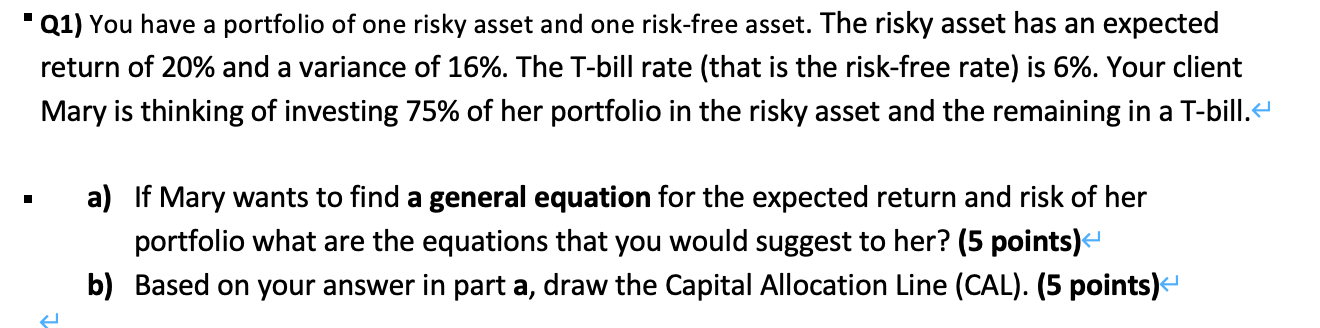

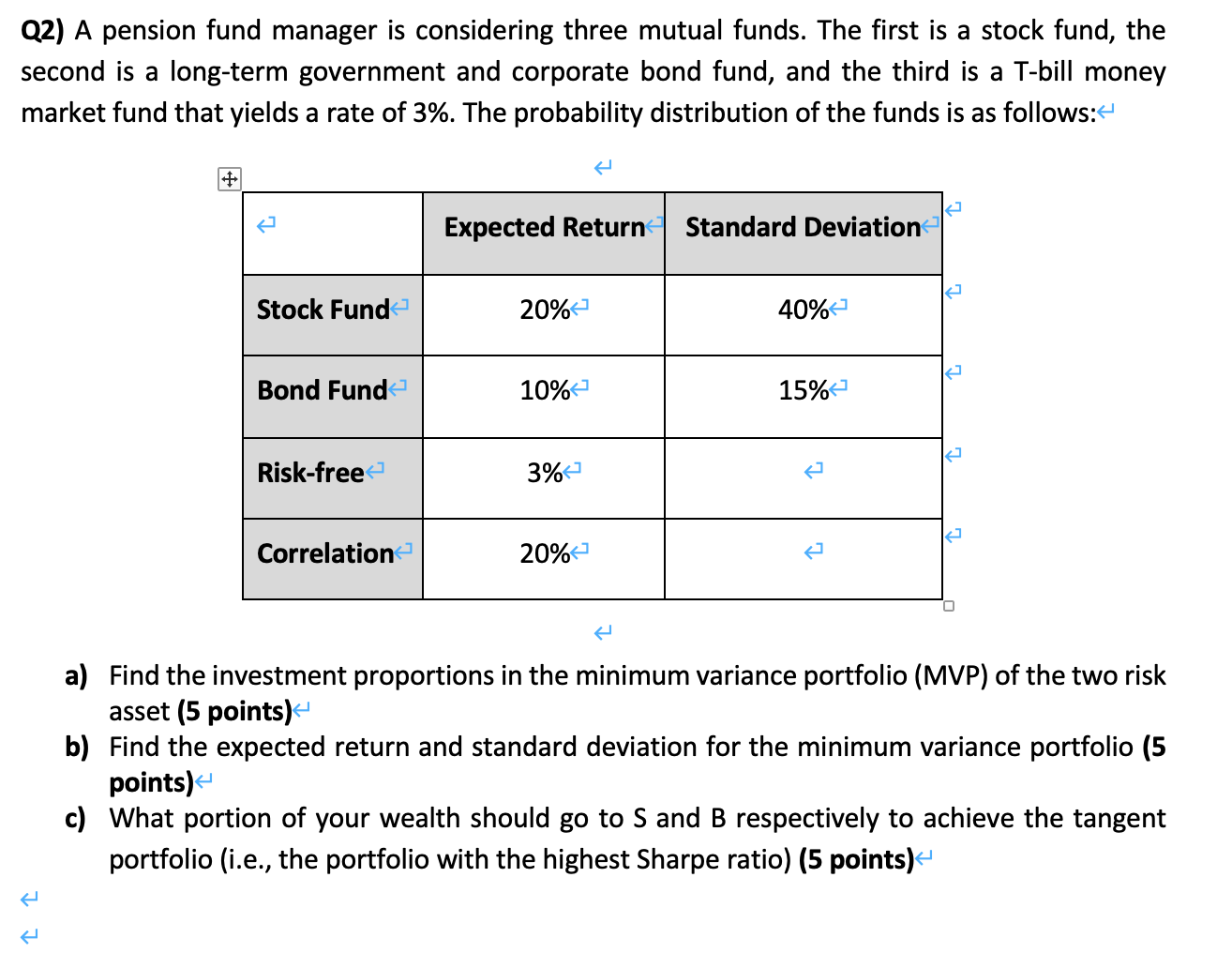

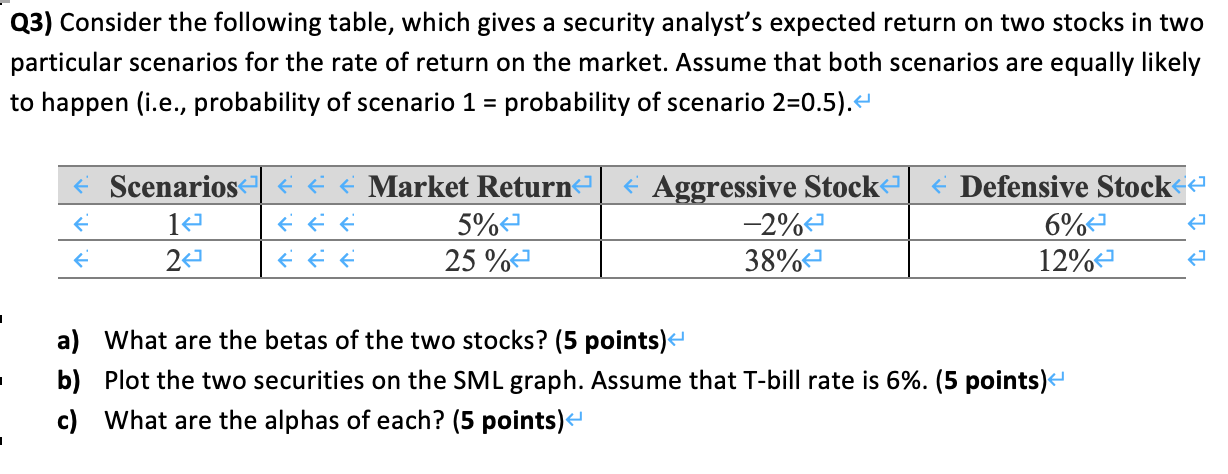

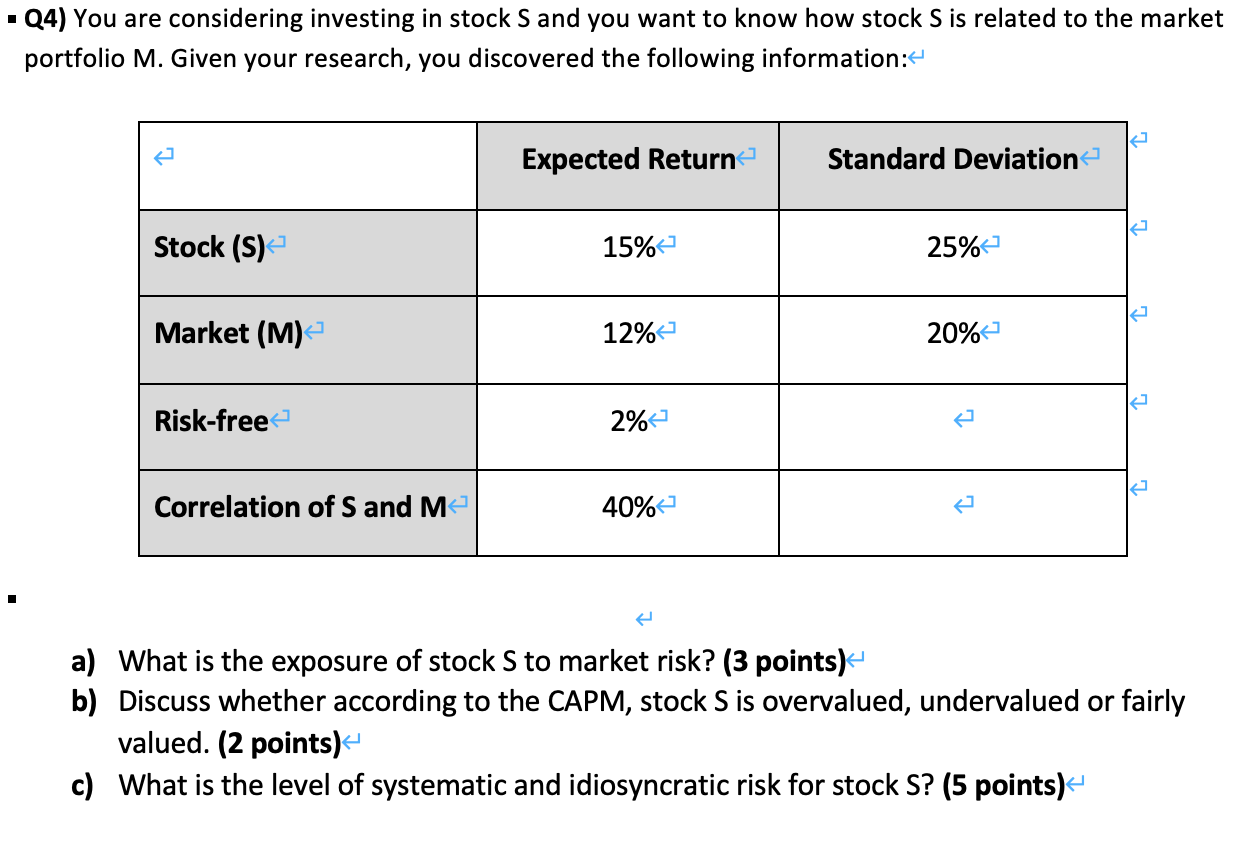

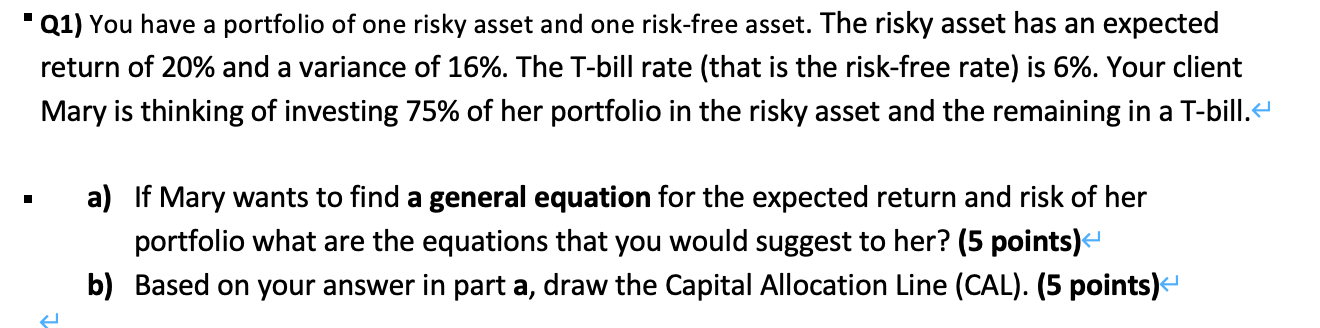

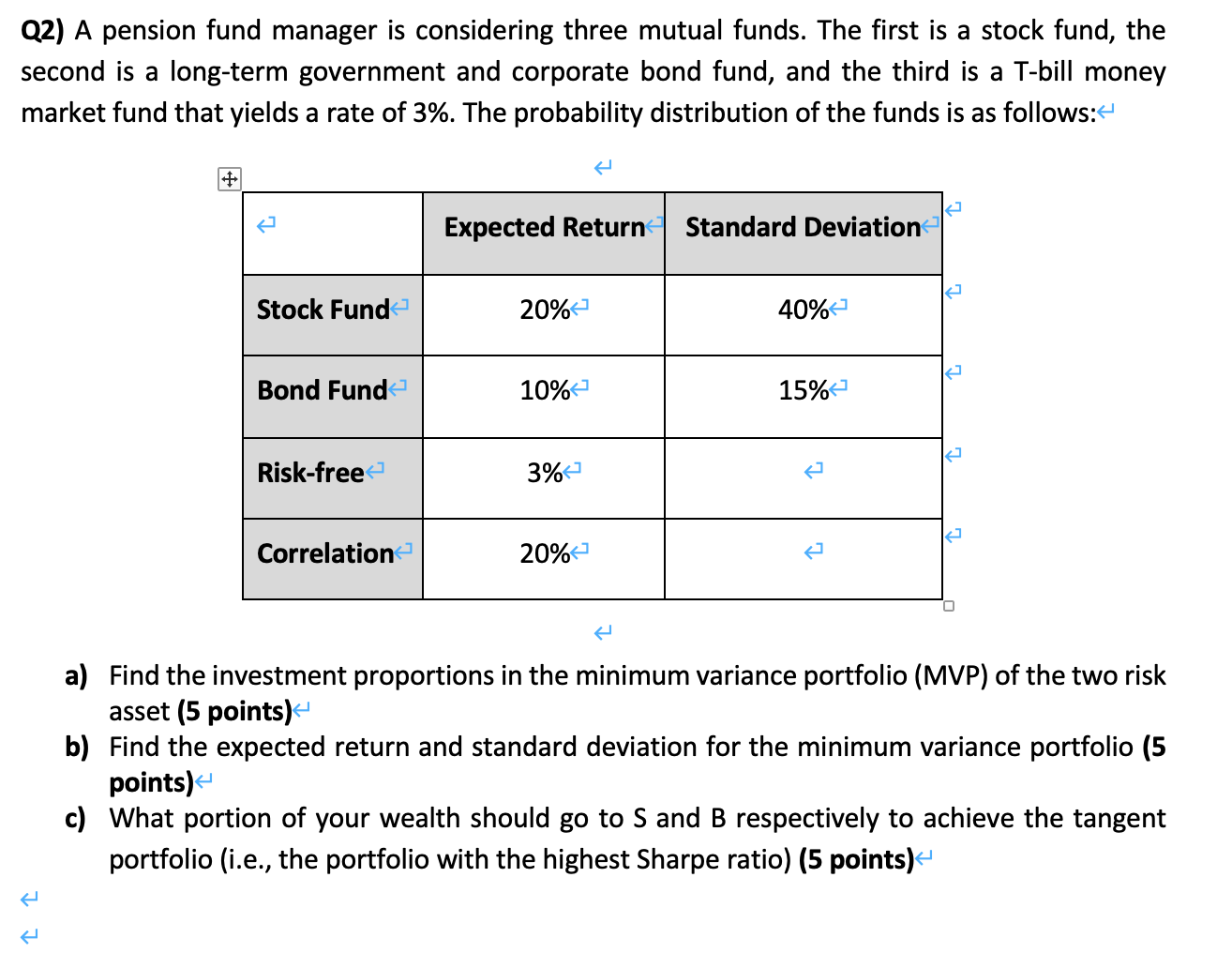

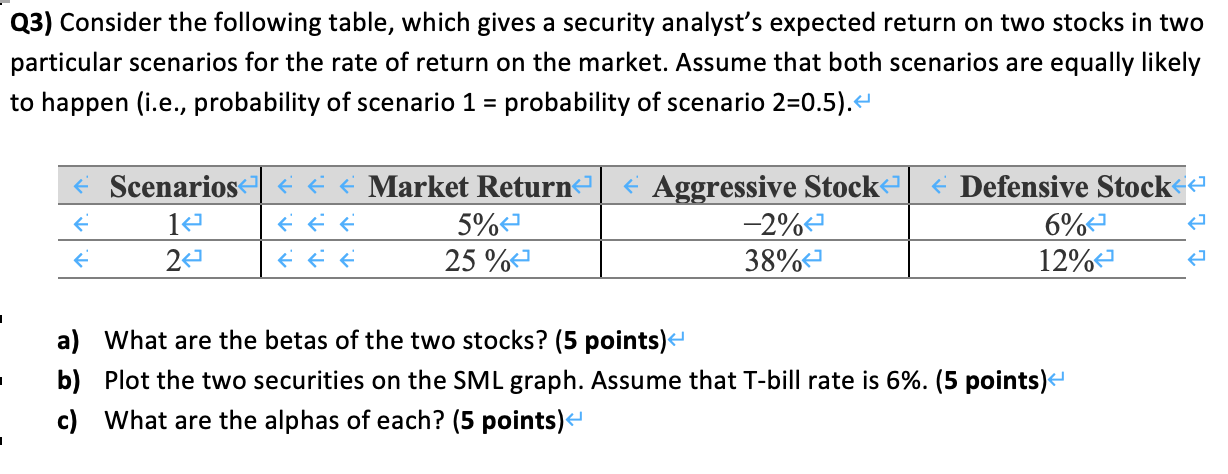

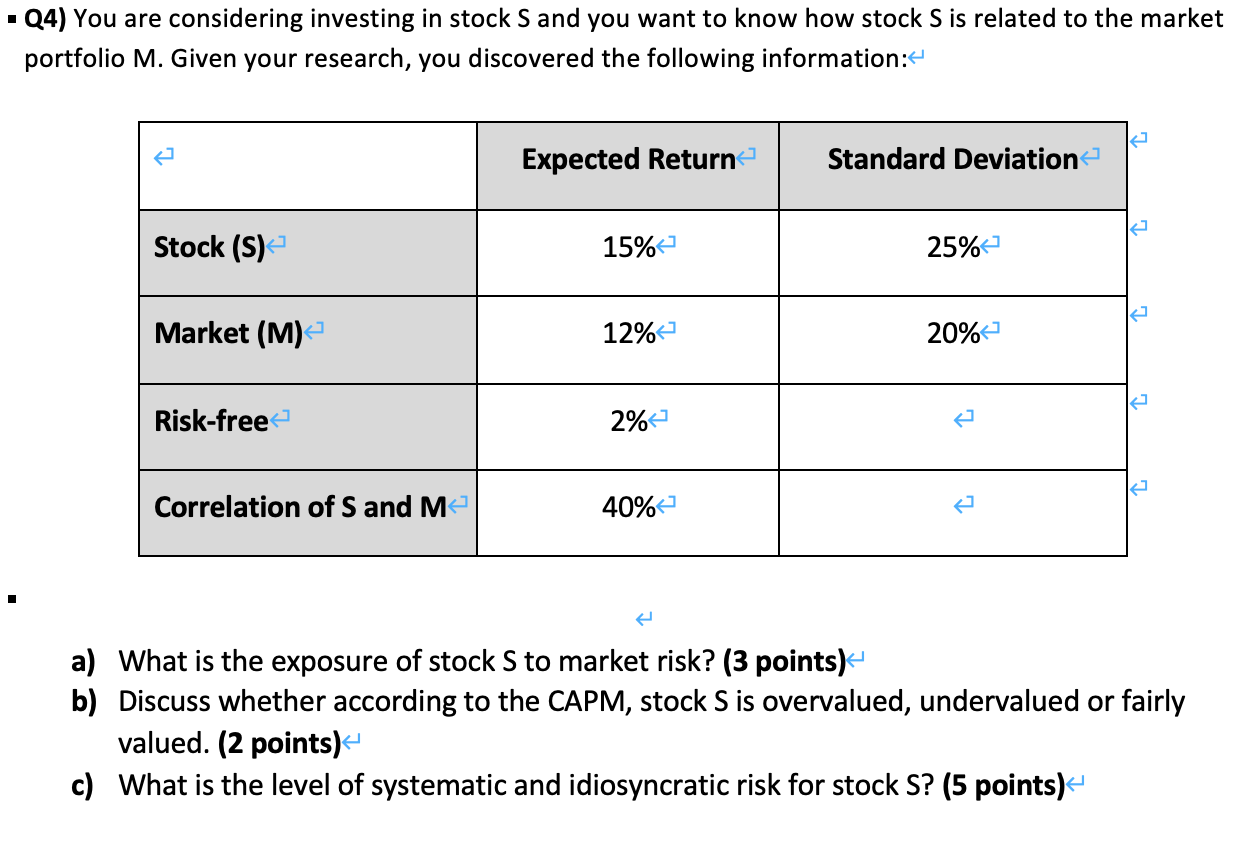

Q1) You have a portfolio of one risky asset and one risk-free asset. The risky asset has an expected return of 20% and a variance of 16%. The T-bill rate (that is the risk-free rate) is 6%. Your client Mary is thinking of investing 75% of her portfolio in the risky asset and the remaining in a T-bill. a) If Mary wants to find a general equation for the expected return and risk of her portfolio what are the equations that you would suggest to her? (5 points) b) Based