Answered step by step

Verified Expert Solution

Question

1 Approved Answer

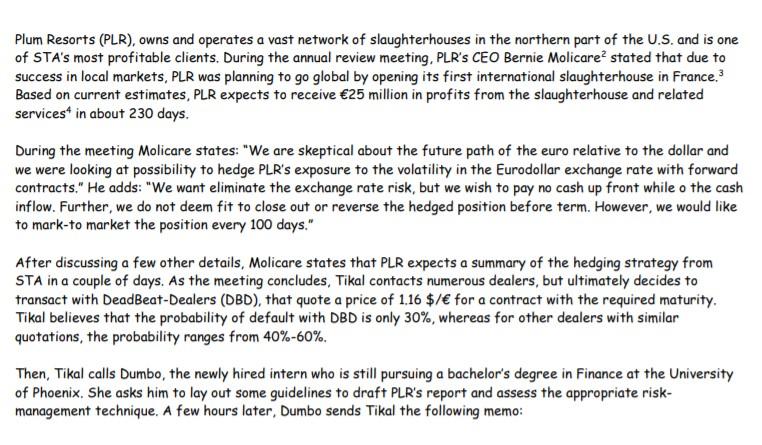

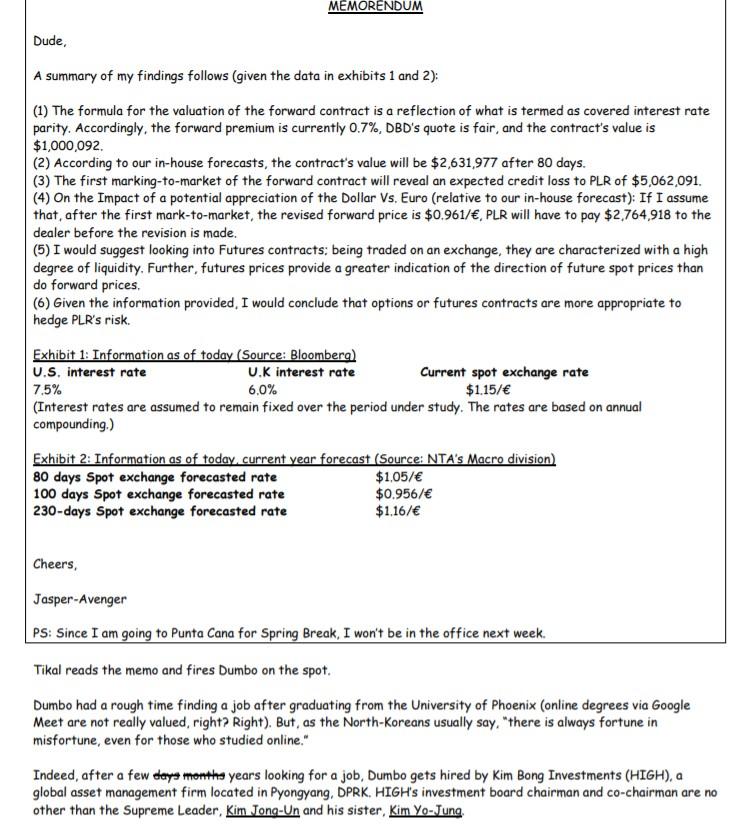

Q18: Regarding Dumbo?s Memo to Tikal, after 80 days, thecurrency forward value is closest to: A. -$2,631,977 B. $2,521,898 C. $2,631,977 Q19: Regarding Dumbo?s Memo

Q18: Regarding Dumbo?s Memo to Tikal, after 80 days, thecurrency forward value is closest to:

A. -$2,631,977

B. $2,521,898

C. $2,631,977

Q19: Regarding Dumbo?s Memo to Tikal, after 100 days, the creditloss estimate on the forward contract is closest to:

A.0.5M

B.1.5M

C.4.9M

Q20: Regarding Dumbo?s Memo to Tikal, after 100 days and giventhe revised forecast of 0.961, the currency forward value isclosest to:

