Answered step by step

Verified Expert Solution

Question

1 Approved Answer

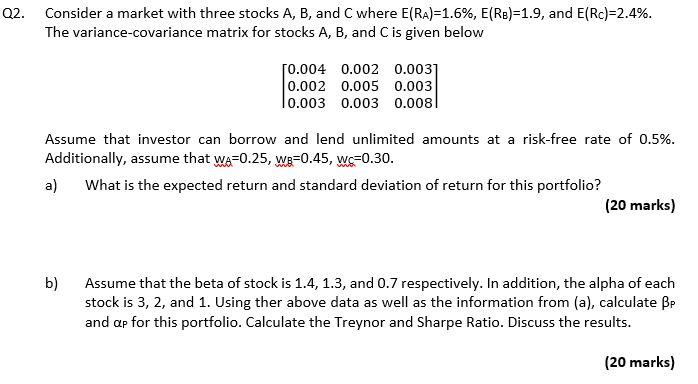

Q2. Consider a market with three stocks A, B, and C where E(Ra)=1.6%, E(Re)=1.9, and E(Rc)=2.4%. The variance-covariance matrix for stocks A, B, and C

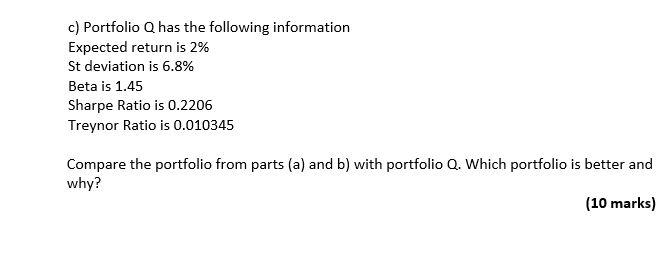

Q2. Consider a market with three stocks A, B, and C where E(Ra)=1.6%, E(Re)=1.9, and E(Rc)=2.4%. The variance-covariance matrix for stocks A, B, and C is given below 50.004 0.002 0.0031 0.002 0.005 0.003 10.003 0.003 0.008 Assume that investor can borrow and lend unlimited amounts at a risk-free rate of 0.5%. Additionally, assume that wa=0.25, we=0.45, W=0.30. a) What is the expected return and standard deviation of return for this portfolio? (20 marks) b) Assume that the beta of stock is 1.4, 1.3, and 0.7 respectively. In addition, the alpha of each stock is 3, 2, and 1. Using ther above data as well as the information from (a), calculate Bp and ap for this portfolio. Calculate the Treynor and Sharpe Ratio. Discuss the results. (20 marks) c) Portfolio Q has the following information Expected return is 2% St deviation is 6.8% Beta is 1.45 Sharpe Ratio is 0.2206 Treynor Ratio is 0.010345 Compare the portfolio from parts (a) and b) with portfolio Q. Which portfolio is better and why? (10 marks) Q2. Consider a market with three stocks A, B, and C where E(Ra)=1.6%, E(Re)=1.9, and E(Rc)=2.4%. The variance-covariance matrix for stocks A, B, and C is given below 50.004 0.002 0.0031 0.002 0.005 0.003 10.003 0.003 0.008 Assume that investor can borrow and lend unlimited amounts at a risk-free rate of 0.5%. Additionally, assume that wa=0.25, we=0.45, W=0.30. a) What is the expected return and standard deviation of return for this portfolio? (20 marks) b) Assume that the beta of stock is 1.4, 1.3, and 0.7 respectively. In addition, the alpha of each stock is 3, 2, and 1. Using ther above data as well as the information from (a), calculate Bp and ap for this portfolio. Calculate the Treynor and Sharpe Ratio. Discuss the results. (20 marks) c) Portfolio Q has the following information Expected return is 2% St deviation is 6.8% Beta is 1.45 Sharpe Ratio is 0.2206 Treynor Ratio is 0.010345 Compare the portfolio from parts (a) and b) with portfolio Q. Which portfolio is better and why? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started