Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Sam's Bakery has sales of $576,000 with costs of $382,000. Interest expense is $15,000 and depreciation is $31,000. The tax rate is 27%.

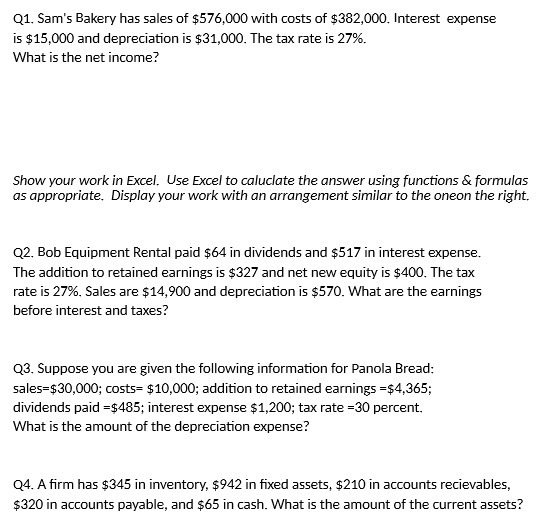

Q1. Sam's Bakery has sales of $576,000 with costs of $382,000. Interest expense is $15,000 and depreciation is $31,000. The tax rate is 27%. What is the net income? Show your work in Excel. Use Excel to caluclate the answer using functions & formulas as appropriate. Display your work with an arrangement similar to the oneon the right. Q2. Bob Equipment Rental paid $64 in dividends and $517 in interest expense. The addition to retained earnings is $327 and net new equity is $400. The tax rate is 27%. Sales are $14,900 and depreciation is $570. What are the earnings before interest and taxes? Q3. Suppose you are given the following information for Panola Bread: sales=$30,000; costs $10,000; addition to retained earnings =$4,365; dividends paid $485; interest expense $1,200; tax rate=30 percent. What is the amount of the depreciation expense? Q4. A firm has $345 in inventory, $942 in fixed assets, $210 in accounts recievables, $320 in accounts payable, and $65 in cash. What is the amount of the current assets?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer To solve these problems in Excel you can use the following formulas and functions 1 Net Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started