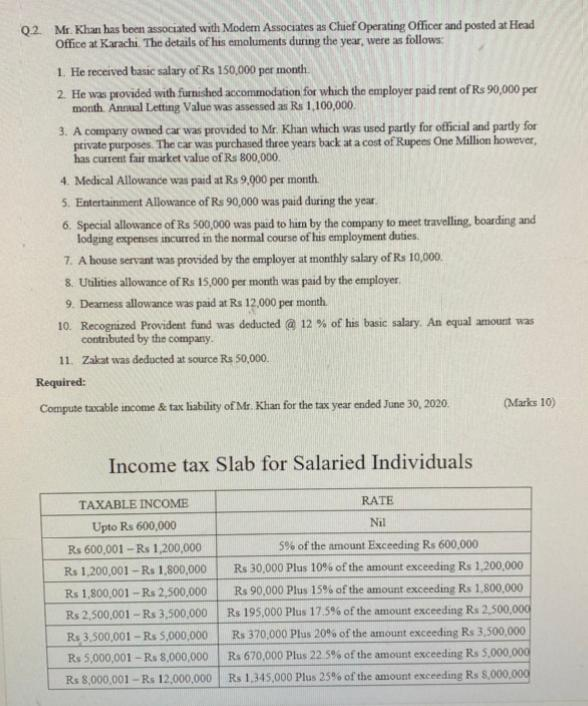

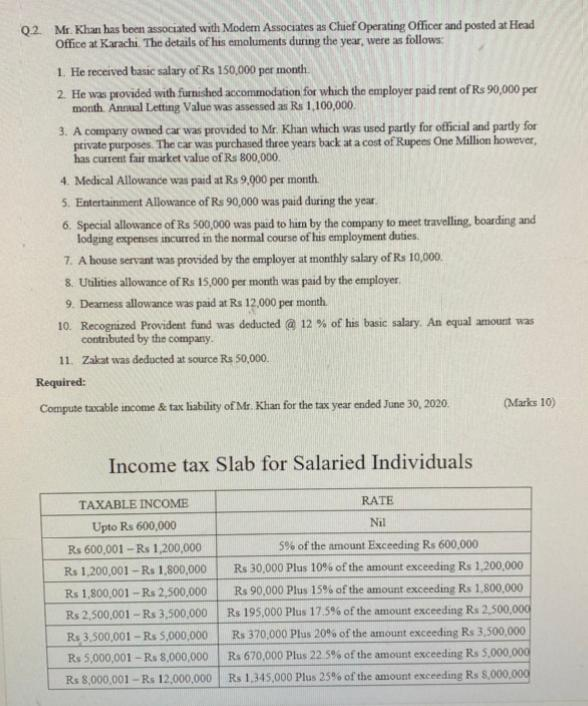

Q2. Mr. Khan has been associated with Modern Associates as Chief Operating Officer and posted at Head Office at Karachi The details of his emoluments during the year, were as follows: 1. He received basic salary of Rs 150,000 per month 2. He was provided with furnished accommodation for which the employer paid rent of Rs 90,000 per month Annual Letting Value was assessed as Rs 1.100,000 3. A company owned car was provided to Mr. Khan which was used partly for official and partly for private purposes. The car was purchased three years back at a cost of Rupees One Million however, has current fair market value of Rs 800,000 4. Medical Allowance was paid at Rs 9,000 per month. 5. Entertainment Allowance of Rs 90,000 was paid during the year 6. Special allowance of Rs 500,000 was paid to him by the company to meet travelling boarding and lodging expertises incured in the normal course of his employment duties. 7. A house servant was provided by the employer at monthly salary of Rs 10,000 8. Utilities allowance of Rs 15,000 per month was paid by the employer, 9. Dearess allowance was paid at Rs 12,000 per month. 10. Recognized Provident fund was deducted @ 12% of his basic salary. An equal amount was contributed by the company. 11. Zakat was deducted at source R$ 50,000 Required: Compute taxable income & tax liability of Mr. Khan for the tax year ended June 30, 2020, (Marks 10) Income tax Slab for Salaried Individuals TAXABLE INCOME RATE Upto Rs 600,000 Nil Rs 600,001 - Rs 1,200,000 5% of the amount Exceeding Rs 600,000 Rs 1,200,001 - Rs 1,800,000 Rs 30,000 Plus 10% of the amount exceeding Rs 1,200,000 Rs 1,800,001 - Rs 2,500,000 R$ 90,000 Plus 15% of the amount exceeding Rs 1,800,000 Rs 2,500,001 -Rs 3,500,000 Rs 195.000 Plus 175% of the amount exceeding Rs 2.500,000 Rs 3.500,001 - Rs 5,000,000 Rs 370,000 Plus 20% of the amount exceeding Rs 3.500.000 Rs 5,000,001 -Rs 8,000,000 Rs 670,000 Plus 22 5% of the amount exceeding Rs 5,000,000 Rs 8,000,001 - Rs 12,000,000 Rs1,345,000 Plus 25% of the amount exceeding Rs 8,000,000 Q2. Mr. Khan has been associated with Modern Associates as Chief Operating Officer and posted at Head Office at Karachi The details of his emoluments during the year, were as follows: 1. He received basic salary of Rs 150,000 per month 2. He was provided with furnished accommodation for which the employer paid rent of Rs 90,000 per month Annual Letting Value was assessed as Rs 1.100,000 3. A company owned car was provided to Mr. Khan which was used partly for official and partly for private purposes. The car was purchased three years back at a cost of Rupees One Million however, has current fair market value of Rs 800,000 4. Medical Allowance was paid at Rs 9,000 per month. 5. Entertainment Allowance of Rs 90,000 was paid during the year 6. Special allowance of Rs 500,000 was paid to him by the company to meet travelling boarding and lodging expertises incured in the normal course of his employment duties. 7. A house servant was provided by the employer at monthly salary of Rs 10,000 8. Utilities allowance of Rs 15,000 per month was paid by the employer, 9. Dearess allowance was paid at Rs 12,000 per month. 10. Recognized Provident fund was deducted @ 12% of his basic salary. An equal amount was contributed by the company. 11. Zakat was deducted at source R$ 50,000 Required: Compute taxable income & tax liability of Mr. Khan for the tax year ended June 30, 2020, (Marks 10) Income tax Slab for Salaried Individuals TAXABLE INCOME RATE Upto Rs 600,000 Nil Rs 600,001 - Rs 1,200,000 5% of the amount Exceeding Rs 600,000 Rs 1,200,001 - Rs 1,800,000 Rs 30,000 Plus 10% of the amount exceeding Rs 1,200,000 Rs 1,800,001 - Rs 2,500,000 R$ 90,000 Plus 15% of the amount exceeding Rs 1,800,000 Rs 2,500,001 -Rs 3,500,000 Rs 195.000 Plus 175% of the amount exceeding Rs 2.500,000 Rs 3.500,001 - Rs 5,000,000 Rs 370,000 Plus 20% of the amount exceeding Rs 3.500.000 Rs 5,000,001 -Rs 8,000,000 Rs 670,000 Plus 22 5% of the amount exceeding Rs 5,000,000 Rs 8,000,001 - Rs 12,000,000 Rs1,345,000 Plus 25% of the amount exceeding Rs 8,000,000