Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 urgent Muharraq Co. paid the following different costs in 2020: 1. $2,000,000 to acquire a machine to be used in the R&D projects. The

Q1 urgent

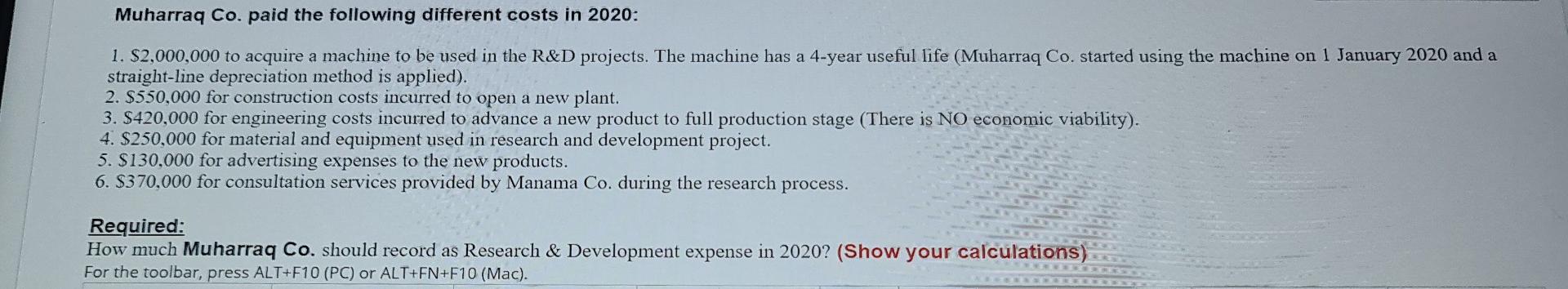

Muharraq Co. paid the following different costs in 2020: 1. $2,000,000 to acquire a machine to be used in the R&D projects. The machine has a 4-year useful life (Muharraq Co. started using the machine on 1 January 2020 and a straight-line depreciation method is applied). 2. $550,000 for construction costs incurred to open a new plant. 3. $420,000 for engineering costs incurred to advance a new product to full production stage (There is NO economic viability). 4. $250,000 for material and equipment used in research and development project. 5. $130,000 for advertising expenses to the new products. 6. $370,000 for consultation services provided by Manama Co. during the research process. Required: How much Muharraq Co. should record as Research & Development expense in 2020? (Show your calculations) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). Muharraq Co. paid the following different costs in 2020: 1. $2,000,000 to acquire a machine to be used in the R&D projects. The machine has a 4-year useful life (Muharraq Co. started using the machine on 1 January 2020 and a straight-line depreciation method is applied). 2. $550,000 for construction costs incurred to open a new plant. 3. $420,000 for engineering costs incurred to advance a new product to full production stage (There is NO economic viability). 4. $250,000 for material and equipment used in research and development project. 5. $130,000 for advertising expenses to the new products. 6. $370,000 for consultation services provided by Manama Co. during the research process. Required: How much Muharraq Co. should record as Research & Development expense in 2020? (Show your calculations) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started