A. $4,713,701

B. $4,848,490

C. $4,900,912

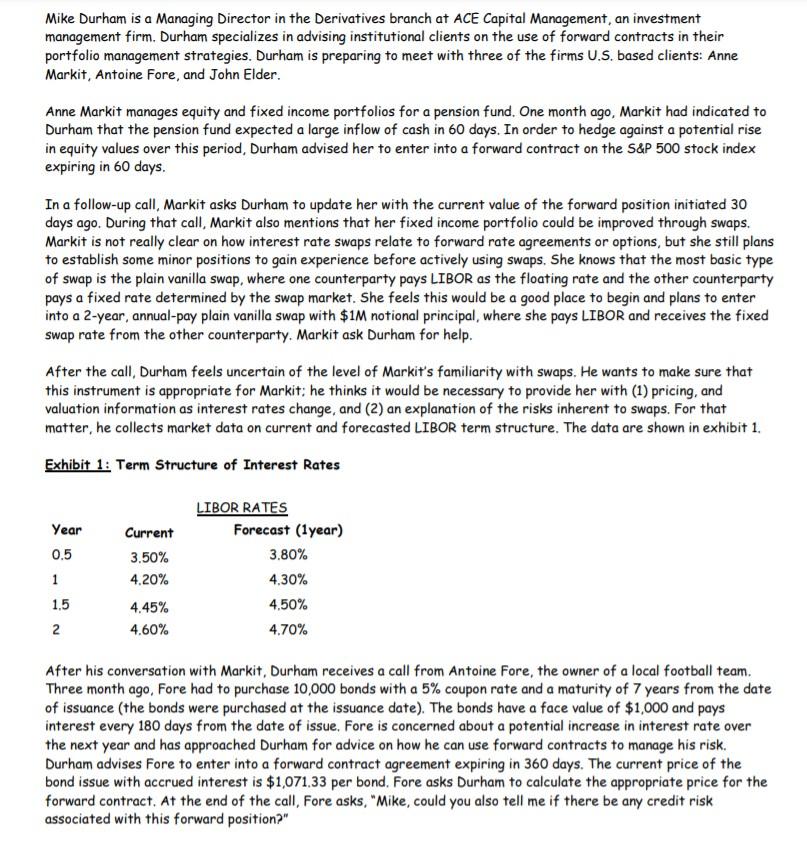

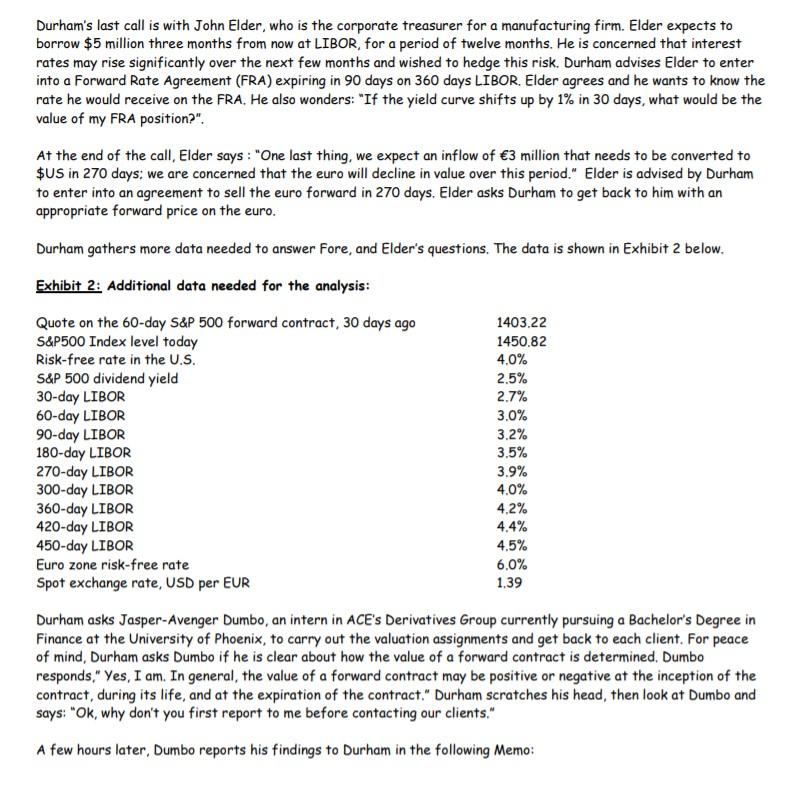

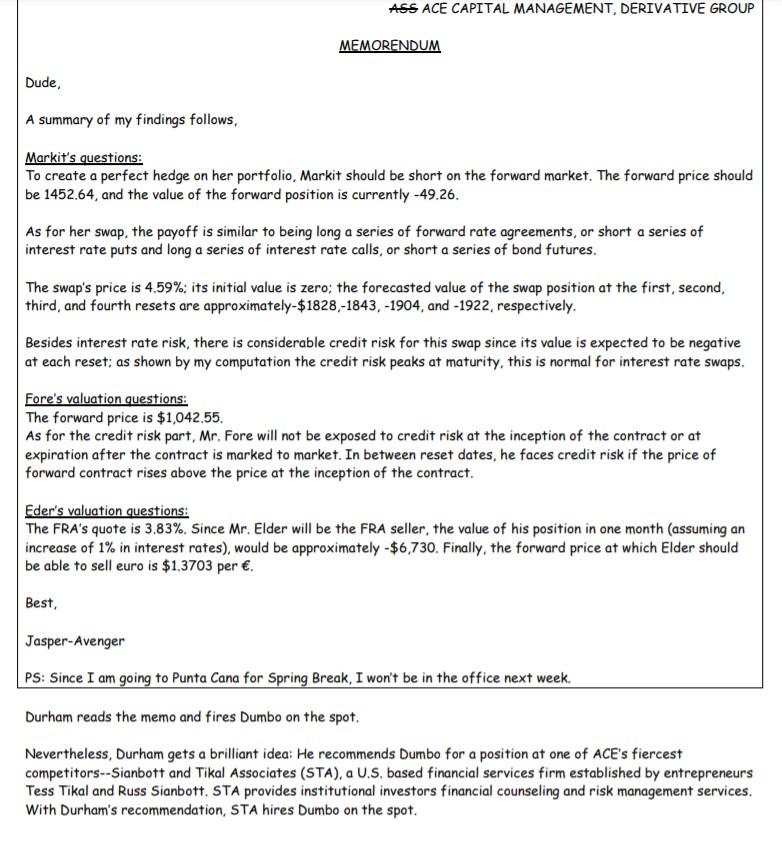

Mike Durham is a Managing Director in the Derivatives branch at ACE Capital Management, an investment management firm. Durham specializes in advising institutional clients on the use of forward contracts in their portfolio management strategies. Durham is preparing to meet with three of the firms U.S. based clients: Anne Markit, Antoine Fore, and John Elder. Anne Markit manages equity and fixed income portfolios for a pension fund. One month ago, Markit had indicated to Durham that the pension fund expected a large inflow of cash in 60 days. In order to hedge against a potential rise in equity values over this period, Durham advised her to enter into a forward contract on the S&P 500 stock index expiring in 60 days. In a follow-up call, Markit asks Durham to update her with the current value of the forward position initiated 30 days ago. During that call, Markit also mentions that her fixed income portfolio could be improved through swaps. Markit is not really clear on how interest rate swaps relate to forward rate agreements or options, but she still plans to establish some minor positions to gain experience before actively using swaps. She knows that the most basic type of swap is the plain vanilla swap, where one counterparty pays LIBOR as the floating rate and the other counterparty pays a fixed rate determined by the swap market. She feels this would be a good place to begin and plans to enter into a 2-year, annual-pay plain vanilla swap with $1M notional principal, where she pays LIBOR and receives the fixed swap rate from the other counterparty. Markit ask