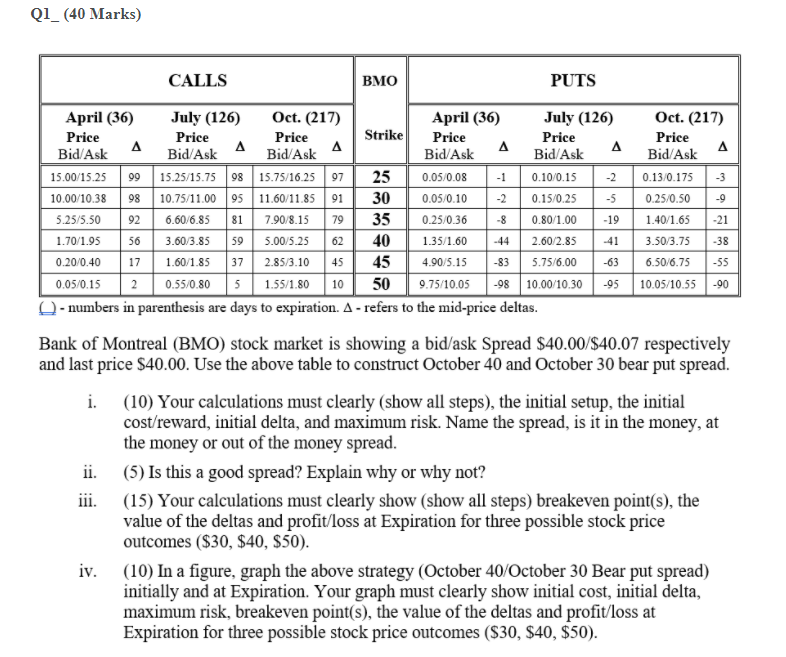

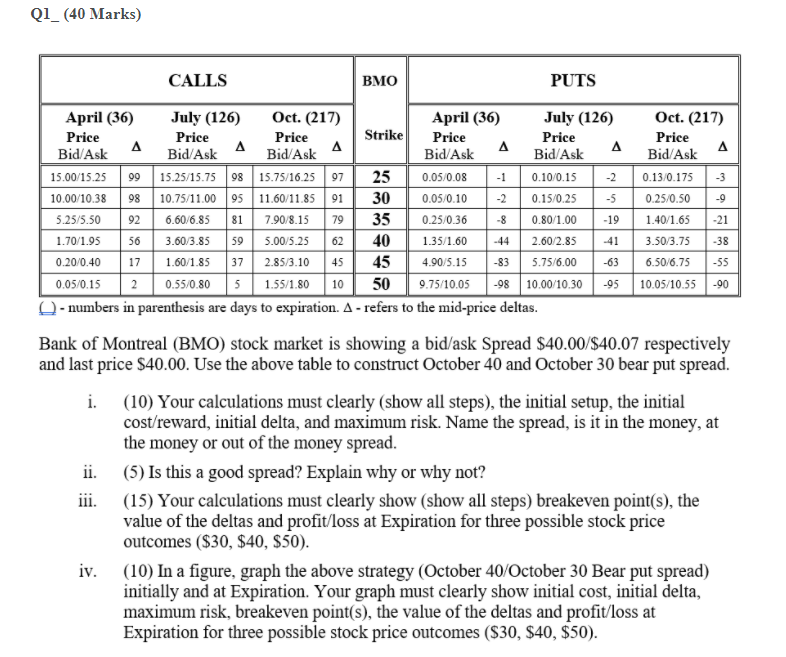

Q1_(40 Marks) CALLS BMO PUTS 25 -9 April (36) July (126) Oct. (217) April (36) July (126) Oct. (217) Price Price Price Strike Price Price Price A A . Bid Ask Bid/Ask Bid Ask Bid Ask Bid Ask A Bid Ask 15.00/15.25 09 15.25/15.75 98 15.75/16.25 97 0.05/0.08 -1 0.100.15 -2 0.13/0.175 -3 10.00/10.38 98 10.75/11.00 95 11.60/11.85 91 30 0.05/0.10 -2 0.15/0.25 -5 0.25/0.50 5.25/5.50 92 6.60/6.85 81 7.90/8.15 79 35 0.25/0.36 -8 0.80/1.00 -19 1.40/1.65 -21 1.70/1.95 56 3.60/3.85 59 5.00/5.25 62 40 1.35/1.60 -44 2.60/2.85 -41 3.50/3.75 -38 0.20/0.40 17 1.60/1.85 37 2.85/3.10 45 4.90/5.15 -83 5.75/6.00 -63 6.50/6.75 -55 0.05/0.15 2 0.55/0.80 5 1.55/1.80 10 50 9.75/10.05 -98 10.00/10.30-95 10.05/10.55 -90 - numbers in parenthesis are days to expiration. A- refers to the mid-price deltas. 9 45 Bank of Montreal (BMO) stock market is showing a bid/ask Spread $40.00/$40.07 respectively and last price $40.00. Use the above table to construct October 40 and October 30 bear put spread. i. (10) Your calculations must clearly (show all steps), the initial setup, the initial cost/reward, initial delta, and maximum risk. Name the spread, is it in the money, at the money or out of the money spread. ii. (5) Is this a good spread? Explain why or why not? iii. (15) Your calculations must clearly show (show all steps) breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($30, $40, $50). (10) In a figure, graph the above strategy (October 40/October 30 Bear put spread) initially and at Expiration. Your graph must clearly show initial cost, initial delta, maximum risk, breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($30, $40, $50). Q1_(40 Marks) CALLS BMO PUTS 25 -9 April (36) July (126) Oct. (217) April (36) July (126) Oct. (217) Price Price Price Strike Price Price Price A A . Bid Ask Bid/Ask Bid Ask Bid Ask Bid Ask A Bid Ask 15.00/15.25 09 15.25/15.75 98 15.75/16.25 97 0.05/0.08 -1 0.100.15 -2 0.13/0.175 -3 10.00/10.38 98 10.75/11.00 95 11.60/11.85 91 30 0.05/0.10 -2 0.15/0.25 -5 0.25/0.50 5.25/5.50 92 6.60/6.85 81 7.90/8.15 79 35 0.25/0.36 -8 0.80/1.00 -19 1.40/1.65 -21 1.70/1.95 56 3.60/3.85 59 5.00/5.25 62 40 1.35/1.60 -44 2.60/2.85 -41 3.50/3.75 -38 0.20/0.40 17 1.60/1.85 37 2.85/3.10 45 4.90/5.15 -83 5.75/6.00 -63 6.50/6.75 -55 0.05/0.15 2 0.55/0.80 5 1.55/1.80 10 50 9.75/10.05 -98 10.00/10.30-95 10.05/10.55 -90 - numbers in parenthesis are days to expiration. A- refers to the mid-price deltas. 9 45 Bank of Montreal (BMO) stock market is showing a bid/ask Spread $40.00/$40.07 respectively and last price $40.00. Use the above table to construct October 40 and October 30 bear put spread. i. (10) Your calculations must clearly (show all steps), the initial setup, the initial cost/reward, initial delta, and maximum risk. Name the spread, is it in the money, at the money or out of the money spread. ii. (5) Is this a good spread? Explain why or why not? iii. (15) Your calculations must clearly show (show all steps) breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($30, $40, $50). (10) In a figure, graph the above strategy (October 40/October 30 Bear put spread) initially and at Expiration. Your graph must clearly show initial cost, initial delta, maximum risk, breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($30, $40, $50)