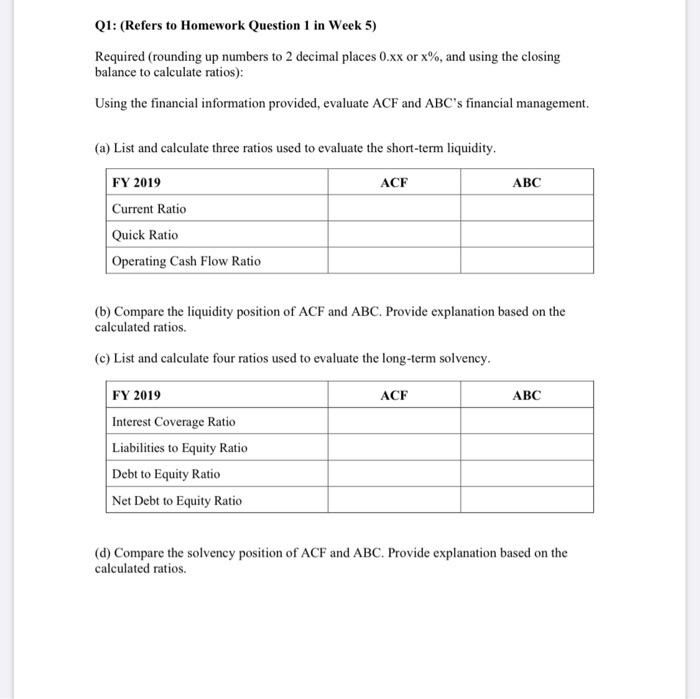

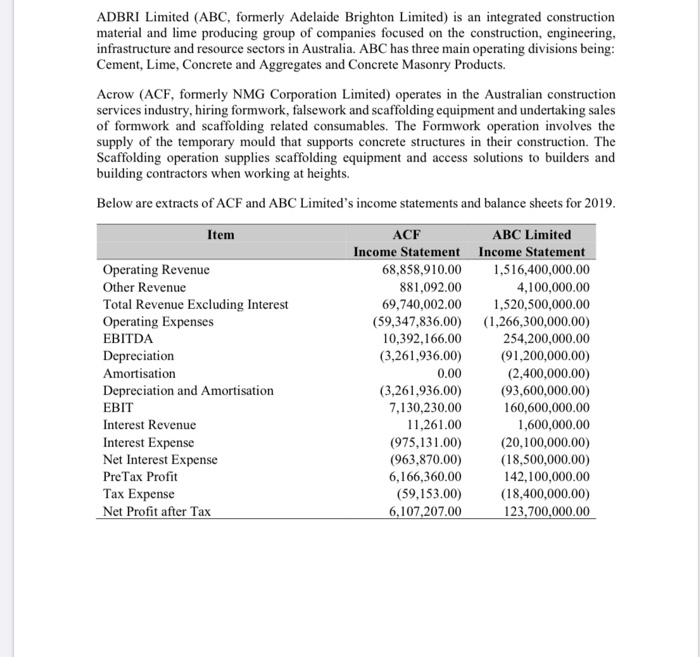

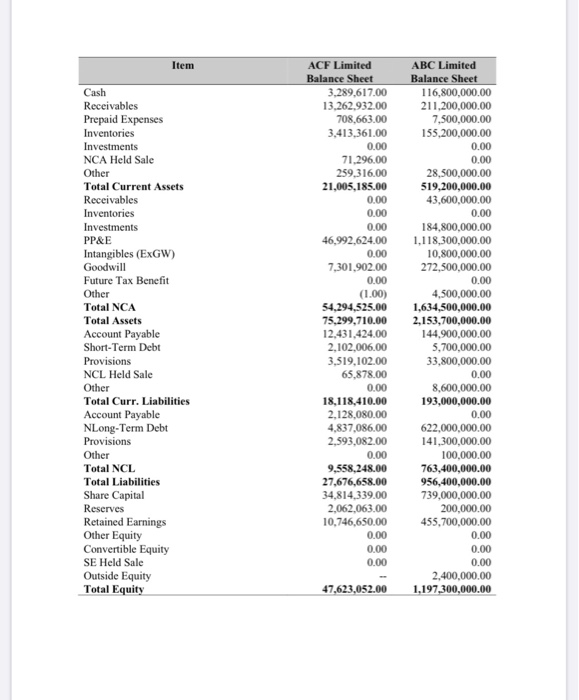

Q1: (Refers to Homework Question 1 in Week 5) Required (rounding up numbers to 2 decimal places 0.xx or x%, and using the closing balance to calculate ratios): Using the financial information provided, evaluate ACF and ABC's financial management. (a) List and calculate three ratios used to evaluate the short-term liquidity. ACF ABC FY 2019 Current Ratio Quick Ratio Operating Cash Flow Ratio (b) Compare the liquidity position of ACF and ABC. Provide explanation based on the calculated ratios. (c) List and calculate four ratios used to evaluate the long-term solvency. FY 2019 ACF ABC Interest Coverage Ratio Liabilities to Equity Ratio Debt to Equity Ratio Net Debt to Equity Ratio (d) Compare the solvency position of ACF and ABC. Provide explanation based on the calculated ratios. ADBRI Limited (ABC, formerly Adelaide Brighton Limited) is an integrated construction material and lime producing group of companies focused on the construction, engineering, infrastructure and resource sectors in Australia. ABC has three main operating divisions being: Cement, Lime, Concrete and Aggregates and Concrete Masonry Products. Acrow (ACF, formerly NMG Corporation Limited) operates in the Australian construction services industry, hiring formwork, falsework and scaffolding equipment and undertaking sales of formwork and scaffolding related consumables. The Formwork operation involves the supply of the temporary mould that supports concrete structures in their construction. The Scaffolding operation supplies scaffolding equipment and access solutions to builders and building contractors when working at heights. Below are extracts of ACF and ABC Limited's income statements and balance sheets for 2019. Item ACF ABC Limited Income Statement Income Statement Operating Revenue 68,858,910.00 1,516,400,000.00 Other Revenue 881,092.00 4,100,000.00 Total