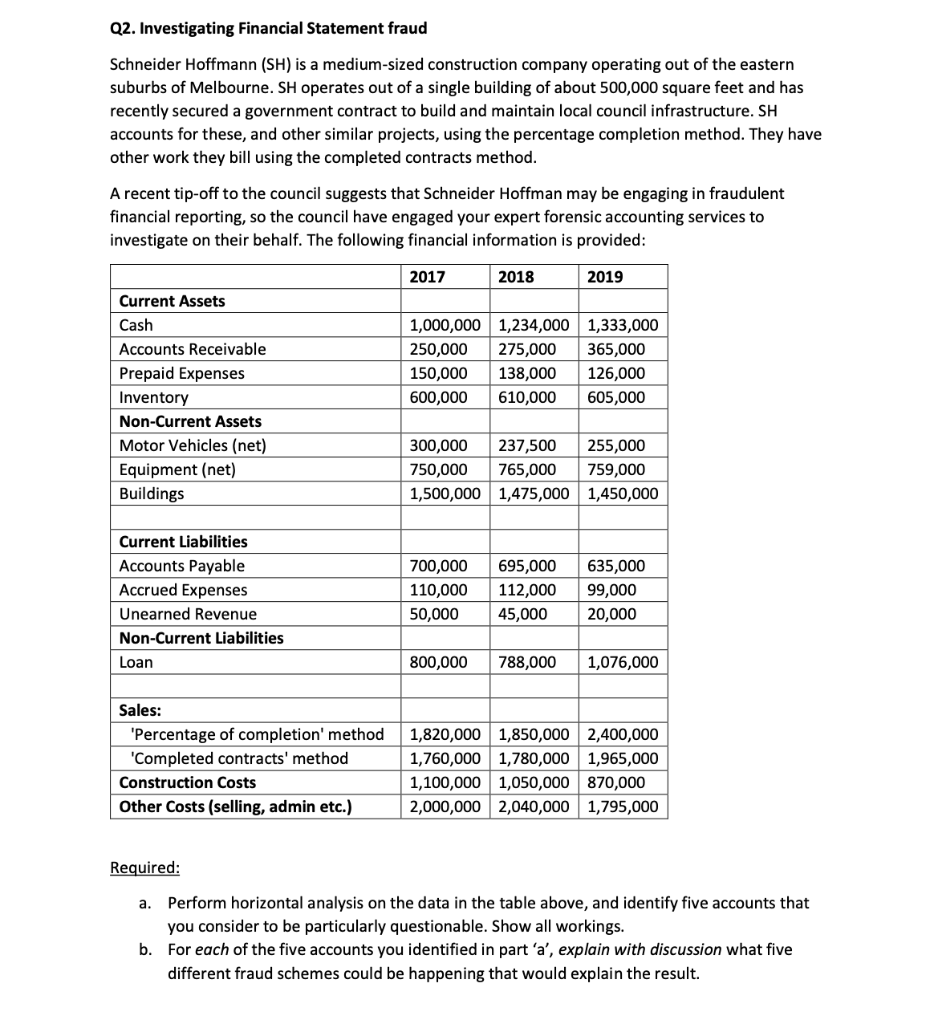

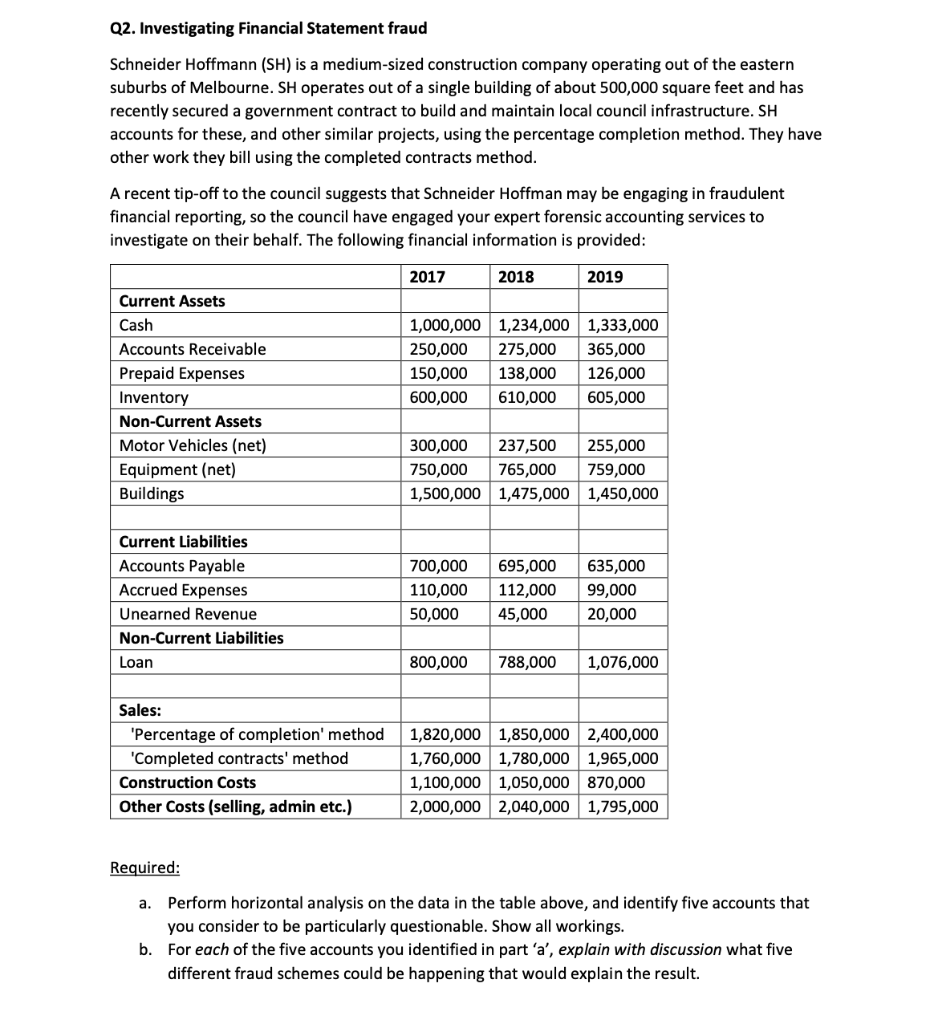

Q2. Investigating Financial Statement fraud Schneider Hoffmann (SH) is a medium-sized construction company operating out of the eastern suburbs of Melbourne. SH operates out of a single building of about 500,000 square feet and has recently secured a government contract to build and maintain local council infrastructure. SH accounts for these, and other similar projects, using the percentage completion method. They have other work they bill using the completed contracts method. A recent tip-off to the council suggests that Schneider Hoffman may be engaging in fraudulent financial reporting, so the council have engaged your expert forensic accounting services to investigate on their behalf. The following financial information is provided: 2017 2018 2019 Current Assets Cash Accounts Receivable Prepaid Expenses Inventory Non-Current Assets Motor Vehicles (net) Equipment (net) Buildings 1,000,000 1,234,000 1,333,000 250,000 275,000 365,000 150,000 138,000 126,000 600,000 610,000 605,000 300,000 237,500 255,000 750,000 765,000 759,000 1,500,000 1,475,000 1,450,000 Current Liabilities Accounts Payable Accrued Expenses Unearned Revenue Non-Current Liabilities Loan 700,000 110,000 50,000 695,000 112,000 45,000 635,000 99,000 20,000 800,000 788,000 1,076,000 Sales: 'Percentage of completion' method 'Completed contracts' method Construction Costs Other Costs (selling, admin etc.) 1,820,000 1,850,000 2,400,000 1,760,000 1,780,000 1,965,000 1,100,000 1,050,000 870,000 2,000,000 2,040,000 1,795,000 Required: a. Perform horizontal analysis on the data in the table above, and identify five accounts that you consider to be particularly questionable. Show all workings. b. For each of the five accounts you identified in part 'a', explain with discussion what five different fraud schemes could