Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Q2 Q3 Q4 Q5 PLZ ANSWER ALL THE QUESTIONS I WILL LEAVE GOOD COMMENT AND RATINGS THANKS Which of the following journal entries is

Q1

Q2

Q3

Q4

Q5

PLZ ANSWER ALL THE QUESTIONS I WILL LEAVE GOOD COMMENT AND RATINGS THANKS

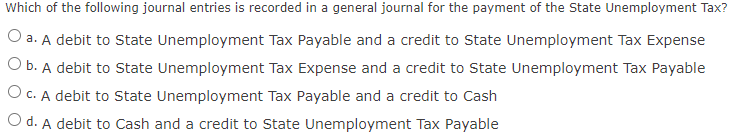

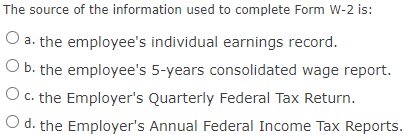

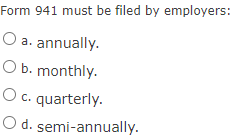

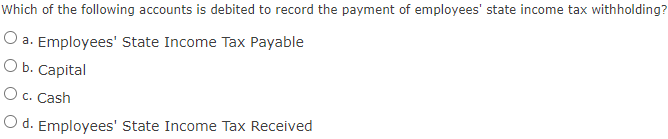

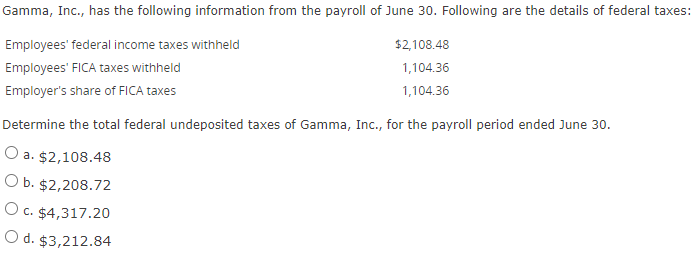

Which of the following journal entries is recorded in a general journal for the payment of the State Unemployment Tax? O a. A debit to State Unemployment Tax Payable and a credit to State Unemployment Tax Expense Ob. A debit to State Unemployment Tax Expense and a credit to State Unemployment Tax Payable OC. A debit to State Unemployment Tax Payable and a credit to Cash Od. A debit to Cash and a credit to State Unemployment Tax Payable The source of the information used to complete Form W-2 is: O a. the employee's individual earnings record. O b. the employee's 5-years consolidated wage report. O c. the Employer's Quarterly Federal Tax Return. O d. the Employer's Annual Federal Income Tax Reports. Form 941 must be filed by employers: O a. annually. O b. monthly. O c. quarterly. O d. semi-annually. Which of the following accounts is debited to record the payment of employees' state income tax withholding? O a. Employees' State Income Tax Payable O b. Capital O c. Cash O d. Employees' State Income Tax Received Gamma, Inc., has the following information from the payroll of June 30. Following are the details of federal taxes: Employees' federal income taxes withheld Employees' FICA taxes withheld Employer's share of FICA taxes $2,108.48 1,104.36 1,104.36 Determine the total federal undeposited taxes of Gamma, Inc., for the payroll period ended June 30. O a. $2,108.48 O b. $2,208.72 O c. $4,317.20 O d. $3,212.84Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started