Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q#18) Schwartz Company, a real estate developer, paid $780,000 cash to buy 3 distinct assets. An independent appraiser assigned the following values to the assets

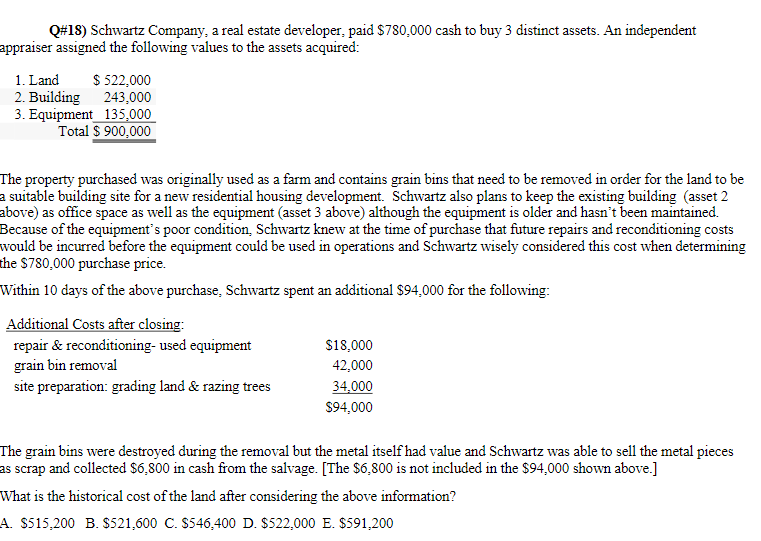

Q\#18) Schwartz Company, a real estate developer, paid $780,000 cash to buy 3 distinct assets. An independent appraiser assigned the following values to the assets acquired: The property purchased was originally used as a farm and contains grain bins that need to be removed in order for the land to be a suitable building site for a new residential housing development. Schwartz also plans to keep the existing building (asset 2 above) as office space as well as the equipment (asset 3 above) although the equipment is older and hasn't been maintained. Because of the equipment's poor condition, Schwartz knew at the time of purchase that future repairs and reconditioning costs would be incurred before the equipment could be used in operations and Schwartz wisely considered this cost when determining the $780,000 purchase price. Within 10 days of the above purchase, Schwartz spent an additional $94,000 for the following: The grain bins were destroyed during the removal but the metal itself had value and Schwartz was able to sell the metal pieces as scrap and collected $6,800 in cash from the salvage. [The $6,800 is not included in the $94,000 shown above.] What is the historical cost of the land after considering the above information? A. $515,200 B. $521,600 C. $546,400 D. $522,000 E. $591,200

Q\#18) Schwartz Company, a real estate developer, paid $780,000 cash to buy 3 distinct assets. An independent appraiser assigned the following values to the assets acquired: The property purchased was originally used as a farm and contains grain bins that need to be removed in order for the land to be a suitable building site for a new residential housing development. Schwartz also plans to keep the existing building (asset 2 above) as office space as well as the equipment (asset 3 above) although the equipment is older and hasn't been maintained. Because of the equipment's poor condition, Schwartz knew at the time of purchase that future repairs and reconditioning costs would be incurred before the equipment could be used in operations and Schwartz wisely considered this cost when determining the $780,000 purchase price. Within 10 days of the above purchase, Schwartz spent an additional $94,000 for the following: The grain bins were destroyed during the removal but the metal itself had value and Schwartz was able to sell the metal pieces as scrap and collected $6,800 in cash from the salvage. [The $6,800 is not included in the $94,000 shown above.] What is the historical cost of the land after considering the above information? A. $515,200 B. $521,600 C. $546,400 D. $522,000 E. $591,200 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started