Answered step by step

Verified Expert Solution

Question

1 Approved Answer

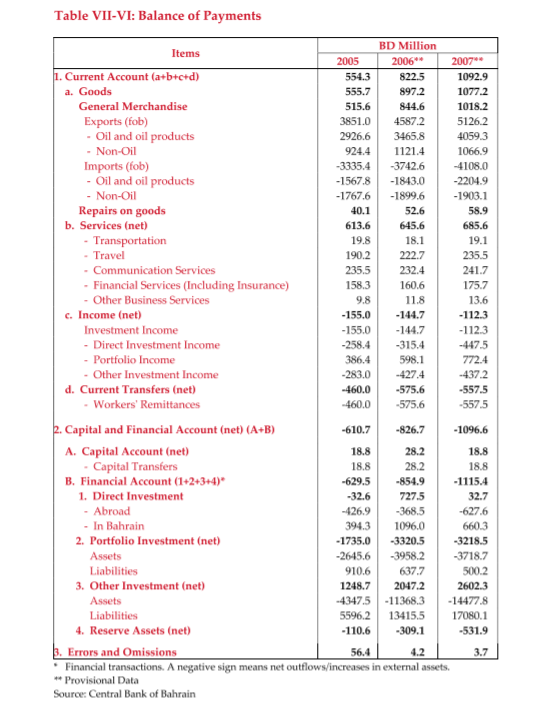

Q2: Based on the Central Bank of Bahrain (CBB) report, which is attached, answer the following: a) List the component of Bahrain BOP (Current-Capital-Finance Account)

Q2: Based on the Central Bank of Bahrain (CBB) report, which is attached, answer the following:

a) List the component of Bahrain BOP (Current-Capital-Finance Account) from the table shown in the report.

b) Bahrain economy has a positive development in 2007, can you explain the reasons lead this surplus in their economy? (Figures are needed)

Table VII-VI: Balance of Payments Items BD Million 2005 2006 2007 1. Current Account (a+b+c+d) 554.3 822.5 1092.9 a. Goods 555.7 8972 1077.2 General Merchandise 515.6 844.6 1018.2 Exports (fob) 3851.0 45872 5126.2 - Oil and oil products 2926.6 3465.8 4059.3 - Non-Oil 924.4 1121.4 1066.9 Imports (fob) -3335.4 -3742.6 -4108.0 - Oil and oil products -1567.8 -1843.0 -2204.9 - Non-Oil -1767.6 -1899.6 -1903.1 Repairs on goods 40.1 52.6 58.9 b. Services (net) 613.6 645.6 685.6 - Transportation 19.8 18.1 19.1 - Travel 190.2 222.7 235.5 - Communication Services 235.5 232.4 241.7 - Financial Services (Including Insurance) 158.3 160.6 175.7 - Other Business Services 9.8 11.8 13.6 C. Income (net) -155.0 -144.7 - 1123 Investment Income -155.0 -144.7 -112.3 - Direct Investment Income -258.4 -315.4 -447.5 - Portfolio Income 386.4 598.1 772.4 Other Investment Income -283.0 -427.4 -4372 d. Current Transfers (net) -460.0 -575.6 -557.5 - Workers' Remittances -460.0 -575,6 -557.5 2. Capital and Financial Account (net) (A+B) -610.7 -826.7 -1096.6 A. Capital Account (net) 18.8 28.2 18.8 - Capital Transfers 18.8 28.2 18.8 B. Financial Account (1+2+3+4)* -629.5 -854.9 -1115.4 1. Direct Investment -32.6 7275 32.7 - Abroad -426.9 -368.5 -627.6 - In Bahrain 394.3 1096.0 660.3 2. Portfolio Investment (net) -1735.0 -3320.5 -3218.5 Assets -2645.6 -3958.2 -3718.7 Liabilities 910.6 637.7 5002 3. Other Investment (net) 1248.7 2047.2 2602.3 Assets -4347.5 -11368.3 -14477.8 Liabilities 5596.2 13415,5 17080.1 4. Reserve Assets (net) -110.6 -309.1 -531.9 3. Errors and Omissions 56.4 4.2 3.7 Financial transactions. A negative sign means net outflows/increases in external assets, ** Provisional Data Source: Central Bank of Bahrain Table VII-VI: Balance of Payments Items BD Million 2005 2006 2007 1. Current Account (a+b+c+d) 554.3 822.5 1092.9 a. Goods 555.7 8972 1077.2 General Merchandise 515.6 844.6 1018.2 Exports (fob) 3851.0 45872 5126.2 - Oil and oil products 2926.6 3465.8 4059.3 - Non-Oil 924.4 1121.4 1066.9 Imports (fob) -3335.4 -3742.6 -4108.0 - Oil and oil products -1567.8 -1843.0 -2204.9 - Non-Oil -1767.6 -1899.6 -1903.1 Repairs on goods 40.1 52.6 58.9 b. Services (net) 613.6 645.6 685.6 - Transportation 19.8 18.1 19.1 - Travel 190.2 222.7 235.5 - Communication Services 235.5 232.4 241.7 - Financial Services (Including Insurance) 158.3 160.6 175.7 - Other Business Services 9.8 11.8 13.6 C. Income (net) -155.0 -144.7 - 1123 Investment Income -155.0 -144.7 -112.3 - Direct Investment Income -258.4 -315.4 -447.5 - Portfolio Income 386.4 598.1 772.4 Other Investment Income -283.0 -427.4 -4372 d. Current Transfers (net) -460.0 -575.6 -557.5 - Workers' Remittances -460.0 -575,6 -557.5 2. Capital and Financial Account (net) (A+B) -610.7 -826.7 -1096.6 A. Capital Account (net) 18.8 28.2 18.8 - Capital Transfers 18.8 28.2 18.8 B. Financial Account (1+2+3+4)* -629.5 -854.9 -1115.4 1. Direct Investment -32.6 7275 32.7 - Abroad -426.9 -368.5 -627.6 - In Bahrain 394.3 1096.0 660.3 2. Portfolio Investment (net) -1735.0 -3320.5 -3218.5 Assets -2645.6 -3958.2 -3718.7 Liabilities 910.6 637.7 5002 3. Other Investment (net) 1248.7 2047.2 2602.3 Assets -4347.5 -11368.3 -14477.8 Liabilities 5596.2 13415,5 17080.1 4. Reserve Assets (net) -110.6 -309.1 -531.9 3. Errors and Omissions 56.4 4.2 3.7 Financial transactions. A negative sign means net outflows/increases in external assets, ** Provisional Data Source: Central Bank of Bahrain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started