Question

1.The term double taxation refers to which of the following: Sole proprietorships must pay income taxes on their net incomes and the owners are also

1.The term "double taxation" refers to which of the following:

Sole proprietorships must pay income taxes on their net incomes and the owners are also required to pay income taxes on their withdrawals.

In a partnership, both partners are required to claim their share of net income on their tax returns.

Corporations must pay income taxes on their net income and their stockholders pay income tax on the dividends they receive.

Limited Liability Companies are forced to pay income taxes to both the state and the federal governments.

2.On January 2, 2014, the Hoover Corporation issued 44,000 shares of $10 stated-value common stock for $30.00 per share. Which of the following statements is true?

The Cash account will increase by $880,000.

The Common Stock account will increase by $1,320,000.

The Paid-in Capital in Excess of Stated Value account will increase by $880,000.

The Stock Payable account will increase by $1,320,000.

3.Flynn Corp., which is authorized to issue 25,000 shares of no-par common stock, issued 10,000 shares for $150,000. What effect will this event have on the accounting equation?

Increase assets by $375,000 increase, equity by $375,000.

Increase assets by $150,000, increase net income by $150,000.

Increase assets by $150,000, increase equity by $150,000.

Increase assets by $150,000, increase net income by $150,000 and increase assets by $150,000, increase equity by $150,000.

4.

At the end of the accounting period, Isaac Company had a balance of $4,000 in its common stock account, additional paid in capital of $4,000, retained earnings of $3,000, and $1,000 of treasury stock. The total amount of stockholders' equity is:

$10,000.

$13,000.

$12,000.

$8,000.

5.

Madison Co. paid dividends of $3,000; $6,000; and $10,000 during 2012, 2013 and 2014 respectively. The company had 500 shares of preferred stock outstanding with a $10 per share cumulative dividend. The amount of dividends received by the common shareholders during 2014 would be:

$6,000.

$5,000.

$3,000.

$4,000.

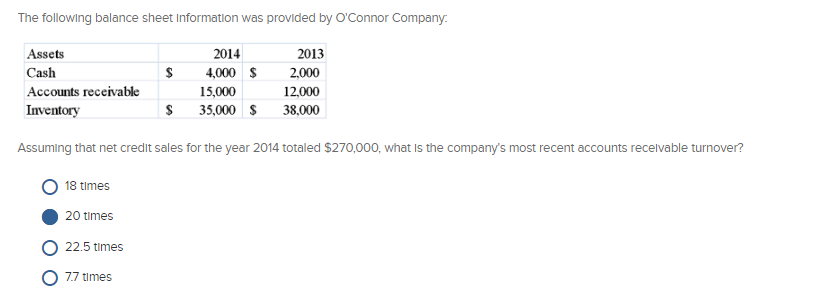

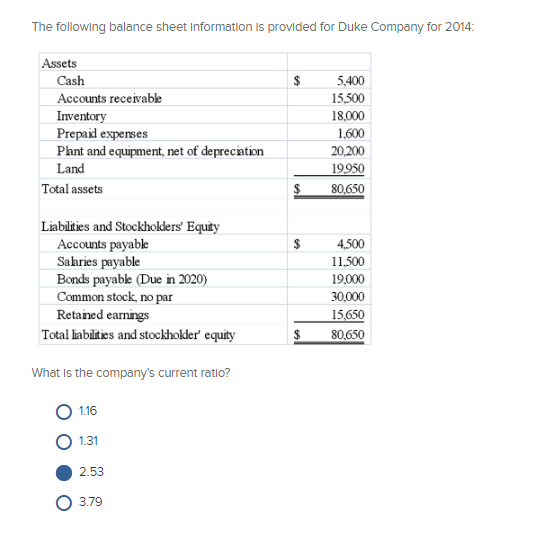

6.

7 .

.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started