Answered step by step

Verified Expert Solution

Question

1 Approved Answer

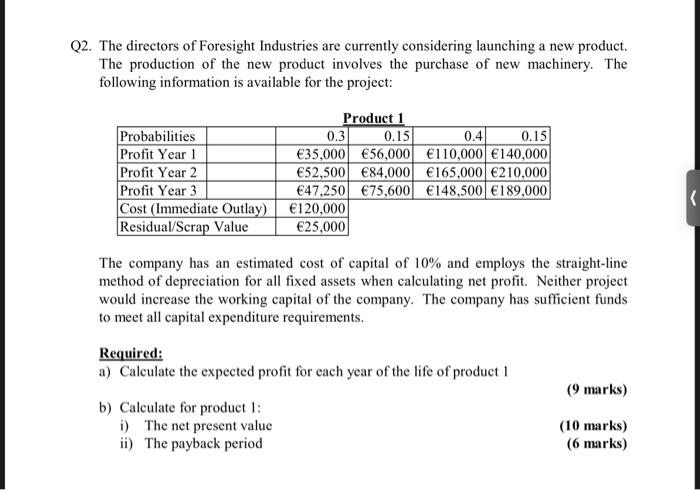

Q2. The directors of Foresight Industries are currently considering launching a new product. The production of the new product involves the purchase of new

Q2. The directors of Foresight Industries are currently considering launching a new product. The production of the new product involves the purchase of new machinery. The following information is available for the project: Probabilities Profit Year 1 Profit Year 2 Profit Year 3 Cost (Immediate Outlay) 120,000 Residual/Scrap Value Product 1 0.3 35,000 56,000 E110,000 140,000 52,500 84,000 165,000 210,000 47,250 75,600 148,500 189,000 0.15 0.4 0.15 25,000 The company has an estimated cost of capital of 10% and employs the straight-line method of depreciation for all fixed assets when calculating net profit. Neither project would increase the working capital of the company. The company has sufficient funds to meet all capital expenditure requirements. Required: a) Calculate the expected profit for each year of the life of product 1 (9 marks) b) Calculate for product 1: i) The net present value ii) The payback period (10 marks) (6 marks)

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Probability 03 015 04 015 100 3500003 56000015 11000004 140000015 5250003 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started