Question

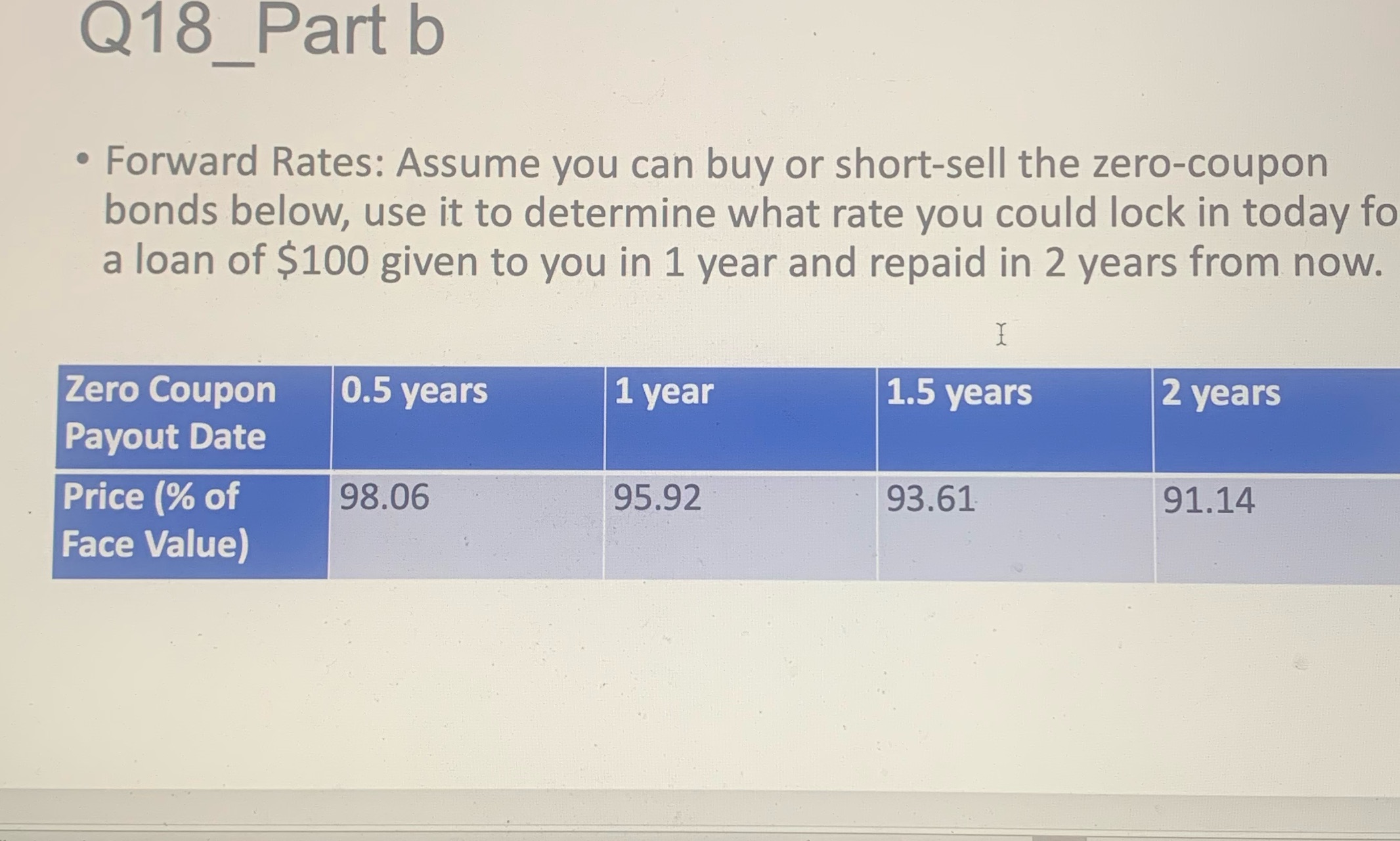

Q18_Part b Forward Rates: Assume you can buy or short-sell the zero-coupon bonds below, use it to determine what rate you could lock in

Q18_Part b Forward Rates: Assume you can buy or short-sell the zero-coupon bonds below, use it to determine what rate you could lock in today fo a loan of $100 given to you in 1 year and repaid in 2 years from now. I 1.5 years Zero Coupon 0.5 years Payout Date Price (% of Face Value) 98.06 1 year 95.92 93.61 2 years 91.14

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 You can buy the 1 year zero coupon bond today for 9592 of face value So you pay 9592 In 1 year thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Algebra With Modeling And Visualization

Authors: Gary Rockswold

6th Edition

0134418042, 978-0134418049

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App