Revenue Excluding Interest 69,740,002.00 1,520,500,000.00 Operating Expenses (59,347,836.00) (1,266,300,000.00) EBITDA 10,392,166.00 254,200,000.00 Depreciation (3,261,936.00) (91,200,000.00) Amortisation 0.00 (2,400,000,00) Depreciation and Amortisation (3,261,936.00) (93,600,000.00) EBIT 7,130,230.00 160,600,000.00 Interest Revenue 11,261.00 1,600,000.00 Interest Expense (975,131.00) (20,100,000.00) Net Interest Expense (963,870.00) (18,500,000.00) PreTax Profit 6,166,360.00 142,100,000.00 Tax Expense (59,153.00) (18,400,000.00) Net Profit after Tax 6,107,207.00 123,700,000.00 Item Cash Receivables Prepaid Expenses Inventories Investments NCA Held Sale Other Total Current Assets Receivables Inventories Investments PP&E Intangibles (ExGW) Goodwill Future Tax Benefit Other Total NCA Total Assets Account Payable Short-Term Debt Provisions NCL Held Sale Other Total Curr. Liabilities Account Payable NLong-Term Debt Provisions Other Total NCL Total Liabilities Share Capital Reserves Retained Earnings Other Equity Convertible Equity SE Held Sale Outside Equity Total Equity ACF Limited Balance Sheet 3,289,617.00 13,262,932.00 708,663.00 3,413,361.00 0.00 71,296.00 259,316.00 21,005,185.00 0.00 0.00 0.00 46,992,624.00 0.00 7,301,902.00 0.00 (1.00) 54,294,525.00 75,299,710.00 12,431,424.00 2,102,006.00 3,519,102.00 65,878.00 0.00 18,118,410.00 2,128,080.00 4,837,086.00 2,593,082.00 0.00 9,558,248.00 27,676,658.00 34,814,339.00 2,062,063.00 10,746,650.00 0.00 0.00 0.00 ABC Limited Balance Sheet 116,800,000.00 211,200,000.00 7,500,000.00 155,200,000.00 0.00 0.00 28,500,000.00 519,200,000.00 43,600,000.00 0.00 184,800,000.00 1,118,300,000.00 10,800,000.00 272,500,000.00 0.00 4,500,000.00 1,634,500,000.00 2,153,700,000.00 144,900,000.00 5,700,000.00 33,800,000.00 0.00 8,600,000.00 193,000,000.00 0.00 622,000,000.00 141,300,000.00 100,000.00 763,400,000.00 956,400,000.00 739,000,000.00 200,000.00 455,700,000.00 0.00 0.00 0.00 2,400,000.00 1,197,300,000.00 47,623,052.00