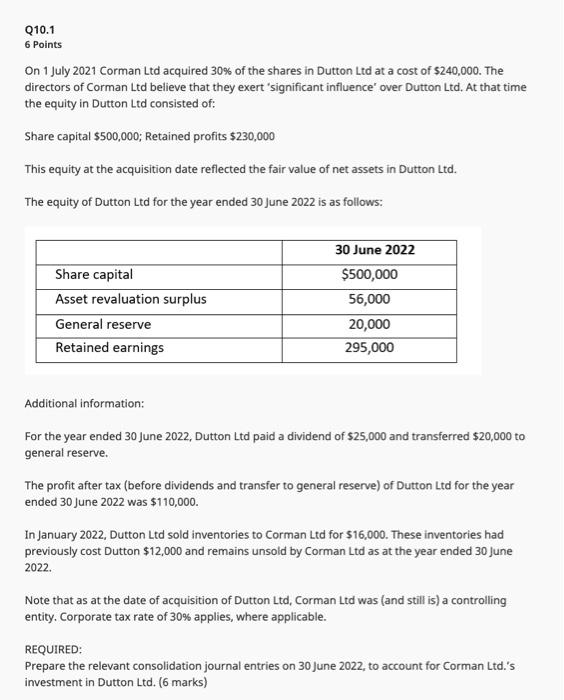

Q10.1 6 Points On 1 July 2021 Corman Ltd acquired 30% of the shares in Dutton Ltd at a cost of $240,000. The directors of Corman Ltd believe that they exert 'significant influence' over Dutton Ltd. At that time the equity in Dutton Ltd consisted of: Share capital $500,000; Retained profits $230,000 This equity at the acquisition date reflected the fair value of net assets in Dutton Ltd. The equity of Dutton Ltd for the year ended 30 June 2022 is as follows: Additional information: For the year ended 30 June 2022, Dutton Ltd paid a dividend of $25,000 and transferred $20,000 to general reserve. The profit after tax (before dividends and transfer to general reserve) of Dutton Ltd for the year ended 30 June 2022 was $110,000. In January 2022, Dutton Ltd sold inventories to Corman Ltd for $16,000. These inventories had previously cost Dutton $12,000 and remains unsold by Corman Ltd as at the year ended 30 June 2022. Note that as at the date of acquisition of Dutton Ltd, Corman Ltd was (and still is) a controlling entity. Corporate tax rate of 30% applies, where applicable. REQUIRED: Prepare the relevant consolidation journal entries on 30 June 2022, to account for Corman Ltd.'s investment in Dutton Ltd. ( 6 marks) 3 Points Laser Ltd is an Australian company that makes motorised toys. It prepares its accounts at 30 June every year. Before the financial statements are authorised for issue, the company becomes aware of the following event On 8 July 2022, the company became aware that a particular motorised toy had dangerous small parts which could be harmful to children if ingested. These toys which only came to market in May 2022 were subsequently withdrawn from sale. However by 15 July 2022 the company has already received claims from affected parties. Applying AASB110: Events after the Reporting Period, state whether the event would be an adjusting or non-adjusting event in the financial statements of Laser Ltd Ltd for the year ended 30 June 2022. (1 mark) Provide an explanation of your reasoning and the impact (if any) on the financial statements of Laser Ltd.for the year ended 30 June 2022 (2 marks) Type your answer to Q. 10.2 in the ANSWER BOX below. Q10.3 3 Points During the year ended 30 June 2022 Mr Lee, one of the senior management staff of Big Ltd., a leading retailer of luxury goods, purchased goods worth $80,000 from the company. These goods were purchased on normal commercial terms. Mr Lee's annual compensation is $1,000,000 comprising of cash and a profit-based bonus. He has also been awarded 100,000 stock options in the current year, contingent on his continued employment for the next 5 years. Required: Is there a related party relationship between Mr Lee and Big Ltd.in accordance with AASB124 Related party disclosures? ( 1 mark) What disclosures are required under AASB 124 Related party disclosures? (2 marks) Type your answer to Q. 10.3 in the ANSWER BOX below