Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q:1 Ms. Sarah is a single woman with no children. Her parents, all pass away long time ago, the only relative she has is

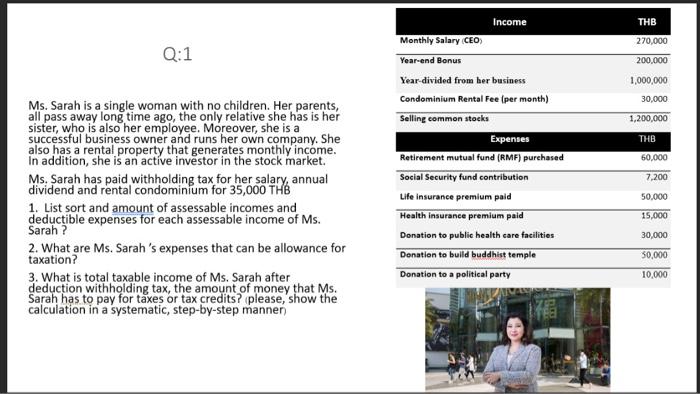

Q:1 Ms. Sarah is a single woman with no children. Her parents, all pass away long time ago, the only relative she has is her sister, who is also her employee. Moreover, she is a successful business owner and runs her own company. She also has a rental property that generates monthly income. In addition, she is an active investor in the stock market. Ms. Sarah has paid withholding tax for her salary, annual dividend and rental condominium for 35,000 THB 1. List sort and amount of assessable incomes and deductible expenses for each assessable income of Ms. Sarah? 2. What are Ms. Sarah's expenses that can be allowance for taxation? 3. What is total taxable income of Ms. Sarah after deduction withholding tax, the amount of money that Ms. Sarah has to pay for taxes or tax credits? (please, show the calculation in a systematic, step-by-step mannen) Monthly Salary (CEO) Year-end Bonus Income Year-divided from her business Condominium Rental Fee (per month) Selling common stocks Expenses Retirement mutual fund (RMF) purchased Social Security fund contribution Life insurance premium paid Health insurance premium paid Donation to public health care facilities Donation to build buddhist temple Donation to a political party THB 270,000 200,000 1,000,000 30,000 1,200,000 THB 60,000 7,200 50,000 15,000 30,000 50,000 10,000

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Assessable Incomes Monthly Salary CEO 270000 THB Yearend Bonus 1200000 THB Rental Income Monthly C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started