Answered step by step

Verified Expert Solution

Question

1 Approved Answer

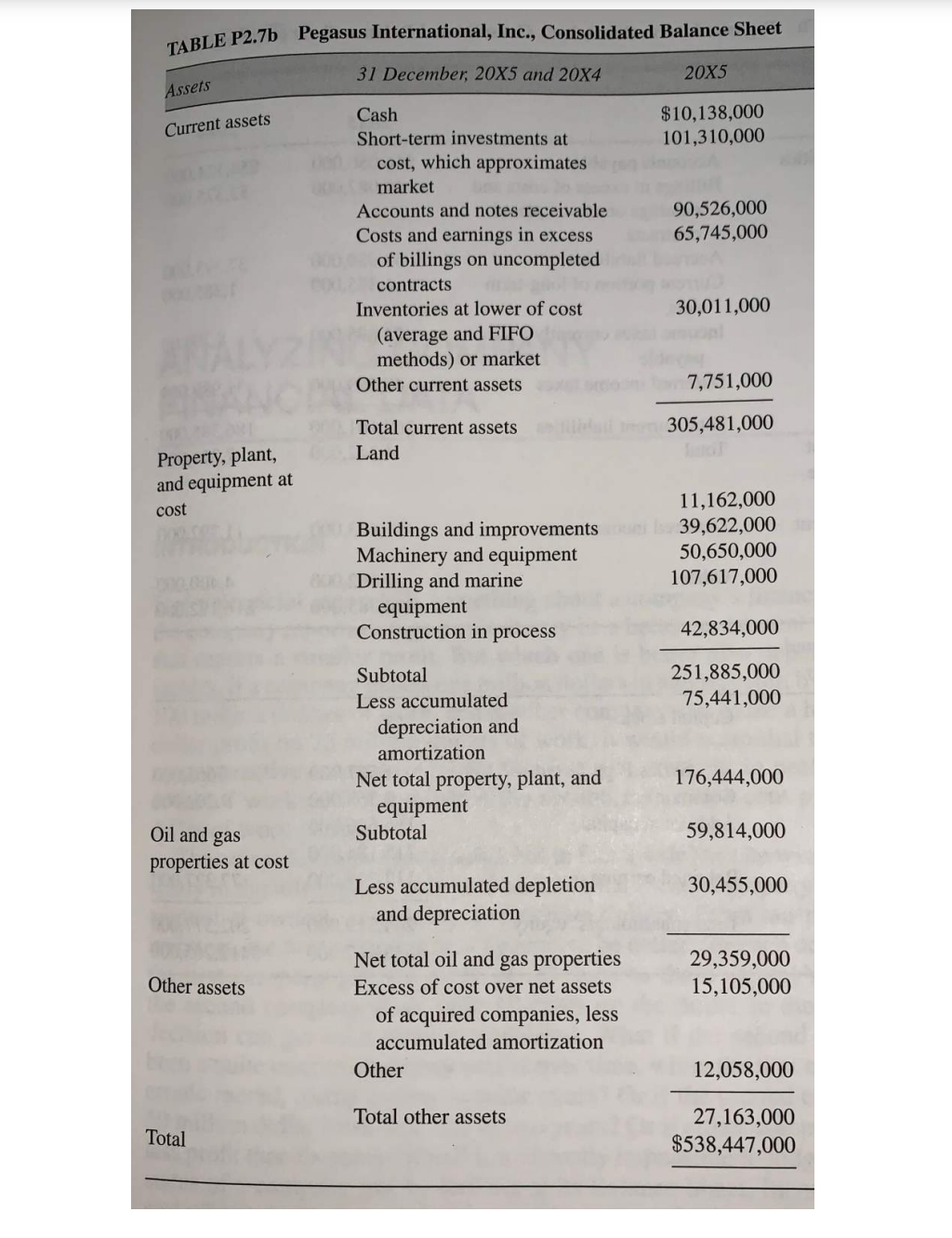

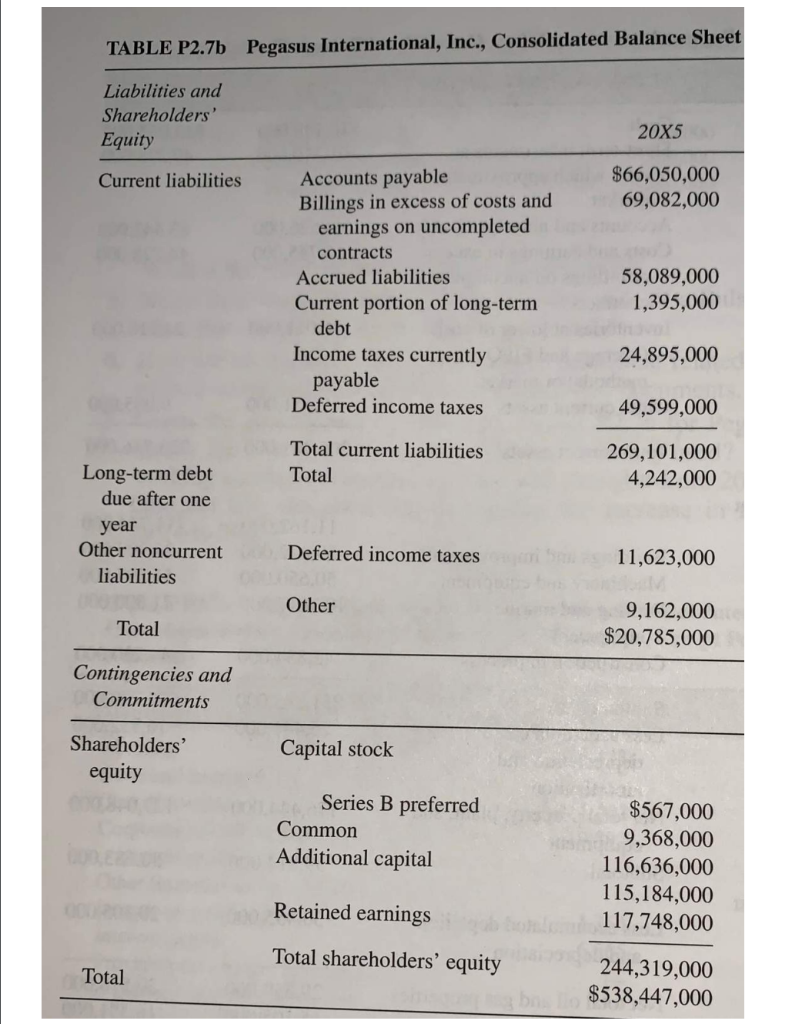

Q1. What is the current ratio of Pegasus International , Inc.? A.) 1.1352 B.) 0.8809 C.) $36,380,000 D.) 14.56 Q2. What is the working capital

Q1. What is the current ratio of Pegasus International , Inc.?

A.) 1.1352

B.) 0.8809

C.) $36,380,000

D.) 14.56

Q2. What is the working capital for Pegasus International, Inc.?

