Answered step by step

Verified Expert Solution

Question

1 Approved Answer

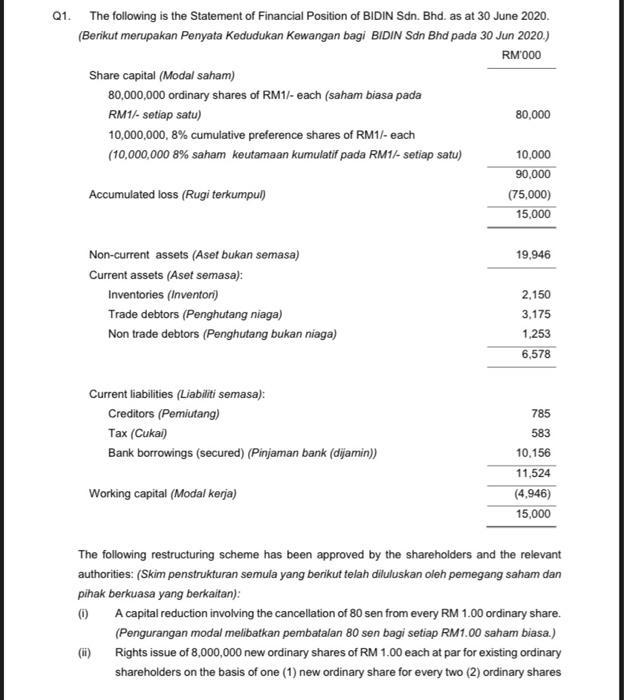

Q1. The following is the Statement of Financial Position of BIDIN Sdn. Bhd. as at 30 June 2020. (Berikut merupakan Penyata Kedudukan Kewangan bagi

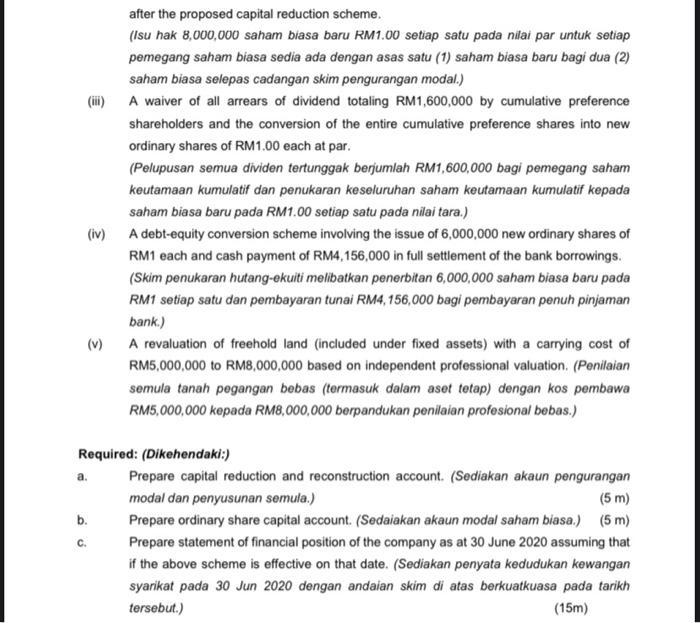

Q1. The following is the Statement of Financial Position of BIDIN Sdn. Bhd. as at 30 June 2020. (Berikut merupakan Penyata Kedudukan Kewangan bagi BIDIN Sdn Bhd pada 30 Jun 2020.) RM'000 Share capital (Modal saham) 80,000,000 ordinary shares of RM1/- each (saham biasa pada RM1/-setiap satu) 10,000,000, 8% cumulative preference shares of RM1/- each (10,000,000 8% saham keutamaan kumulatif pada RM1/-setiap satu) Accumulated loss (Rugi terkumpul) Non-current assets (Aset bukan semasa) Current assets (Aset semasa): Inventories (Inventori) Trade debtors (Penghutang niaga) Non trade debtors (Penghutang bukan niaga) Current liabilities (Liabiliti semasa): Creditors (Pemiutang) Tax (Cukai) Bank borrowings (secured) (Pinjaman bank (dijamin)) Working capital (Modal kerja) (ii) 80,000 10,000 90,000 (75,000) 15,000 19,946 2,150 3,175 1,253 6,578 785 583 10,156 11,524 (4,946) 15,000 The following restructuring scheme has been approved by the shareholders and the relevant authorities: (Skim penstrukturan semula yang berikut telah diluluskan oleh pemegang saham dan pihak berkuasa yang berkaitan): (0) A capital reduction involving the cancellation of 80 sen from every RM 1.00 ordinary share. (Pengurangan modal melibatkan pembatalan 80 sen bagi setiap RM1.00 saham biasa.) Rights issue of 8,000,000 new ordinary shares of RM 1.00 each at par for existing ordinary shareholders on the basis of one (1) new ordinary share for every two (2) ordinary shares after the proposed capital reduction scheme. (Isu hak 8,000,000 saham biasa baru RM1.00 setiap satu pada nilai par untuk setiap pemegang saham biasa sedia ada dengan asas satu (1) saham biasa baru bagi dua (2) saham biasa selepas cadangan skim pengurangan modal.) (iii) A waiver of all arrears of dividend totaling RM1,600,000 by cumulative preference shareholders and the conversion of the entire cumulative preference shares into new ordinary shares of RM1.00 each at par. (Pelupusan semua dividen tertunggak berjumlah RM1,600,000 bagi pemegang saham keutamaan kumulatif dan penukaran keseluruhan saham keutamaan kumulatif kepada saham biasa baru pada RM1.00 setiap satu pada nilai tara.) (iv) A debt-equity conversion scheme involving the issue of 6,000,000 new ordinary shares of RM1 each and cash payment of RM4,156,000 in full settlement of the bank borrowings. (Skim penukaran hutang-ekuiti melibatkan penerbitan 6,000,000 saham biasa baru pada RM1 setiap satu dan pembayaran tunai RM4, 156,000 bagi pembayaran penuh pinjaman bank.) (v) A revaluation of freehold land (included under fixed assets) with a carrying cost of RM5,000,000 to RM8,000,000 based on independent professional valuation. (Penilaian semula tanah pegangan bebas (termasuk dalam aset tetap) dengan kos pembawa RM5,000,000 kepada RM8,000,000 berpandukan penilaian profesional bebas.) Required: (Dikehendaki:) a. b. C. Prepare capital reduction and reconstruction account. (Sediakan akaun pengurangan modal dan penyusunan semula.) (5 m) Prepare ordinary share capital account. (Sedaiakan akaun modal saham biasa.) (5 m) Prepare statement of financial position of the company as at 30 June 2020 assuming that if the above scheme is effective on that date. (Sediakan penyata kedudukan kewangan syarikat pada 30 Jun 2020 dengan andaian skim di atas berkuatkuasa pada tarikh tersebut.) (15m)

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Business restructuringis process of reconstructing a companys financial struc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started