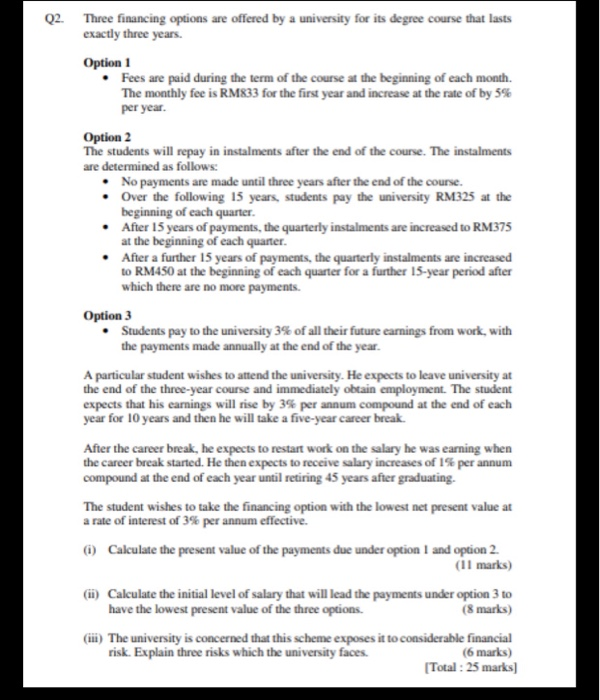

Q2. Three financing options are offered by a university for its degree course that lasts exactly three years. Option 1 Fees are paid during the term of the course at the beginning of each month. The monthly fee is RM833 for the first year and increase at the rate of by 5% per year. Option 2 The students will repay in instalments after the end of the course. The instalments are determined as follows: No payments are made until three years after the end of the course. Over the following 15 years, students pay the university RM325 at the beginning of each quarter. After 15 years of payments, the quarterly instalments are increased to RM375 at the beginning of each quarter. After a further 15 years of payments, the quarterly instalments are increased to RM450 at the beginning of each quarter for a further 15-year period after which there are no more payments. Option 3 Students pay to the university 3% of all their future carnings from work, with the payments made annually at the end of the year. A particular student wishes to attend the university. He expects to leave university at the end of the three-year course and immediately obtain employment. The student expects that his earnings will rise by 3% per annum compound at the end of each year for 10 years and then he will take a five-year career break After the career break, he expects to restart work on the salary he was earning when the career break started. He then expects to receive salary increases of 1% per annum compound at the end of each year until retiring 45 years after graduating. The student wishes to take the financing option with the lowest net present value at a rate of interest of 3% per annum effective. (i) Calculate the present value of the payments due under option 1 and option 2 (11 marks) (ii) Calculate the initial level of salary that will lead the payments under option 3 to have the lowest present value of the three options (8 marks) (ii) The university is concerned that this scheme exposes it to considerable financial risk. Explain three risks which the university faces (6 marks) Total: 25 marks