Durham for help. After the call, Durham feels uncertain of the level of Markit's familiarity with swaps. He wants to make sure that this instrument is appropriate for Markit; he thinks it would be necessary to provide her with (1) pricing, and valuation information as interest rates change, and (2) an explanation of the risks inherent to swaps. For that matter, he collects market data on current and forecasted LIBOR term structure. The data are shown in exhibit 1. Exhibit 1: Term Structure of Interest Rates Year 0.5 1 1.5 2 Current 3.50% 4.20% 4.45% 4.60% LIBOR RATES Forecast (1year) 3.80% 4.30% 4.50% 4.70% After his conversation with Markit, Durham receives a call from Antoine Fore, the owner of a local football team. Three month ago, Fore had to purchase 10,000 bonds with a 5% coupon rate and a maturity of 7 years from the date of issuance (the bonds were purchased at the issuance date). The bonds have a face value of $1,000 and pays interest every 180 days from the date of issue. Fore is concerned about a potential increase in interest rate over the next year and has approached Durham for advice on how he can use forward contracts to manage his risk. Durham advises Fore to enter into a forward contract agreement expiring in 360 days. The current price of the bond issue with accrued interest is $1,071.33 per bond. Fore asks Durham to calculate the appropriate price for the forward contract. At the end of the call, Fore asks, "Mike, could you also tell me if there be any credit risk associated with this forward position?"

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solutions 1Forward Price Formula The forward price formula which assumes zero dividends is seen b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started