Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q18 for the second part each select is yes or no An oil-drilling company must choose between two mutually exclusive extraction projects, and each requires

Q18

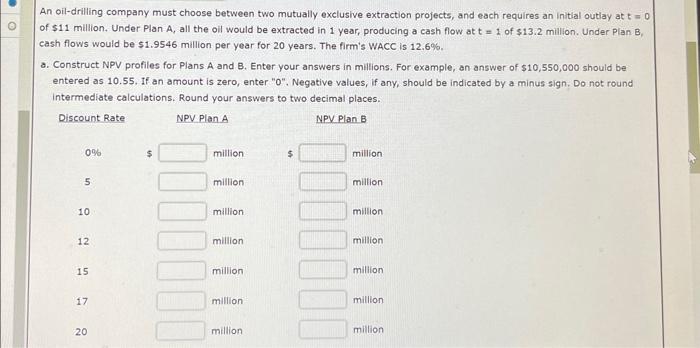

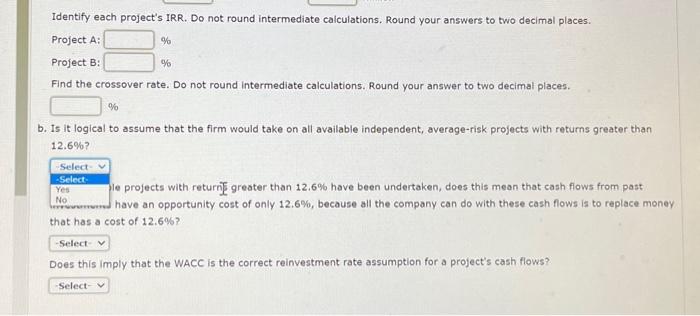

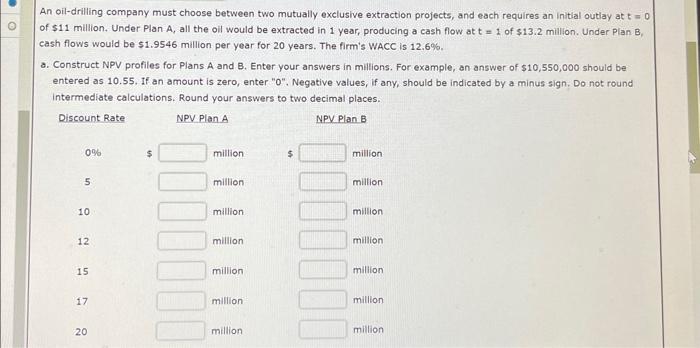

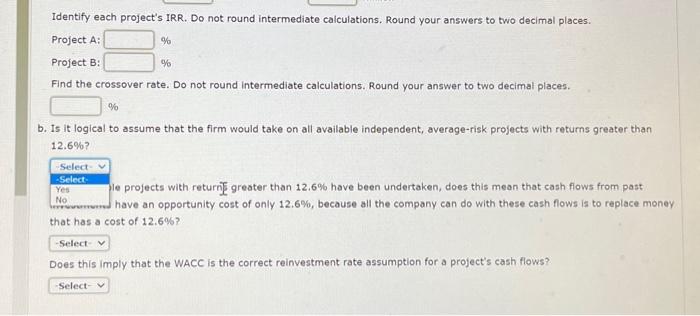

An oil-drilling company must choose between two mutually exclusive extraction projects, and each requires an initial outiay at t=0 of $11 million. Under Plan A, all the oil would be extracted in 1 year, producing a cash flow at t=1 of $13.2 million. Under Plan B, cash flows would be $1.9546 million per year for 20 years. The firm's WACC is 12.6%. a. Construct NPV profiles for Plans A and B. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. If an amount is zero, enter " 0 ". Negative values, if any, should be indicated by a minus sign. Do not round Intermediate calculations. Round your answers to two decimal places. Identify each project's IRR. Do not round intermediate calculations. Round your answers to two decimal places. ProjectA:ProjectB:%% Find the crossover rate. Do not round intermediate calculations. Round your answer to two decimal places. b. Is it logical to assume that the firm would take on all available independent, average-risk projects with returns greater than 12.6% ? le projects with returnE greater than 12.6% have been undertaken, does this mean that cash flows from past have an opportunity cost of only 12.6%, because all the company can do with these cash flows is to replace money that has a cost of 12.6% ? Does this imply that the WACC is the correct reinvestment rate assumption for a project's cash flows

for the second part each select is yes or no

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started