be happening that would explain the result. Q2. Investigating Financial Statement fraud Schneider Hoffmann (SH) is a medium-sized construction company operating out of the eastern suburbs of Melbourne. SH operates out of a single building of about 500,000 square feet and has recently secured a government contract to build and maintain local council infrastructure. SH accounts for these, and other similar projects, using the percentage completion method. They have other work they bill using the completed contracts method. A recent tip-off to the council suggests that Schneider Hoffman may be engaging in fraudulent financial reporting, so the council have engaged your expert forensic accounting services to investigate on their behalf. The following financial information is provided: 2017 2018 2019 Current Assets Cash Accounts Receivable Prepaid Expenses Inventory Non-Current Assets Motor Vehicles (net) Equipment (net) Buildings 1,000,000 1,234,000 1,333,000 250,000 275,000 365,000 150,000 138,000 126,000 600,000 610,000 605,000 300,000 237,500 255,000 750,000 765,000 759,000 1,500,000 1,475,000 1,450,000 Current Liabilities Accounts Payable Accrued Expenses Unearned Revenue Non-Current Liabilities Loan 700,000 110,000 50,000 695,000 112,000 45,000 635,000 99,000 20,000 800,000 788,000 1,076,000 Sales: 'Percentage of completion' method 'Completed contracts' method Construction Costs Other Costs (selling, admin etc.) 1,820,000 1,850,000 2,400,000 1,760,000 1,780,000 1,965,000 1,100,000 1,050,000 870,000 2,000,000 2,040,000 1,795,000 Required: a. Perform horizontal analysis on the data in the table above, and identify five accounts that you consider to be particularly questionable. Show all workings. b. For each of the five accounts you identified in part 'a', explain with discussion what five different fraud schemes could be happening that would explain the result