Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q19 answer the following multiple choice questions with the most correct answer A company sells inventory to a customer and offers the customer a 2%

q19 answer the following multiple choice questions with the most correct answer

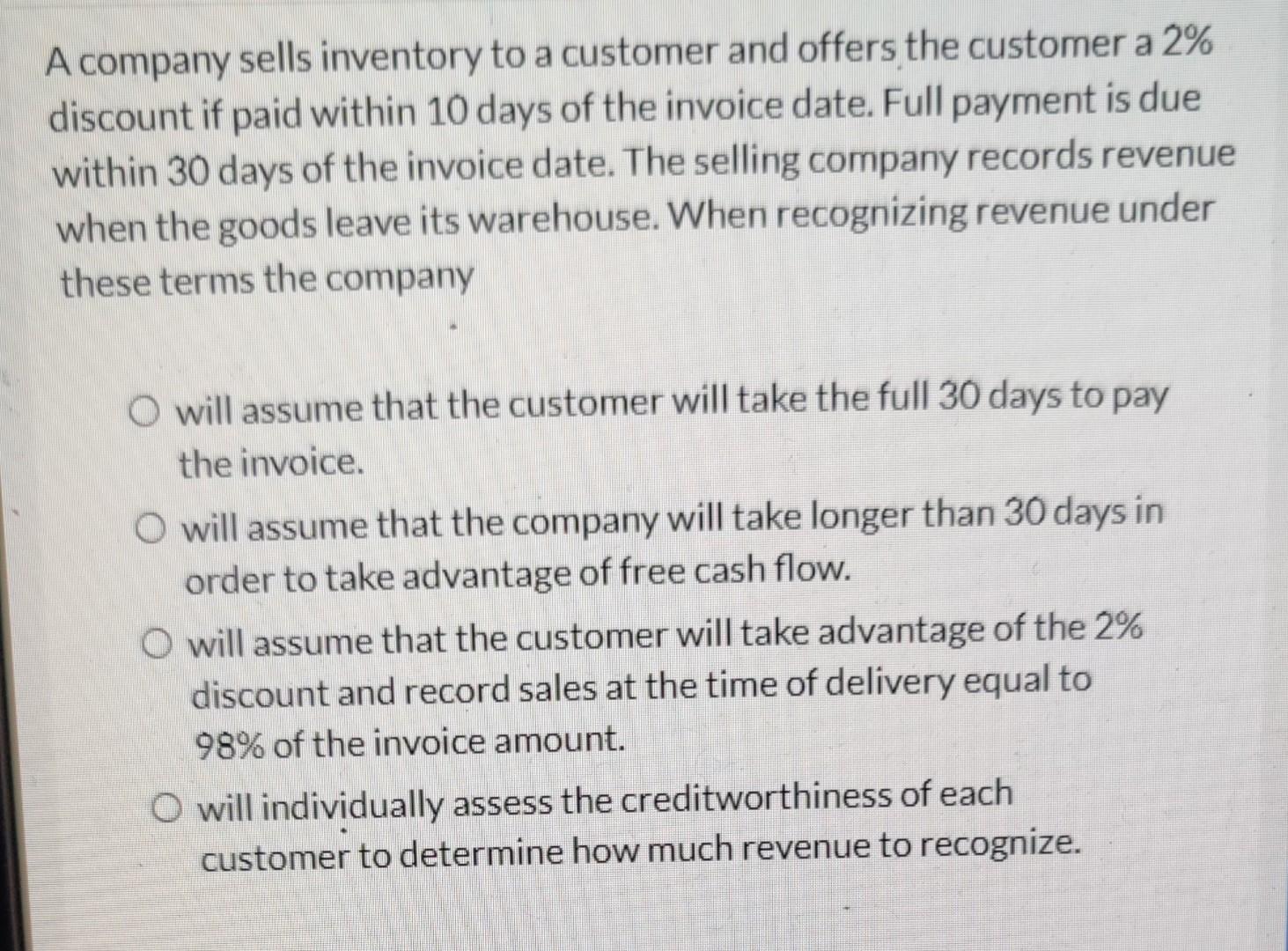

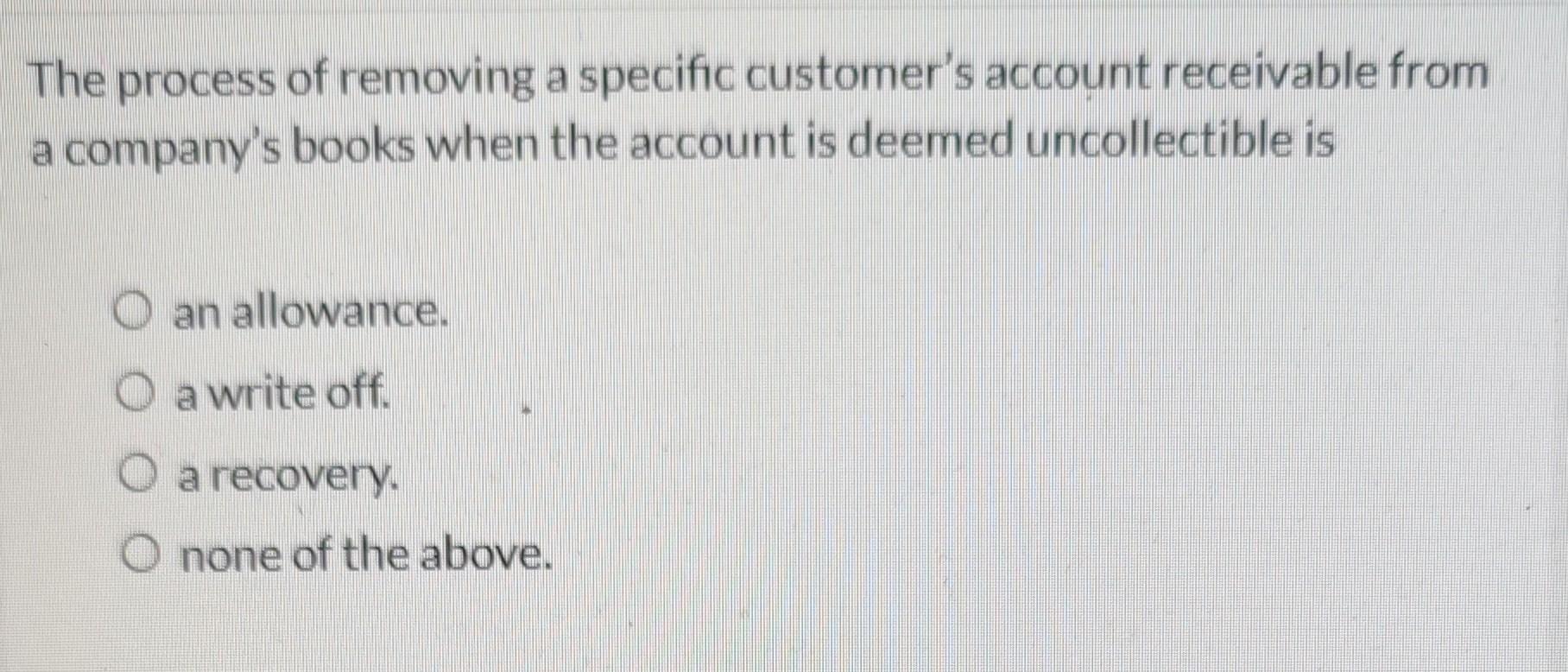

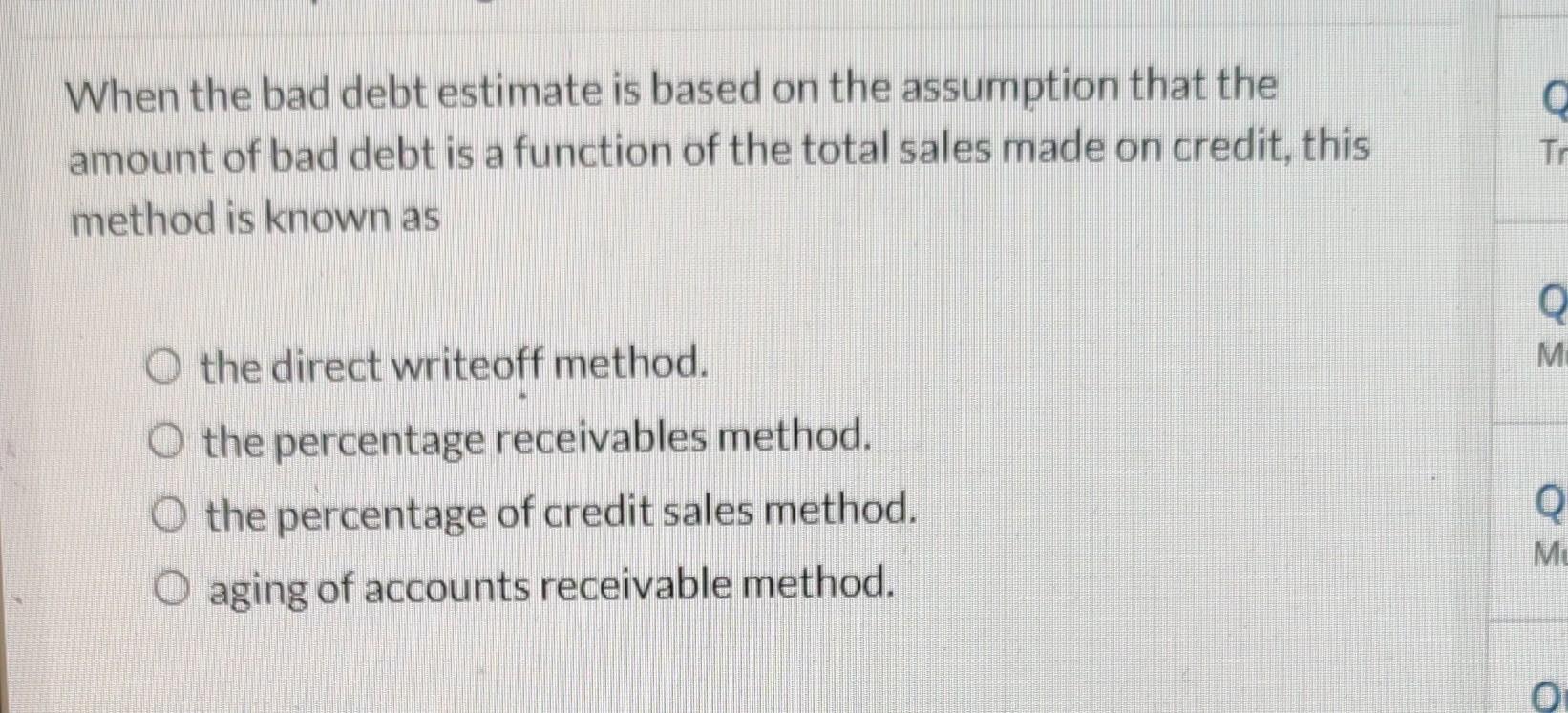

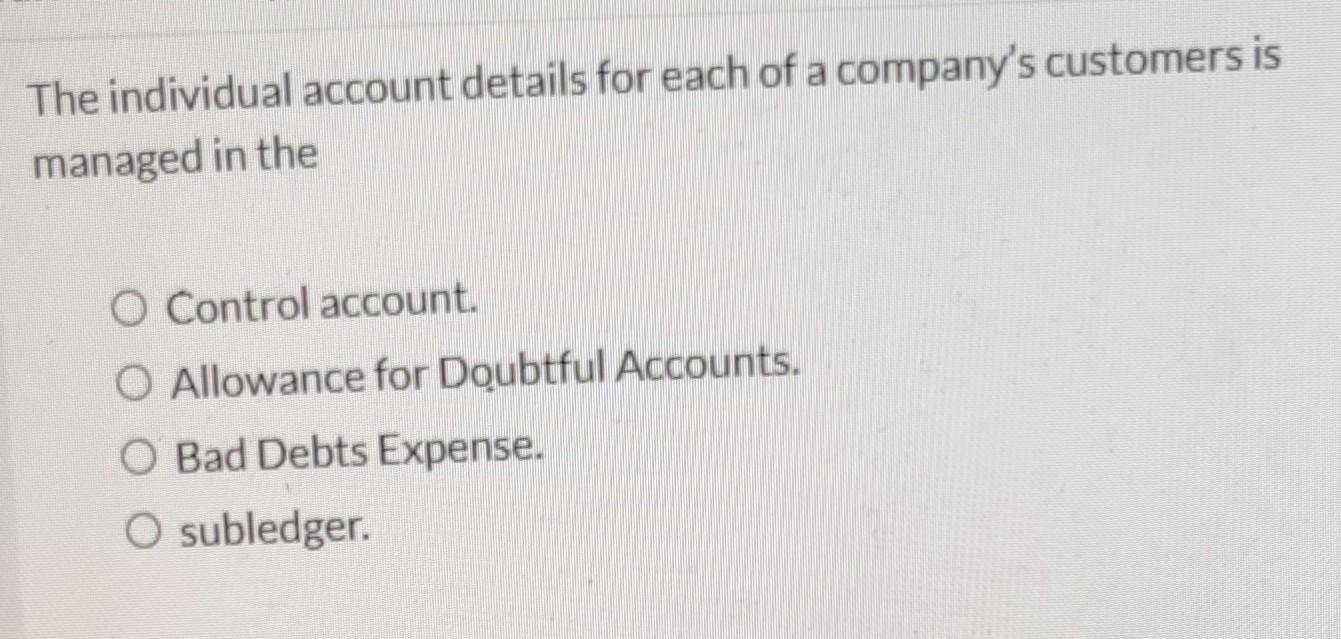

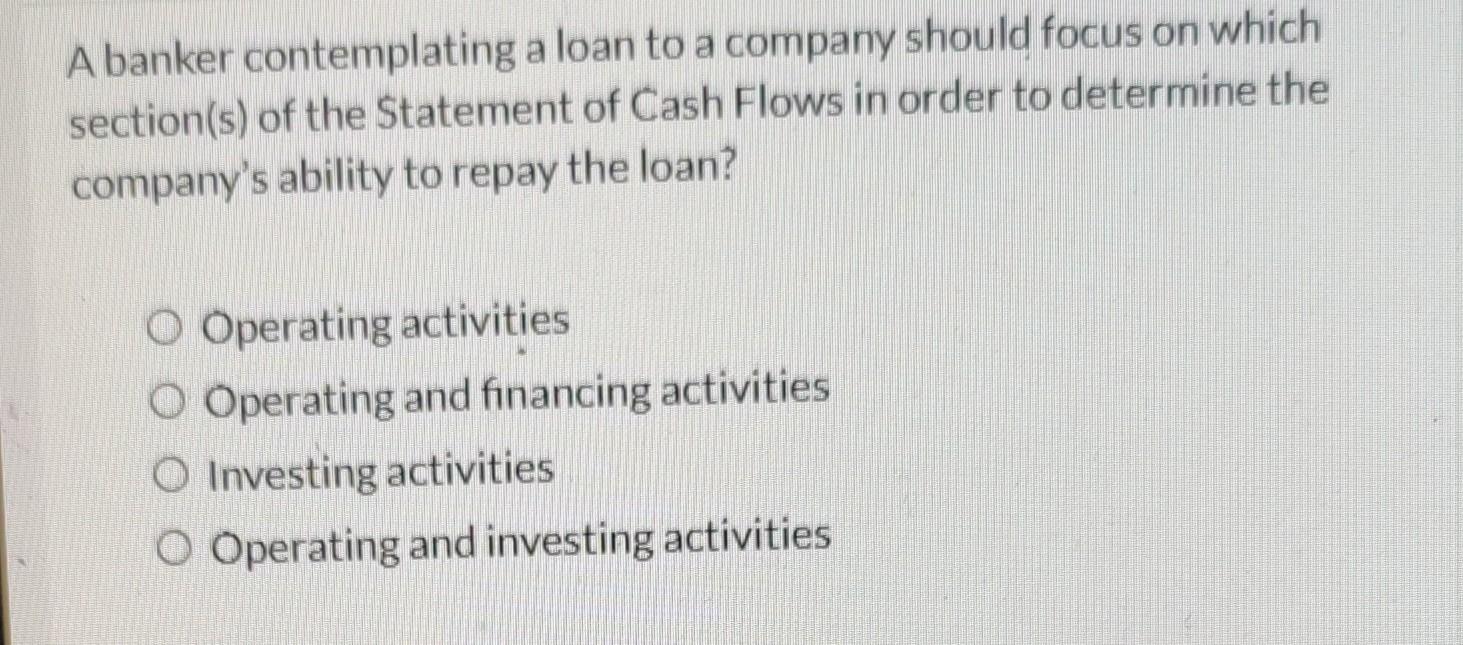

A company sells inventory to a customer and offers the customer a 2% discount if paid within 10 days of the invoice date. Full payment is due within 30 days of the invoice date. The selling company records revenue when the goods leave its warehouse. When recognizing revenue under these terms the company O will assume that the customer will take the full 30 days to pay the invoice. O will assume that the company will take longer than 30 days in order to take advantage of free cash flow. O will assume that the customer will take advantage of the 2% discount and record sales at the time of delivery equal to 98% of the invoice amount. O will individually assess the creditworthiness of each customer to determine how much revenue to recognize. The process of removing a specific customer's account receivable from a company's books when the account is deemed uncollectible is an allowance. O a write off. O a recovery. a O none of the above. When the bad debt estimate is based on the assumption that the amount of bad debt is a function of the total sales made on credit, this method is known as o O the direct writeoff method. M O the percentage receivables method. O the percentage of credit sales method. O aging of accounts receivable method. My The individual account details for each of a company's customers is managed in the O Control account. O Allowance for Doubtful Accounts. O Bad Debts Expense. O subledger A banker contemplating a loan to a company should focus on which section(s) of the Statement of Cash Flows in order to determine the company's ability to repay the loan? O Operating activities O Operating and financing activities O Investing activities O Operating and investing activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started