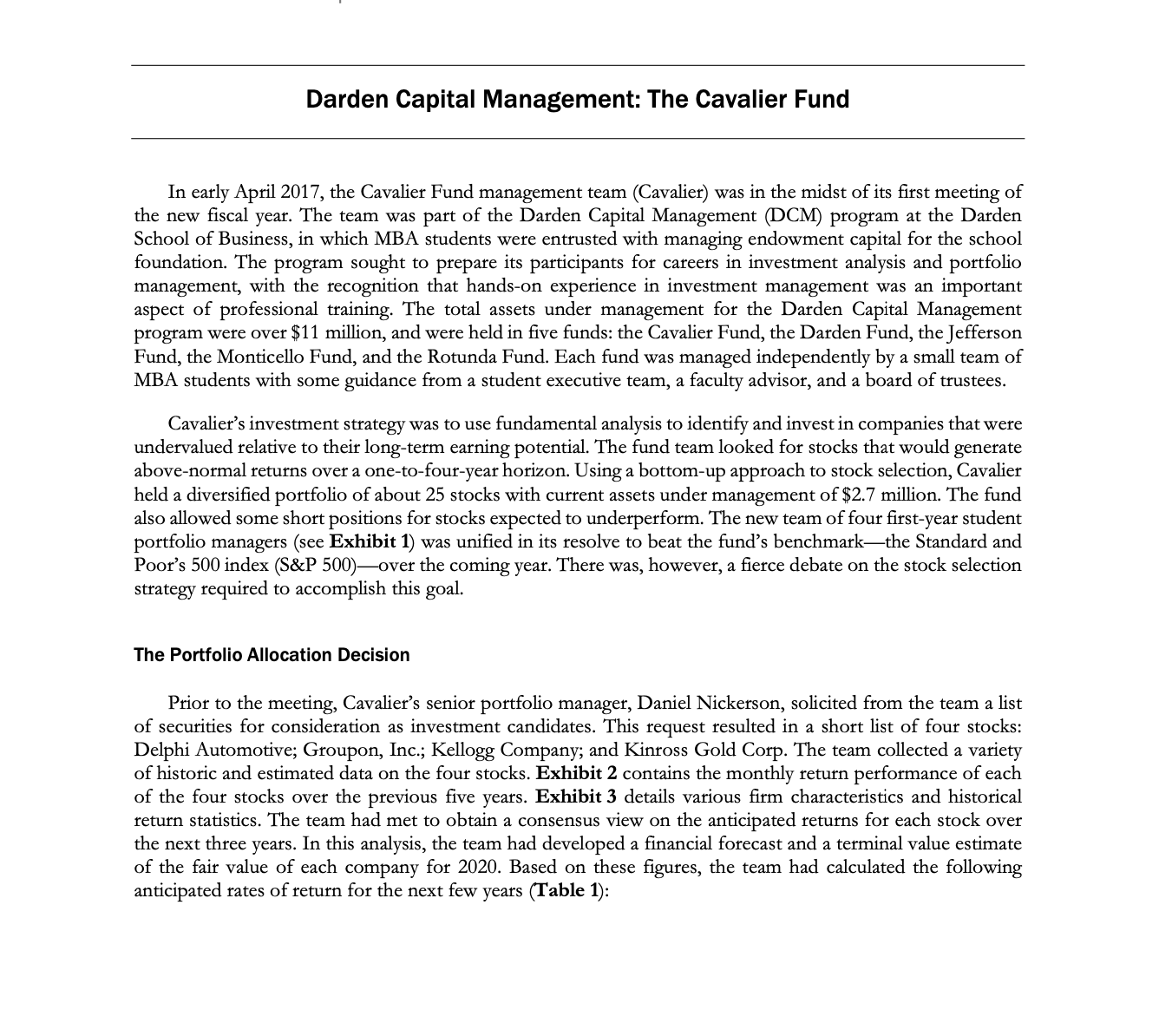

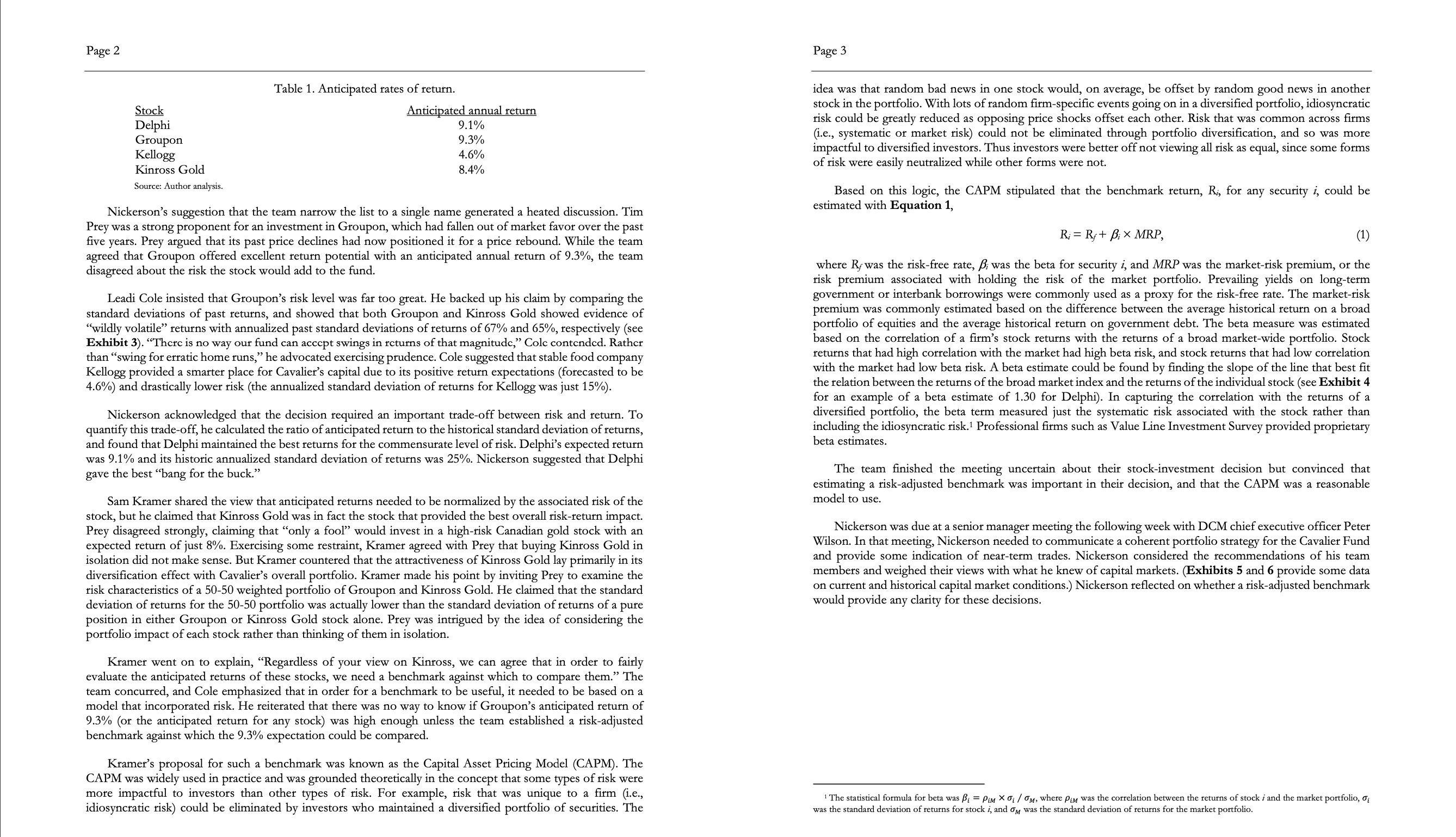

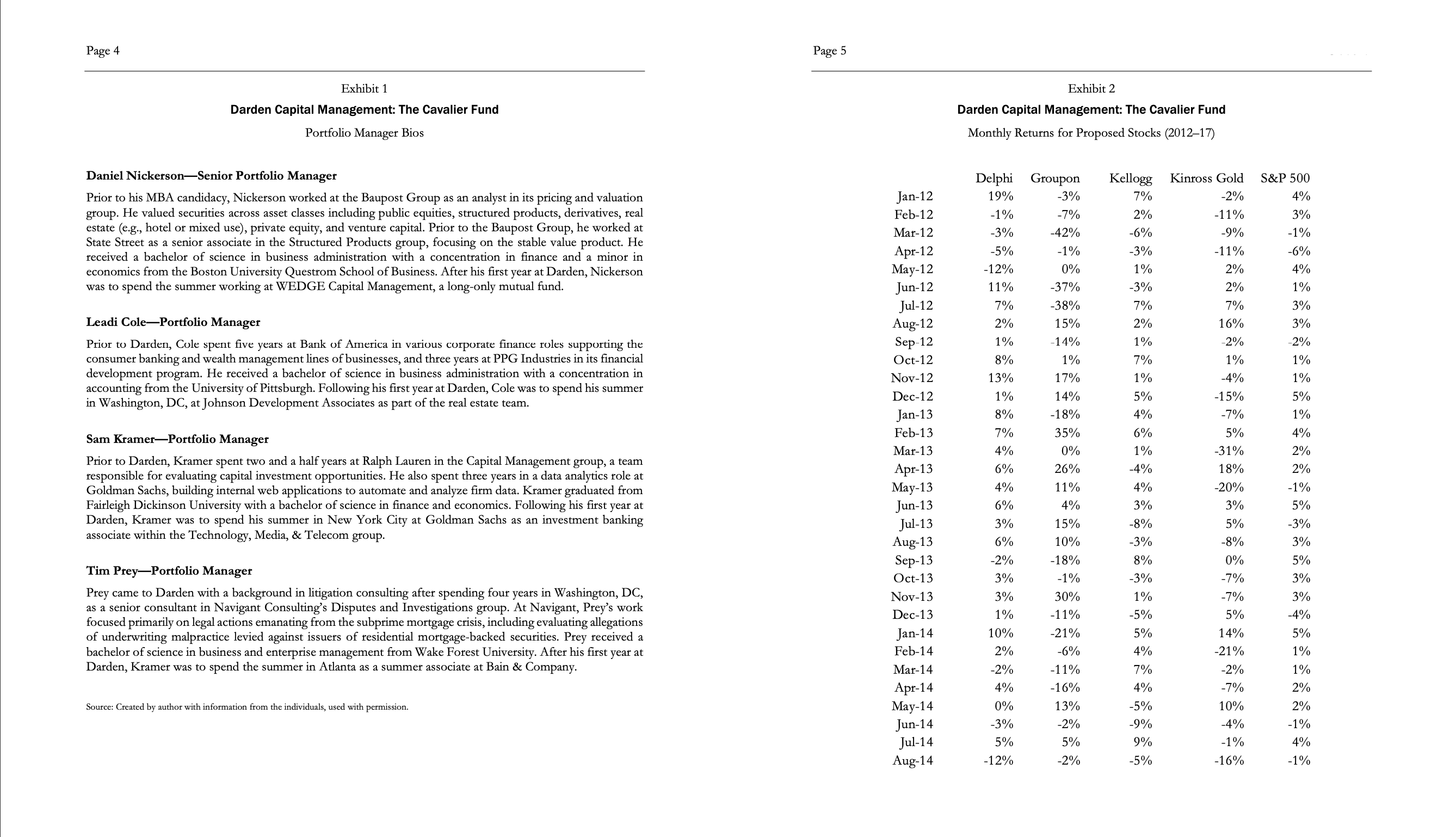

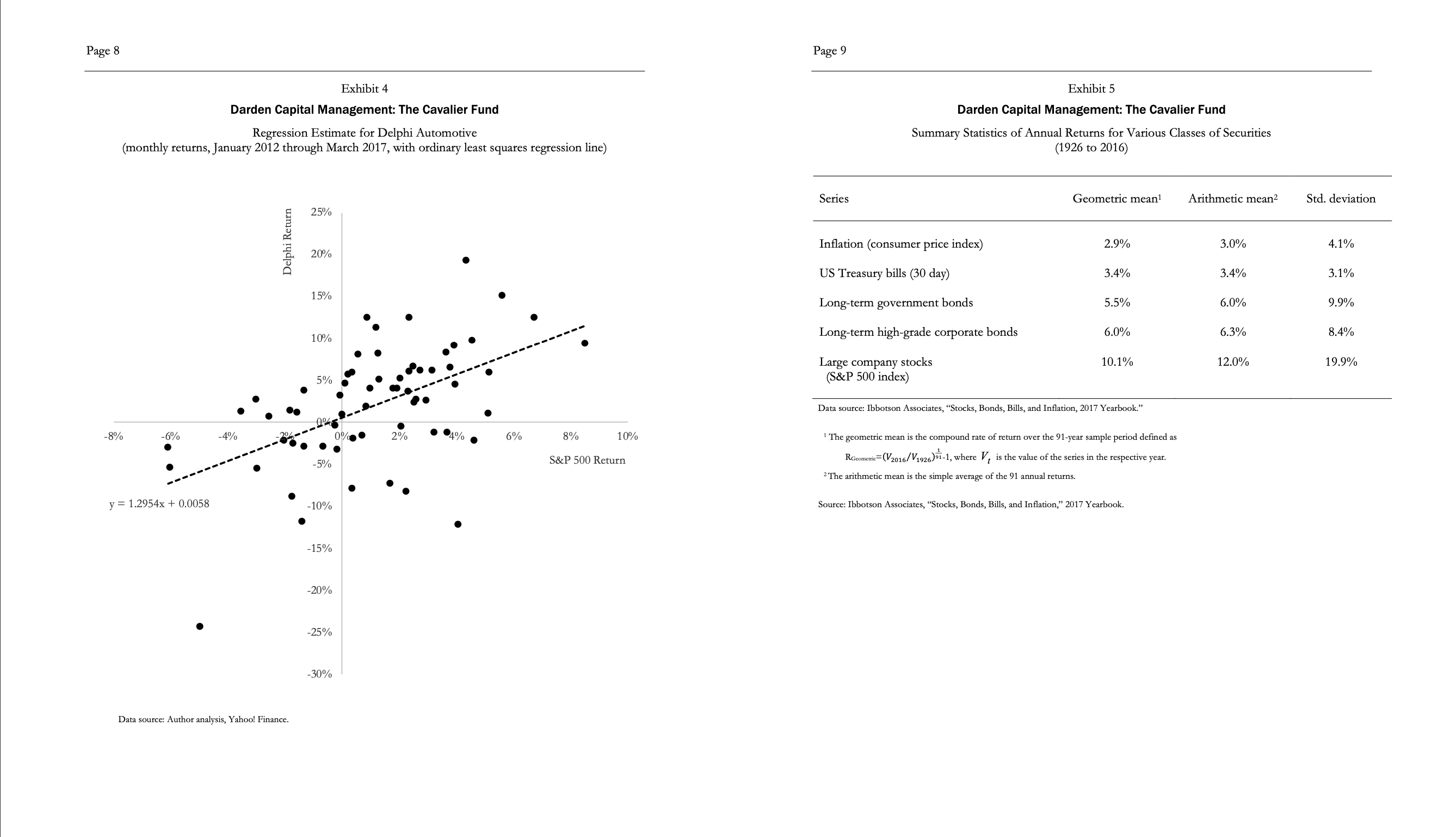

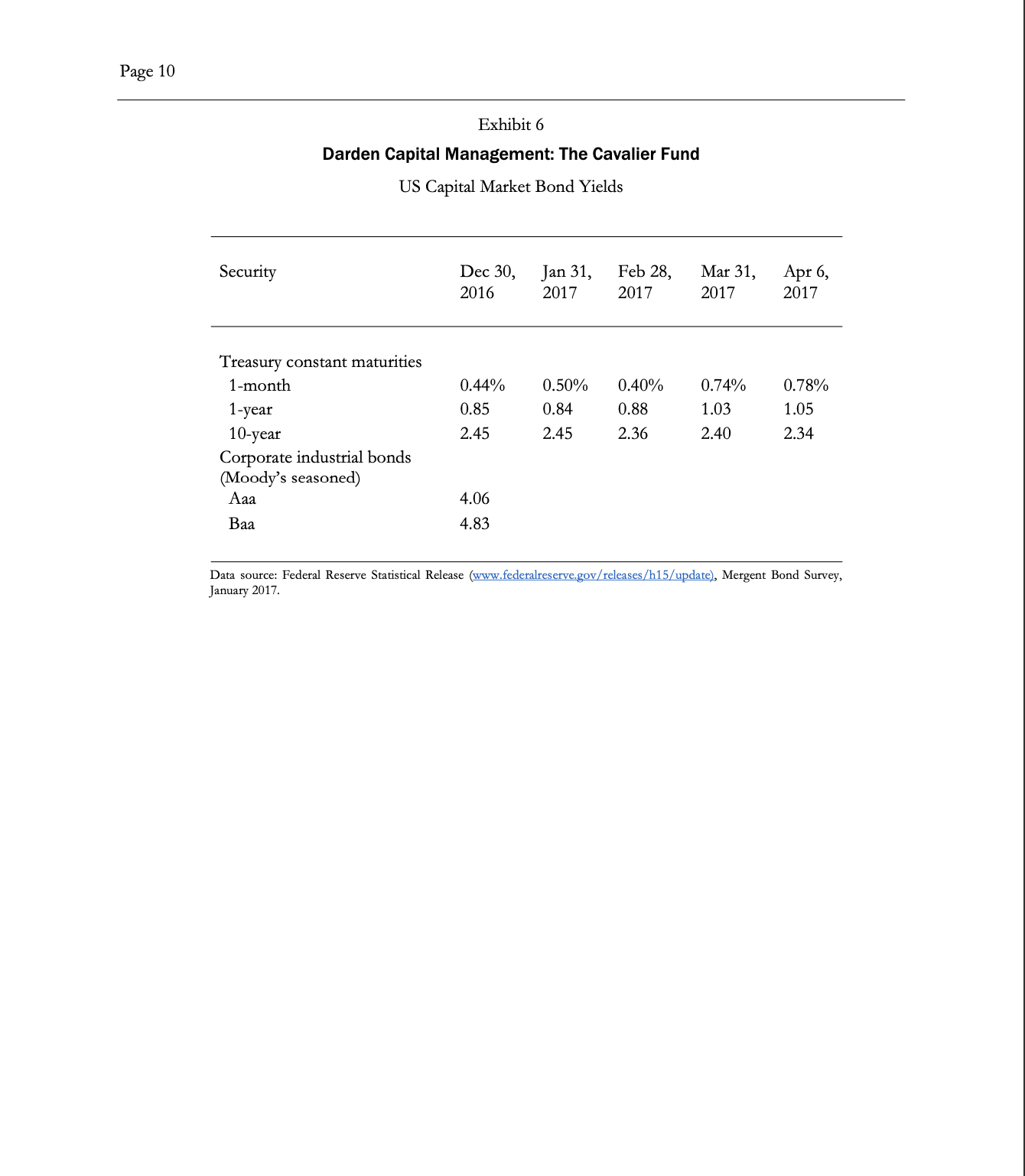

Darden Capital Management: The Cavalier Fund In early April 2017, the Cavalier Fund management team (Cavalier) was in the midst of its first meeting of the new fiscal year. The team was part of the Darden Capital Management (DCM) program at the Darden School of Business, in which MBA students were entrusted with managing endowment capital for the school foundation. The program sought to prepare