Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2. You are considering investing $5,000 in a bank term deposit for 3 years. The term deposit will pay a semi-annual interest of 4%

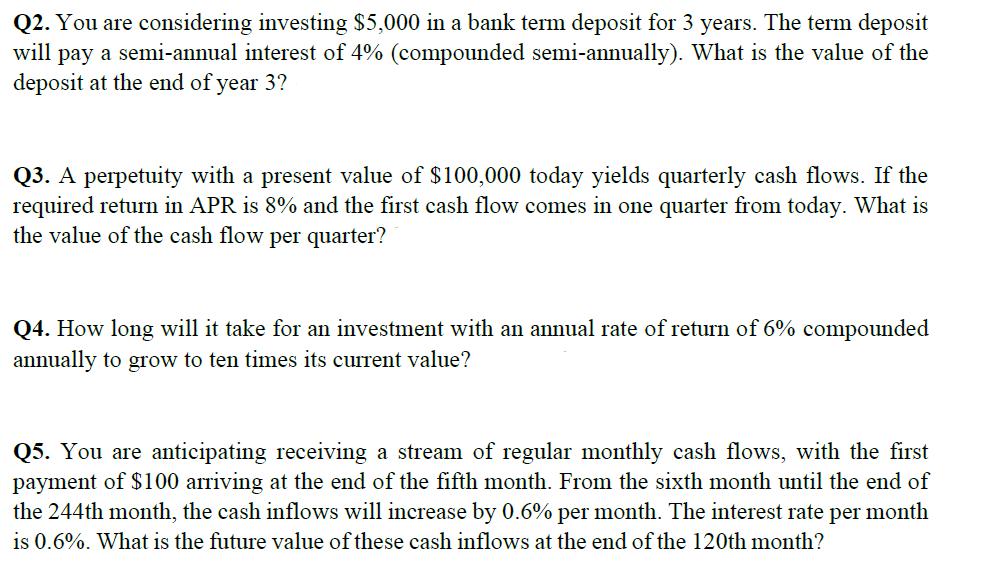

Q2. You are considering investing $5,000 in a bank term deposit for 3 years. The term deposit will pay a semi-annual interest of 4% (compounded semi-annually). What is the value of the deposit at the end of year 3? Q3. A perpetuity with a present value of $100,000 today yields quarterly cash flows. If the required return in APR is 8% and the first cash flow comes in one quarter from today. What is the value of the cash flow per quarter? Q4. How long will it take for an investment with an annual rate of return of 6% compounded annually to grow to ten times its current value? Q5. You are anticipating receiving a stream of regular monthly cash flows, with the first payment of $100 arriving at the end of the fifth month. From the sixth month until the end of the 244th month, the cash inflows will increase by 0.6% per month. The interest rate per month is 0.6%. What is the future value of these cash inflows at the end of the 120th month?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q2 The term deposit pays a semiannual interest of 4 compounded semiannually This means that the interest rate per compounding period is 2 42 and there will be 6 compounding periods over the 3year term ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started