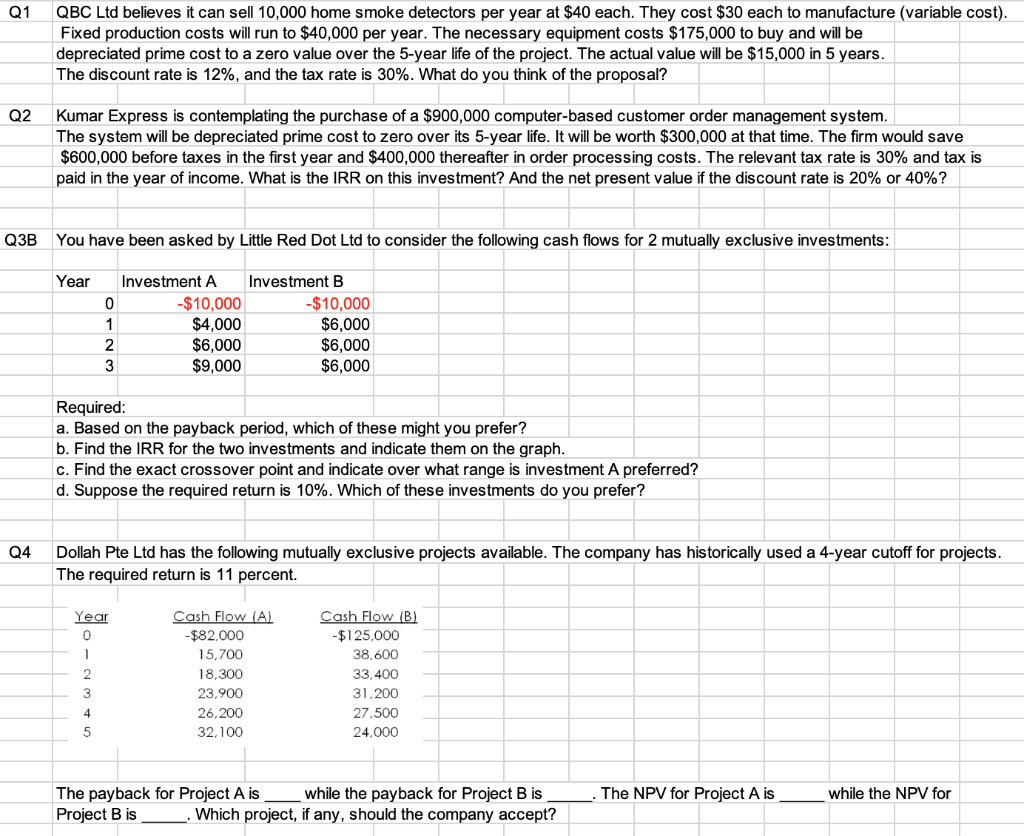

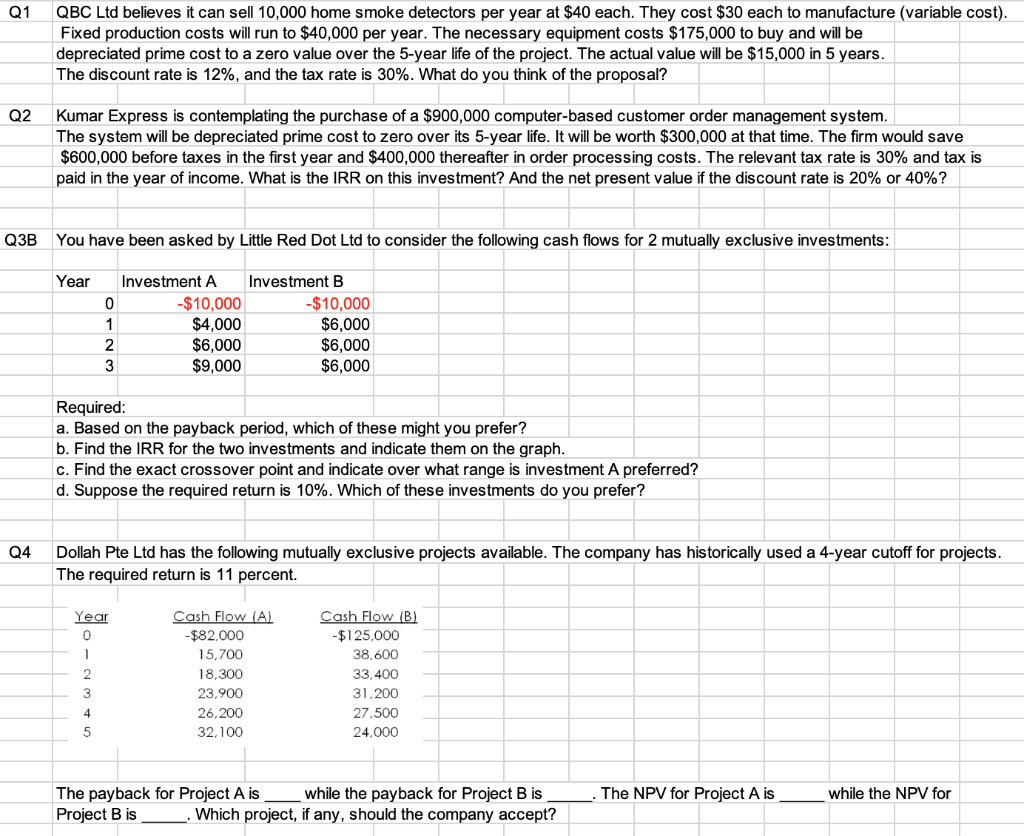

Q1 QBC Ltd believes it can sell 10,000 home smoke detectors per year at $40 each. They cost $30 each to manufacture (variable cost). Fixed production costs will run to $40,000 per year. The necessary equipment costs $175,000 to buy and will be depreciated prime cost to a zero value over the 5-year life of the project. The actual value will be $15,000 in 5 years. The discount rate is 12%, and the tax rate is 30%. What do you think of the proposal? Q2 Kumar Express is contemplating the purchase of a $900,000 computer-based customer order management system. The system will be depreciated prime cost to zero over its 5 -year life. It will be worth $300,000 at that time. The firm would save $600,000 before taxes in the first year and $400,000 thereafter in order processing costs. The relevant tax rate is 30% and tax is paid in the year of income. What is the IRR on this investment? And the net present value if the discount rate is 20% or 40% ? Q3B You have been asked by Little Red Dot Ltd to consider the following cash flows for 2 mutually exclusive investments: Required: a. Based on the payback period, which of these might you prefer? b. Find the IRR for the two investments and indicate them on the graph. c. Find the exact crossover point and indicate over what range is investment A preferred? d. Suppose the required return is 10%. Which of these investments do you prefer? C I he payback tor Project A is while the payback tor Project B is . I he NPV tor Project A is while the NPV tor Project B is . Which