on your answer in part a, draw the Capital Allocation Line (CAL). (5 points) Q2) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 3%. The probability distribution of the funds is as follows: + Expected Return Standard Deviation Stock Fund 20% 40% KA Bond Fund 10% 15% Risk-free 3% Correlation 20% a) Find the investment proportions in the minimum variance portfolio (MVP) of the two risk asset (5 points) b) Find the expected return and standard deviation for the minimum variance portfolio (5 points) c) What portion of your wealth should go to S and B respectively to achieve the tangent portfolio (i.e., the portfolio with the highest Sharpe ratio) (5 points) Q3) Consider the following table, which gives a security analyst's expected return on two stocks in two particular scenarios for the rate of return on the market. Assume that both scenarios are equally likely to happen (i.e., probability of scenario 1 = probability of scenario 2=0.5).- Scenarios 12 24 Market Return 5% 25 % Aggressive Stock -2% 38% + Defensive Stock 6% 12% a) What are the betas of the two stocks? (5 points) b) Plot the two securities on the SML graph. Assume that T-bill rate is 6%. (5 points) c) What are the alphas of each? (5 points) Q4) You are considering investing in stock S and you want to know how stock S is related to the market portfolio M. Given your research, you discovered the following information: Expected Return Standard Deviation Stock (S) 15% 25% Market (M) 12% 20% Risk-free 2% Correlation of S and Me 40% a) What is the exposure of stock S to market risk? (3 points) b) Discuss whether