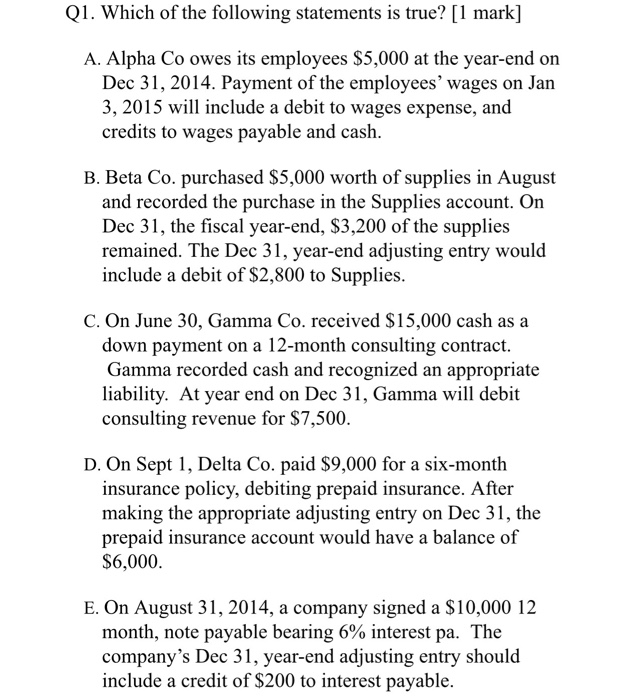

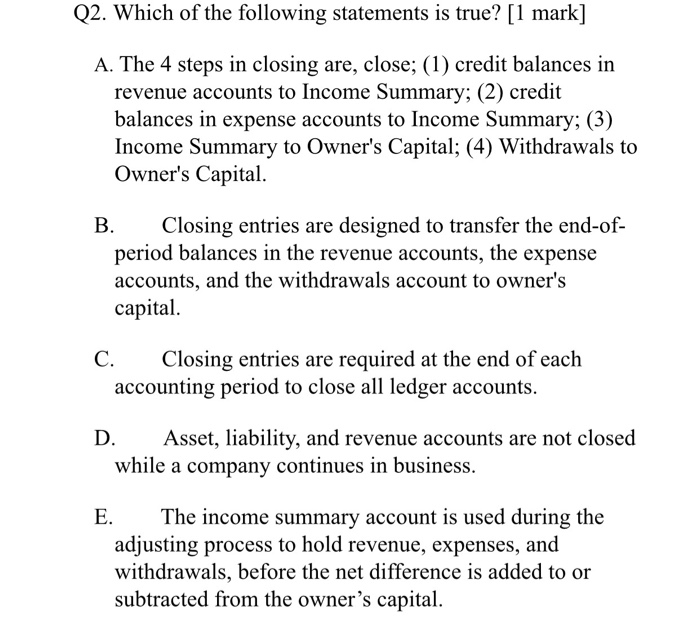

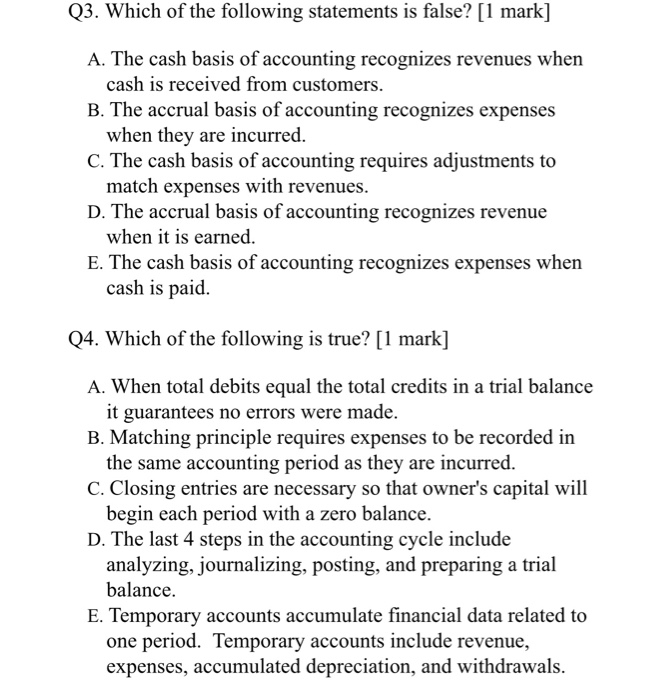

Q1. Which of the following statements is true? [1 mark] A. Alpha Co owes its employees $5,000 at the year-end on Dec 31, 2014. Payment of the employees' wages on Jan 3, 2015 will include a debit to wages expense, and credits to wages payable and cash. B. Beta Co. purchased $5,000 worth of supplies in August and recorded the purchase in the Supplies account. On Dec 31, the fiscal year-end, $3,200 of the supplies remained. The Dec 31, year-end adjusting entry would include a debit of $2,800 to Supplies. C. On June 30, Gamma Co. received $15,000 cash as a down payment on a 12-month consulting contract. Gamma recorded cash and recognized an appropriate liability. At year end on Dec 31, Gamma will debit consulting revenue for $7,500. D. On Sept 1, Delta Co. paid $9,000 for a six-month insurance policy, debiting prepaid insurance. After making the appropriate adjusting entry on Dec 31, the prepaid insurance account would have a balance of $6,000. E. On August 31, 2014, a company signed a $10,000 12 month, note payable bearing 6% interest pa. The company's Dec 31, year-end adjusting entry should include a credit of $200 to interest payable. Q2. Which of the following statements is true? [1 mark] A. The 4 steps in closing are, close; (1) credit balances in revenue accounts to Income Summary; (2) credit balances in expense accounts to Income Summary; (3) Income Summary to Owner's Capital; (4) Withdrawals to Owner's Capital. B. Closing entries are designed to transfer the end-of- period balances in the revenue accounts, the expense accounts, and the withdrawals account to owner's capital. C. Closing entries are required at the end of each accounting period to close all ledger accounts. D. Asset, liability, and revenue accounts are not closed while a company continues in business. E. The income summary account is used during the adjusting process to hold revenue, expenses, and withdrawals, before the net difference is added to or subtracted from the owner's capital. Q3. Which of the following statements is false? [1 mark] A. The cash basis of accounting recognizes revenues when cash is received from customers. B. The accrual basis of accounting recognizes expenses when they are incurred. C. The cash basis of accounting requires adjustments to match expenses with revenues. D. The accrual basis of accounting recognizes revenue when it is earned. E. The cash basis of accounting recognizes expenses when cash is paid. Q4. Which of the following is true? [1 mark] A. When total debits equal the total credits in a trial balance it guarantees no errors were made. B. Matching principle requires expenses to be recorded in same accounting period as they are incurred. C. Closing entries are necessary so that owner's capital will begin each period with a zero balance. D. The last 4 steps in the accounting cycle include analyzing, journalizing, posting, and preparing a trial balance. E. Temporary accounts accumulate financial data related to one period. Temporary accounts include revenue, expenses, accumulated depreciation, and withdrawals