project, if any, should the company accept? Q1 QBC Ltd believes it can sell 10,000 home smoke detectors per year at $40 each. They cost $30 each to manufacture (variable cost). Fixed production costs will run to $40,000 per year. The necessary equipment costs $175,000 to buy and will be depreciated prime cost to a zero value over the 5-year life of the project. The actual value will be $15,000 in 5 years. The discount rate is 12%, and the tax rate is 30%. What do you think of the proposal? Q2 Kumar Express is contemplating the purchase of a $900,000 computer-based customer order management system. The system will be depreciated prime cost to zero over its 5 -year life. It will be worth $300,000 at that time. The firm would save $600,000 before taxes in the first year and $400,000 thereafter in order processing costs. The relevant tax rate is 30% and tax is paid in the year of income. What is the IRR on this investment? And the net present value if the discount rate is 20% or 40% ? Q3B You have been asked by Little Red Dot Ltd to consider the following cash flows for 2 mutually exclusive investments: Required: a. Based on the payback period, which of these might you prefer? b. Find the IRR for the two investments and indicate them on the graph. c. Find the exact crossover point and indicate over what range is investment A preferred? d. Suppose the required return is 10%. Which of these investments do you prefer? C I he payback tor Project A is while the payback tor Project B is . I he NPV tor Project A is while the NPV tor Project B is . Which project, if any, should the company accept