Answered step by step

Verified Expert Solution

Question

1 Approved Answer

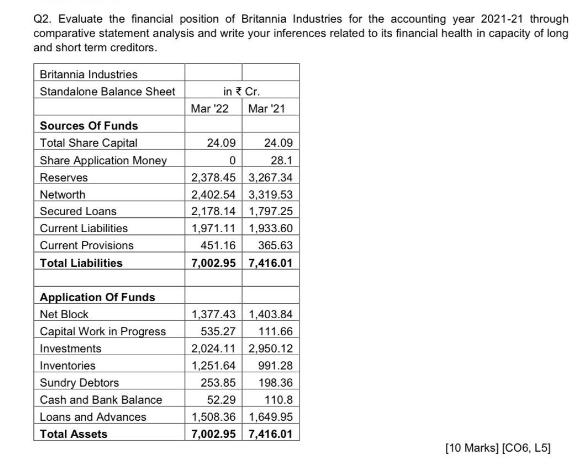

Q2. Evaluate the financial position of Britannia Industries for the accounting year 2021-21 through comparative statement analysis and write your inferences related to its

Q2. Evaluate the financial position of Britannia Industries for the accounting year 2021-21 through comparative statement analysis and write your inferences related to its financial health in capacity of long and short term creditors. Britannia Industries Standalone Balance Sheet Sources Of Funds Total Share Capital Share Application Money in Cr. Mar '22 Mar '21 24.09 24.09 0 28.1 2,378.45 3,267.34 Reserves Networth 2,402.54 3,319.53 Secured Loans 2,178.14 1,797.25 Current Liabilities 1,971.11 1,933.60 Current Provisions Total Liabilities 451.16 365.63 7,002.95 7,416.01 Application Of Funds Net Block 1,377.43 1,403.84 Capital Work in Progress 535.27 111.66 Investments 2,024.11 2,950.12 Inventories 1,251.64 991.28 Sundry Debtors 253.85 198.36 Cash and Bank Balance 52.29 110.8 Loans and Advances 1,508.36 1,649.95 Total Assets 7,002.95 7,416.01 [10 Marks] [CO6, L5]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started