Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1.Hasan is willing to invest in opening a new training center:Hasan is considering the optionshe has for renting the training center facility. The first option

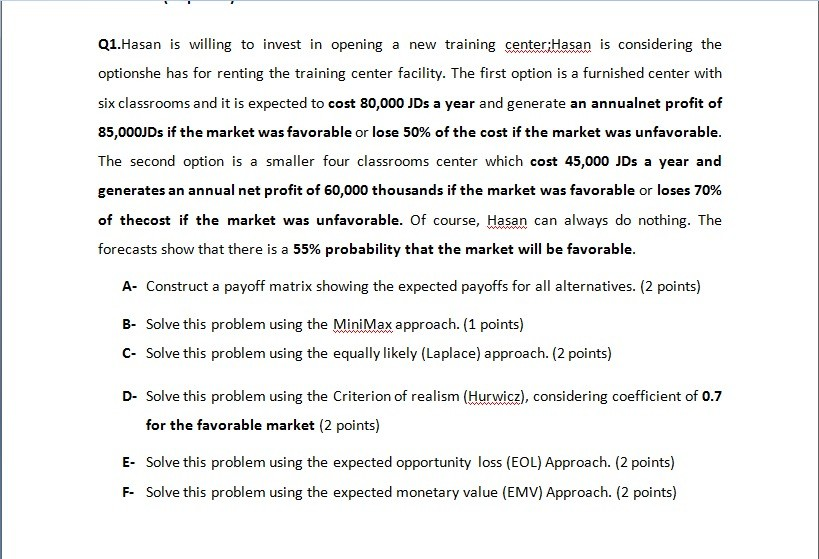

Q1.Hasan is willing to invest in opening a new training center:Hasan is considering the optionshe has for renting the training center facility. The first option is a furnished center with six classrooms and it is expected to cost 80,000 JDs a year and generate an annualnet profit of 85,000JDs if the market was favorable or lose 50% of the cost if the market was unfavorable. The second option is a smaller four classrooms center which cost 45,000 JDs a year and generates an annual net profit of 60,000 thousands if the market was favorable or loses 70% of thecost if the market was unfavorable. Of course, Hasan can always do nothing. The forecasts show that there is a 55% probability that the market will be favorable. A- Construct a payoff matrix showing the expected payoffs for all alternatives. (2 points) B- Solve this problem using the MiniMax approach. (1 points) C- Solve this problem using the equally likely (Laplace) approach. (2 points) D- Solve this problem using the Criterion of realism (Hurwicz), considering coefficient of 0.7 for the favorable market (2 points) E- Solve this problem using the expected opportunity loss (EOL) Approach. (2 points) F- Solve this problem using the expected monetary value (EMV) Approach. (2 points) Q1.Hasan is willing to invest in opening a new training center:Hasan is considering the optionshe has for renting the training center facility. The first option is a furnished center with six classrooms and it is expected to cost 80,000 JDs a year and generate an annualnet profit of 85,000JDs if the market was favorable or lose 50% of the cost if the market was unfavorable. The second option is a smaller four classrooms center which cost 45,000 JDs a year and generates an annual net profit of 60,000 thousands if the market was favorable or loses 70% of thecost if the market was unfavorable. Of course, Hasan can always do nothing. The forecasts show that there is a 55% probability that the market will be favorable. A- Construct a payoff matrix showing the expected payoffs for all alternatives. (2 points) B- Solve this problem using the MiniMax approach. (1 points) C- Solve this problem using the equally likely (Laplace) approach. (2 points) D- Solve this problem using the Criterion of realism (Hurwicz), considering coefficient of 0.7 for the favorable market (2 points) E- Solve this problem using the expected opportunity loss (EOL) Approach. (2 points) F- Solve this problem using the expected monetary value (EMV) Approach. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started