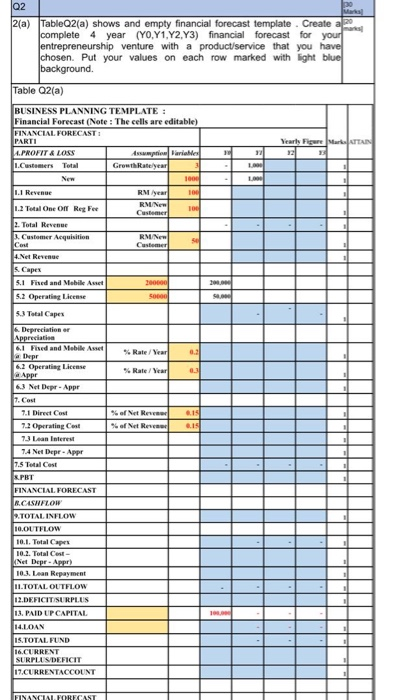

Question: Q2 30 Marta 2(a) TableQ2(a) shows and empty financial forecast template. Create a 20 complete 4 year (YO,Y1, 42,Y3) financial forecast for your entrepreneurship venture

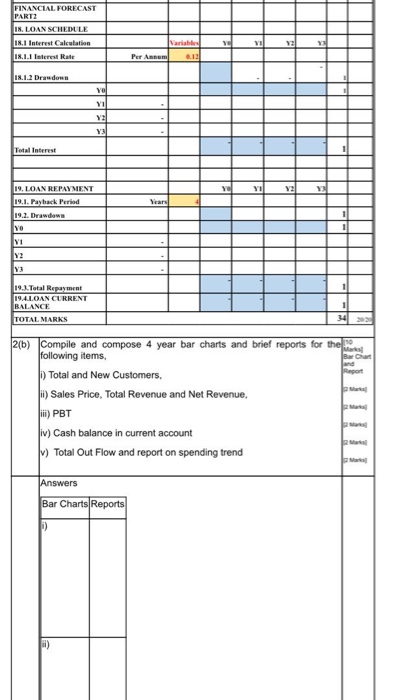

Q2 30 Marta 2(a) TableQ2(a) shows and empty financial forecast template. Create a 20 complete 4 year (YO,Y1, 42,Y3) financial forecast for your entrepreneurship venture with a product/service that you have chosen. Put your values on each row marked with light blue background. Table 02(a) Yearly Figure MATTAN 00 RM BUSINESS PLANNING TEMPLATE: Financial Forecast (Note: The cells are editable) FINANCIAL FORECAST PARTI APROFIT & LOSS IMAftwarMM 1.Customers Total Growth Rate year New 1000 1.1 Revenue 104 1.2 Total One Of Reg Fee RMN 100 Customer 2. Total Revenue 3. Customer Acquisition RMN 90 Cou Customer 4.Net Revenue s Capes 5.1 Fixed and Mobile Asset 200000 5.2 Operating License son % Rate / Year 0. %. Rate / Year % of Net R % of Net Revell .IS 5.3 Total Capes 6. Depreciation or Appreciate 6.1 Fixed and Mobile Asset Depr 62 Operating License a Appr 63 Net Depr - Appr 7. Cou 7.1 Direct Coul 7.2 Operating Cost 73 Lean Interest 7.4 Net Depr - Appr 7.5 Total Cost SPBT FINANCIAL FORECAST N.CASHFLOW 9.TOTAL INFLOW 10.OUTFLOW 10.1. Total Cape 10.2. Total Cost Net Depr. Appr) 103. Lean Repayment 11.TOTAL OUTFLOW 12.DEFICIT SURPLUS 13. PAID UP CAPITAL 14.LOAN 1S.TOTAL FUND 16.CURRENT SURPLUS DEFICIT 17.CURRENTACCOUNT 11 100.00 FINANCIAL FORECAST FINANCIAL FORECAST PART2 18. LOAN SCHEDULE Variable VE V 18.1 Interest Calculation 18.1.1 Interest Rate Per Annum 18.1.2 Drawdown YO YI YE Y3 Total Interest Yal Year 19. LOAN REPAYMENT 19.1. Payback Period 19.2. Drawdown YO Y1 Y2 Y3 19.2. Total Repayment 19.4.LOAN CURRENT BALANCE TOTAL MARKS Barat Report 2(b) Compile and compose 4 year bar charts and brief reports for the following items, Total and New Customers, i) Sales Price, Total Revenue and Net Revenue, PBT iv) Cash balance in current account ) Total Out Flow and report on spending trend Answers Bar Charts Reports ) 1) Bar Charts Reports ) i) MI) iv) v) Q3 10 Q2 30 Marta 2(a) TableQ2(a) shows and empty financial forecast template. Create a 20 complete 4 year (YO,Y1, 42,Y3) financial forecast for your entrepreneurship venture with a product/service that you have chosen. Put your values on each row marked with light blue background. Table 02(a) Yearly Figure MATTAN 00 RM BUSINESS PLANNING TEMPLATE: Financial Forecast (Note: The cells are editable) FINANCIAL FORECAST PARTI APROFIT & LOSS IMAftwarMM 1.Customers Total Growth Rate year New 1000 1.1 Revenue 104 1.2 Total One Of Reg Fee RMN 100 Customer 2. Total Revenue 3. Customer Acquisition RMN 90 Cou Customer 4.Net Revenue s Capes 5.1 Fixed and Mobile Asset 200000 5.2 Operating License son % Rate / Year 0. %. Rate / Year % of Net R % of Net Revell .IS 5.3 Total Capes 6. Depreciation or Appreciate 6.1 Fixed and Mobile Asset Depr 62 Operating License a Appr 63 Net Depr - Appr 7. Cou 7.1 Direct Coul 7.2 Operating Cost 73 Lean Interest 7.4 Net Depr - Appr 7.5 Total Cost SPBT FINANCIAL FORECAST N.CASHFLOW 9.TOTAL INFLOW 10.OUTFLOW 10.1. Total Cape 10.2. Total Cost Net Depr. Appr) 103. Lean Repayment 11.TOTAL OUTFLOW 12.DEFICIT SURPLUS 13. PAID UP CAPITAL 14.LOAN 1S.TOTAL FUND 16.CURRENT SURPLUS DEFICIT 17.CURRENTACCOUNT 11 100.00 FINANCIAL FORECAST FINANCIAL FORECAST PART2 18. LOAN SCHEDULE Variable VE V 18.1 Interest Calculation 18.1.1 Interest Rate Per Annum 18.1.2 Drawdown YO YI YE Y3 Total Interest Yal Year 19. LOAN REPAYMENT 19.1. Payback Period 19.2. Drawdown YO Y1 Y2 Y3 19.2. Total Repayment 19.4.LOAN CURRENT BALANCE TOTAL MARKS Barat Report 2(b) Compile and compose 4 year bar charts and brief reports for the following items, Total and New Customers, i) Sales Price, Total Revenue and Net Revenue, PBT iv) Cash balance in current account ) Total Out Flow and report on spending trend Answers Bar Charts Reports ) 1) Bar Charts Reports ) i) MI) iv) v) Q3 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts