Answered step by step

Verified Expert Solution

Question

1 Approved Answer

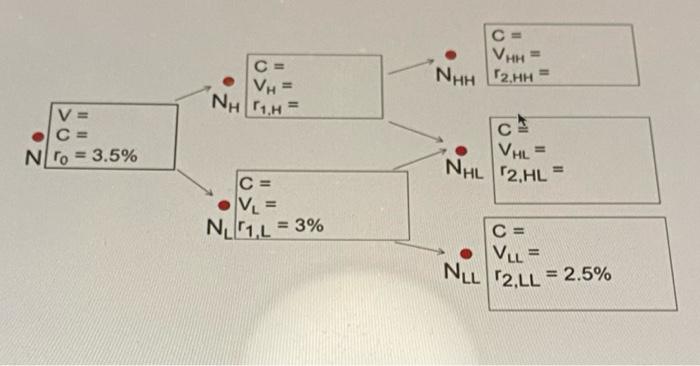

Q1415 Use the following information below to answer QUESTIONS 14-22 You have a 3% annual puttable bond that matures in three years. Assume o to

Q14\15

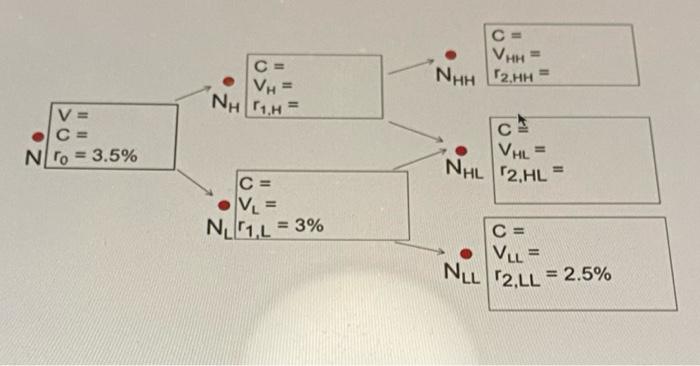

Use the following information below to answer QUESTIONS 14-22 You have a 3% annual puttable bond that matures in three years. Assume o to be 7%. The bond is puttable at par (100). The option can be exercised any time after the first eighteen months. Using the binomial interest rate tree below answer the following questions, In the below hgure you see the predicted interest rate trials for the outcomes when interest rates drop in both years going forward. Use what you have learned about building binomial trees to answer the following questions. I Remember: R1 is the one-year forward rate, at the start of year 2 Formula tip: Determine the corresponding value for the higher one-year forward rate from the lower one-year forward rate as r1(e) C= CE VH = NHH 2.HH VH = NH1, V= C= NITO = 3.5% VHL NHL 12.HL C= VE = NL 1,2 = 3% C= VLL = NEL '2.LL = 2.5% Question 14 1 pts What is the value ofru? (Round to 4 decimal places and do not include the percentage sign. For example, if the answer is 3.67892% then enter 3.6789) Question 15 1 pts What is the value of r2.HL? (Round to 4 decimal places and do not include the percentage sign. For example, if the answer is 3.67892% then enter 3.6789) Use the following information below to answer QUESTIONS 14-22 You have a 3% annual puttable bond that matures in three years. Assume o to be 7%. The bond is puttable at par (100). The option can be exercised any time after the first eighteen months. Using the binomial interest rate tree below answer the following questions, In the below hgure you see the predicted interest rate trials for the outcomes when interest rates drop in both years going forward. Use what you have learned about building binomial trees to answer the following questions. I Remember: R1 is the one-year forward rate, at the start of year 2 Formula tip: Determine the corresponding value for the higher one-year forward rate from the lower one-year forward rate as r1(e) C= CE VH = NHH 2.HH VH = NH1, V= C= NITO = 3.5% VHL NHL 12.HL C= VE = NL 1,2 = 3% C= VLL = NEL '2.LL = 2.5% Question 14 1 pts What is the value ofru? (Round to 4 decimal places and do not include the percentage sign. For example, if the answer is 3.67892% then enter 3.6789) Question 15 1 pts What is the value of r2.HL? (Round to 4 decimal places and do not include the percentage sign. For example, if the answer is 3.67892% then enter 3.6789)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started