Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1(6 points): 1-Company acquired equipment on July 1, 2015 from National Manufacturer at $16000The estimated useful life of 5 years and estimated residual value of

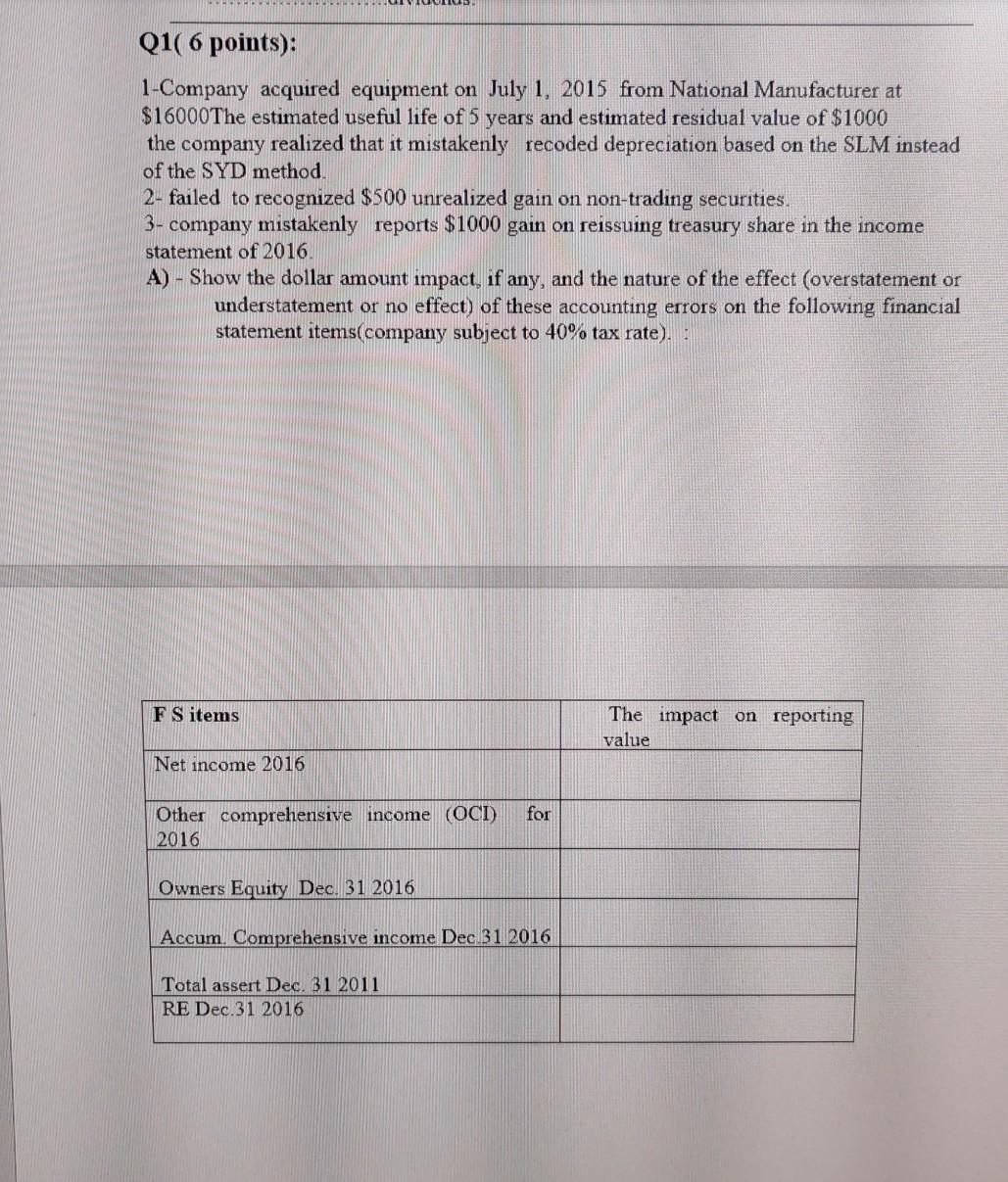

Q1(6 points): 1-Company acquired equipment on July 1, 2015 from National Manufacturer at $16000The estimated useful life of 5 years and estimated residual value of $1000 the company realized that it mistakenly recoded depreciation based on the SLM instead of the SYD method 2- failed to recognized $500 unrealized gain on non-trading securities. 3- company mistakenly reports $1000 gain on reissuing treasury share in the income statement of 2016. A) - Show the dollar amount impact, if any, and the nature of the effect (overstatement or understatement or no effect) of these accounting errors on the following financial statement items(company subject to 40% tax rate). FS items The impact on reporting value Net income 2016 for Other comprehensive income (OCI) 2016 Owners Equity Dec. 31 2016 Accum. Comprehensive income Dec 31 2016 Total assert Dec. 31 2011 RE Dec.31 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started