A.) $36,380,000

B.) 1.1352

C.) 0.8809

D.) 56.489

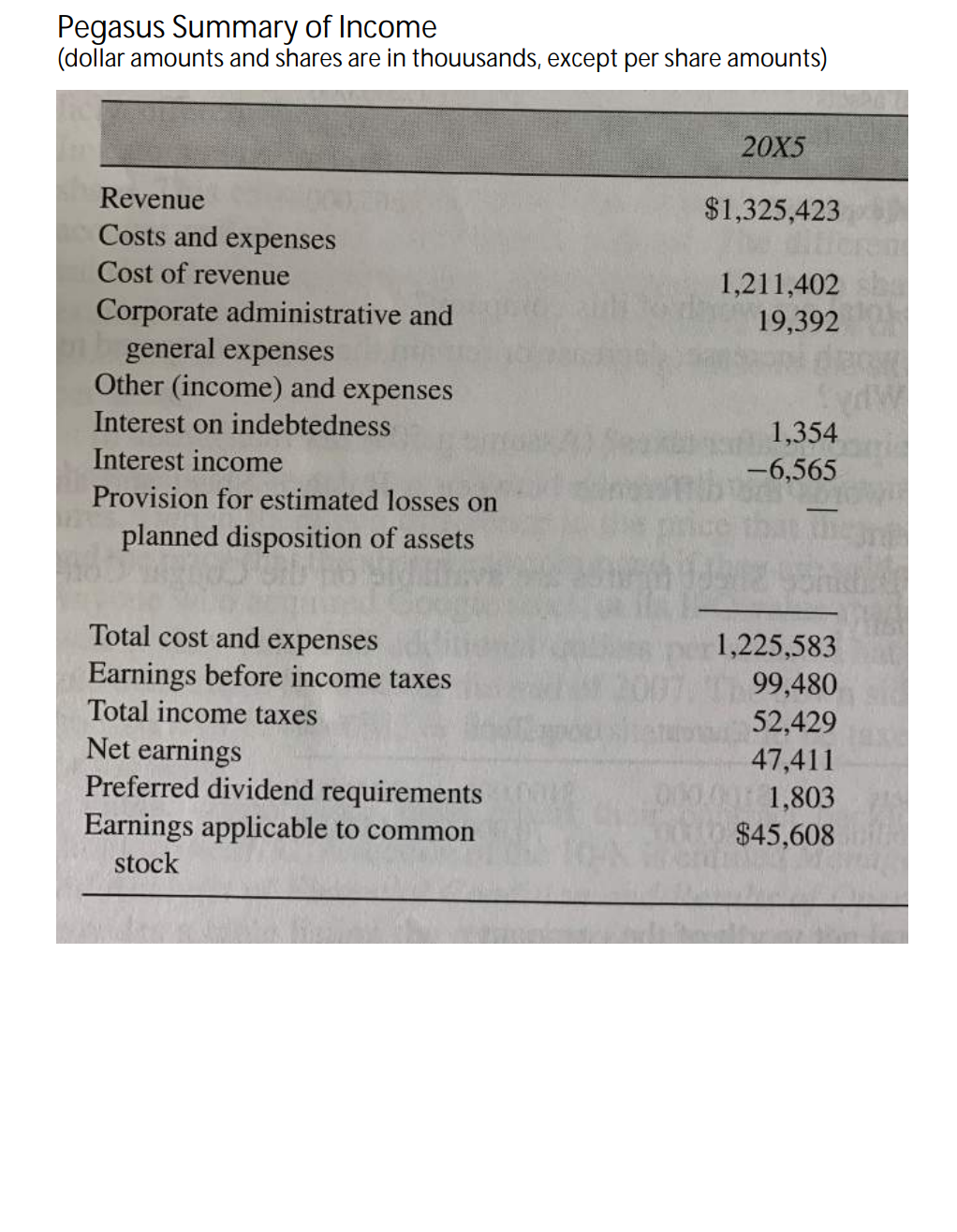

Q3. What is the return on revenue for Pegasus International, Inc.?

A.) 0.03577

B.) 27.956

C.) 0.92467

D.) 1.08146

Dadacus International. Inc Concolidatad Ralance Sheet TABLE P2.7b Pegasus International, Inc., Consolidated Balance Sheet Liabilities and Shareholders' Contingencies and Commitments \begin{tabular}{lcr} \hline Shareholders' equity & Capital stock \\ & Series B preferred & \\ & Common & $567,000 \\ & Additional capital & 9,368,000 \\ & & 116,636,000 \\ & Retained earnings & 115,184,000 \\ & & 117,748,000 \\ \hline Total & Total shareholders' equity & 244,319,000 \\ \hline \end{tabular} Pegasus Summary of Income (dollar amounts and shares are in thouusands, except per share amounts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started