Answered step by step

Verified Expert Solution

Question

1 Approved Answer

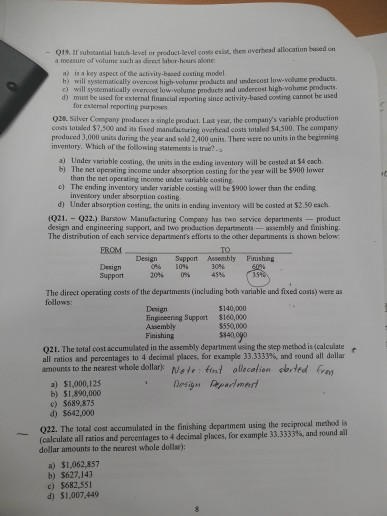

Q19, I suboantial hatch-level or eroductJevel ensts exir them overhead allocation baied on a measure of volume such as diect labor-hours alone a) is a

Q19, I suboantial hatch-level or eroductJevel ensts exir them overhead allocation baied on a measure of volume such as diect labor-hours alone a) is a key aspect of the activity-based costing model. b) will systematically overccet high-volume products and undercost low-volume products ) will systematically overcost low-volume products and undercost high-volume peodocts. d) must be used for external financial renorting since activity-based conting cannot be used. for external reporting purposes Q20. Silver Company produces a single product. Last year, the company's variable production costs totaled $7,500 and its fixed manufacturing overhead costs totaled $4,500. The company produced 3,000 units during the year and sold 2,400 units. There were no units in the beginning. inventory. Which of the following statements is trae? a) Under variable costing, the units in the ending inventory will be costed at $4 each. b) The net operating income under absorption costing for the year will be $900 lower than the net operating income under variable costing c) The ending inventory snder variable costing will be $900 lower than the ending inventory under absorption costing d) Under absorption costing, the units in ending inventory will be costed at $2.50 each (Q21. Q22.) Barssow Manufacturing Compwny has two service departmentsproduct design and engineering support, and two peoduction departments-assembly and finishing. The distribution of each service department's efforts so the odher departments is shown below FROM TO Support Assembly Finishing 60% 35% Design Design Support 10% 30% 20% 0% 45% The direct operating costs of the departments (including both variable and fixed costs) were as follows Design Engineering Support Asembly Finishing $140,000 $160,000 $550,000 $340,090 Q21. The total cost accumulated in the assembly department using the step method is (calculate all ratios and percentages to 4 decimal places, for example 33.33339 % , and round all dollas amounts to the nearest whole dollark ete fint allecalion ortfd Gros a) $1.000.125 b) $1.890,000 Drparlmert Design c) $689.875 d) $642,000 Q22. The total cost accumulated in the finishing department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) a) $1.062.857 b) $627.143 c) $682.551 d) $1.007,449

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started