Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Walsh Company produces a single product. Last year, the company manufactured 25,000 units and sold 22,000 units. Production costs were as follows: Direct material

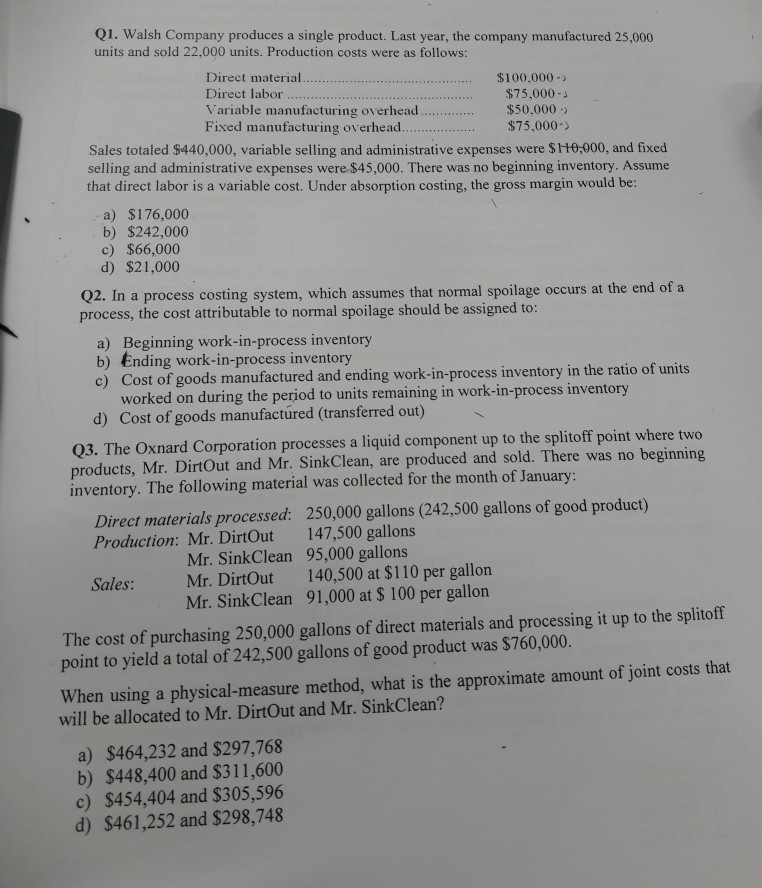

Q1. Walsh Company produces a single product. Last year, the company manufactured 25,000 units and sold 22,000 units. Production costs were as follows: Direct material $100,000- $75,000- $50,000 Direct labor Variable manufacturing overhead Fixed manufacturing overhead. $75,000- Sales totaled $440,000, variable selling and administrative expenses were selling and administrative expenses were $45,000. There was no $H0,000, and fixed beginning inventory. Assume that direct labor is a variable cost. Under absorption costing, the gross margin would be: a) $176,000 b) $242,000 c) $66,000 d) $21,000 Q2. In process, the cost attributable to normal spoilage should be assigned to: process costing system, which assumes that normal spoilage occurs at the end of a C a) Beginning work-in-process inventory b) Ending work-in-process inventory c) Cost of goods manufactured and ending work-in-process inventory in the ratio of units worked on during the period to units remaining in work-in-process inventory d) Cost of goods manufactured (transferred out) I f point where two beginning Q3. The Oxnard Corporation processes a liquid component up to the spl products, Mr. DirtOut and Mr. SinkClean, inventory. The following material was collected for the month of January: produced and sold. There was no are 250,000 gallons (242,500 gallons of good product) 147,500 gallons Direct materials processed: Production: Mr. DirtOut Mr. SinkClean 95,000 gallons Mr. DirtOut Mr. SinkClean 140,500 at $110 per gallon 91,000 at $ 100 per gallon Sales: The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product $760,000. was When using a physical-measure method, what is the approximate amount of joint costs that will be allocated to Mr. DirtOut and Mr. SinkClean? a) $464,232 and $297,768 b) $448,400 and $311,600 c) $454,404 and $305,596 d) $461,252 and $298,748

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started