its participants for careers in investment analysis and portfolio management, with the recognition that hands-on experience in investment management was an important aspect of professional training. The total assets under management for the Darden Capital Management program were over $11 million, and were held in five funds: the Cavalier Fund, the Darden Fund, the Jefferson Fund, the Monticello Fund, and the Rotunda Fund. Each fund was managed independently by a small team of MBA students with some guidance from a student executive team, a faculty advisor, and a board of trustees. Cavalier's investment strategy was to use fundamental analysis to identify and invest in companies that were undervalued relative to their long-term earning potential. The fund team looked for stocks that would generate above-normal returns over a one-to-four-year horizon. Using a bottom-up approach to stock selection, Cavalier held a diversified portfolio of about 25 stocks with current assets under management of $2.7 million. The fund also allowed some short positions for stocks expected to underperform. The new team of four first-year student portfolio managers (see Exhibit 1) was unified in its resolve to beat the fund's benchmark-the Standard and Poor's 500 index (S&P 500)over the coming year. There was, however, a fierce debate on the stock selection strategy required to accomplish this goal. The Portfolio Allocation Decision Prior to the meeting, Cavalier's senior portfolio manager, Daniel Nickerson, solicited from the team a list of securities for consideration as investment candidates. This request resulted in a short list of four stocks: Delphi Automotive; Groupon, Inc.; Kellogg Company; and Kinross Gold Corp. The team collected a variety of historic and estimated data on the four stocks. Exhibit 2 contains the monthly return performance of each of the four stocks over the previous five years. Exhibit 3 details various firm characteristics and historical return statistics. The team had met to obtain a consensus view on the anticipated returns for each stock over the next three years. In this analysis, the team had developed a financial forecast and a terminal value estimate of the fair value of each company for 2020. Based on these figures, the team had calculated the following anticipated rates of return for the next few years (Table 1):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started