according to the CAPM, stock S is overvalued, undervalued or fairly valued. (2 points) c) What is the level of systematic and idiosyncratic risk for stock S? (5 points) Q1) You have a portfolio of one risky asset and one risk-free asset. The risky asset has an expected return of 20% and a variance of 16%. The T-bill rate (that is the risk-free rate) is 6%. Your client Mary is thinking of investing 75% of her portfolio in the risky asset and the remaining in a T-bill. a) If Mary wants to find a general equation for the expected return and risk of her portfolio what are the equations that you would suggest to her? (5 points) b) Based on your answer in part a, draw the Capital Allocation Line (CAL). (5 points) Q2) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 3%. The probability distribution of the funds is as follows: + Expected Return Standard Deviation Stock Fund 20% 40% KA Bond Fund 10% 15% Risk-free 3% Correlation 20% a) Find the investment proportions in the minimum variance portfolio (MVP) of the two risk asset (5 points) b) Find the expected return and standard deviation for the minimum variance portfolio (5 points) c) What portion of your wealth should go to S and B respectively to achieve the tangent portfolio (i.e., the portfolio with the highest Sharpe ratio) (5 points) Q3) Consider the following table, which gives a security analyst's expected return on two stocks in two particular scenarios for the rate of return on the market. Assume that both scenarios are equally likely to happen (i.e., probability of scenario 1 = probability of scenario 2=0.5).- Scenarios 12 24 Market Return 5% 25 % Aggressive Stock -2% 38% + Defensive Stock 6% 12% a) What are the betas of the two stocks? (5 points) b) Plot the two securities on the SML graph. Assume that T-bill rate is 6%. (5 points) c) What are the alphas of each? (5 points) Q4) You are considering investing in stock S and you want to know how stock S is related to the market portfolio M. Given your research, you discovered the following information: Expected Return Standard Deviation Stock (S) 15% 25% Market (M) 12% 20% Risk-free 2% Correlation of S and Me 40% a) What is the exposure of stock S to market risk? (3 points) b) Discuss whether according to the CAPM, stock S is overvalued, undervalued or fairly valued. (2 points) c) What is the level of systematic and idiosyncratic risk for stock S? (5 points)