Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1) The three year bond yield curve is 2.0%, 2.5% and 3.2%. Compute the annual zero coupon bond prices (B), the spot rates (S)

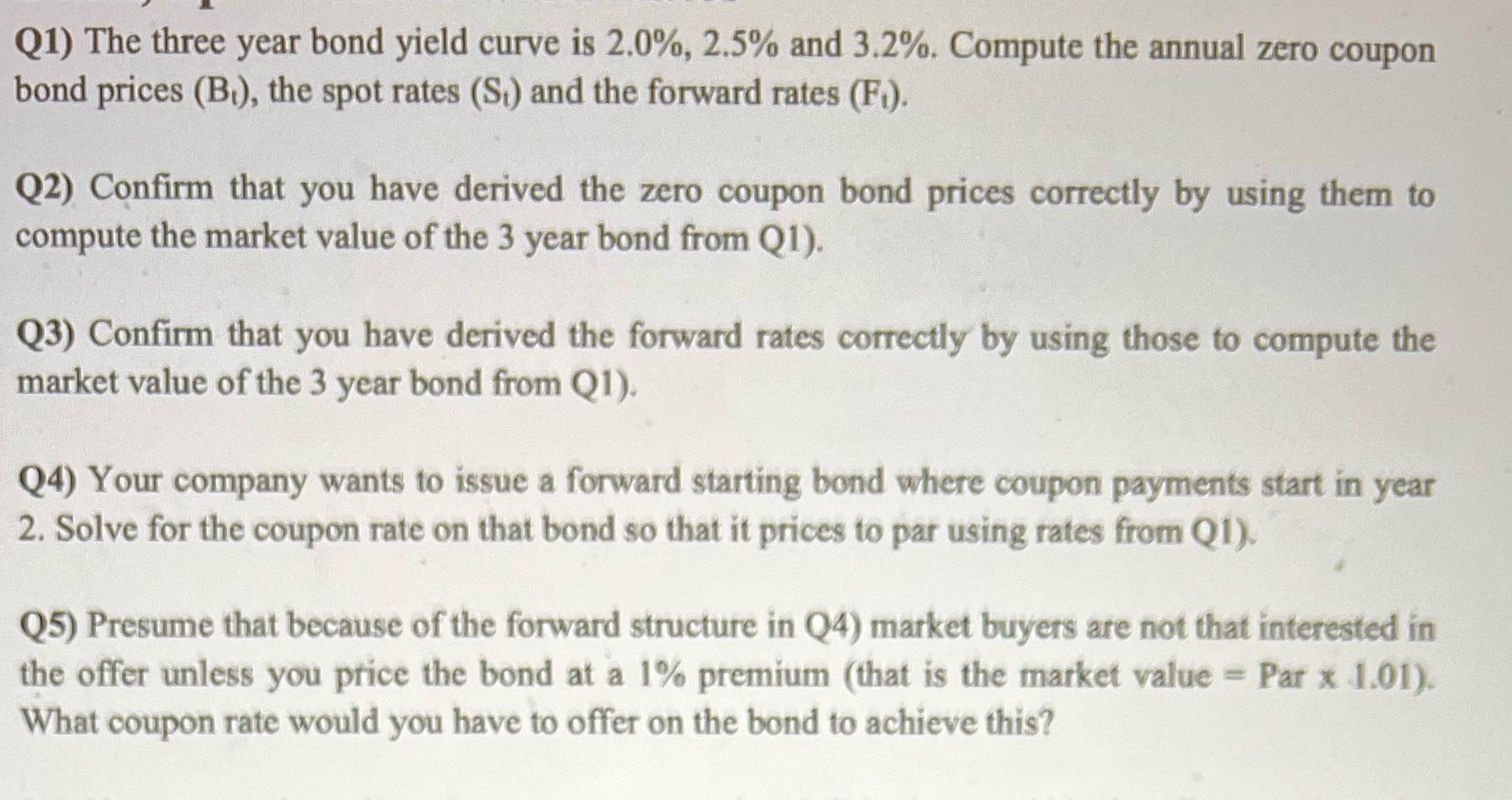

Q1) The three year bond yield curve is 2.0%, 2.5% and 3.2%. Compute the annual zero coupon bond prices (B), the spot rates (S) and the forward rates (F). Q2) Confirm that you have derived the zero coupon bond prices correctly by using them to compute the market value of the 3 year bond from Q1). Q3) Confirm that you have derived the forward rates correctly by using those to compute the market value of the 3 year bond from Q1). Q4) Your company wants to issue a forward starting bond where coupon payments start in year 2. Solve for the coupon rate on that bond so that it prices to par using rates from Q1), Q5) Presume that because of the forward structure in Q4) market buyers are not that interested in the offer unless you price the bond at a 1% premium (that is the market value = Par x 1.01). What coupon rate would you have to offer on the bond to achieve this?

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 To compute the annual zero coupon bond prices B spot rates S and forward rates F based on the given threeyear bond yield curve we can use the following formulas For zero coupon bond prices B B 1 1 S ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started