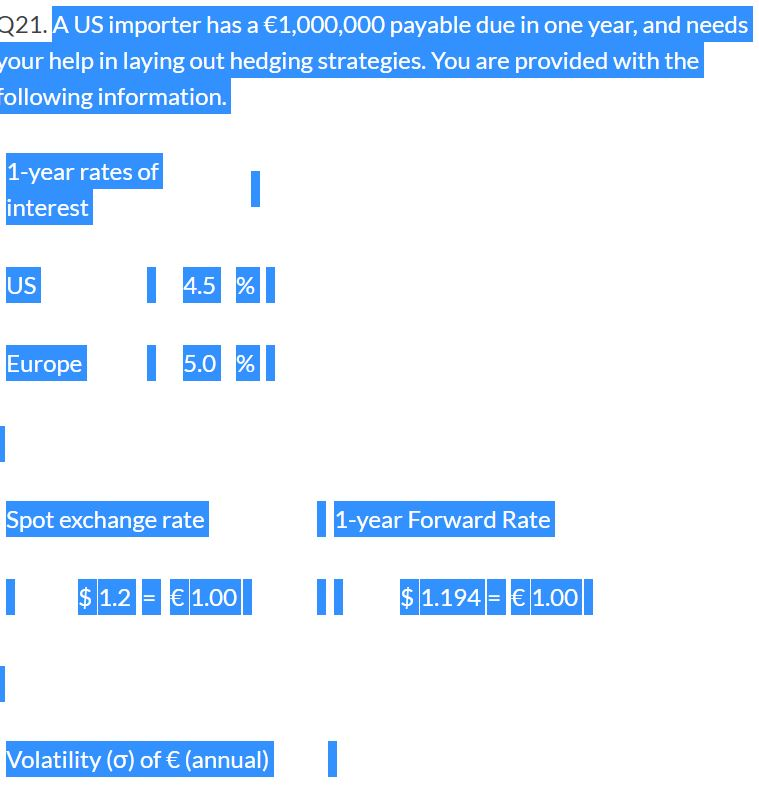

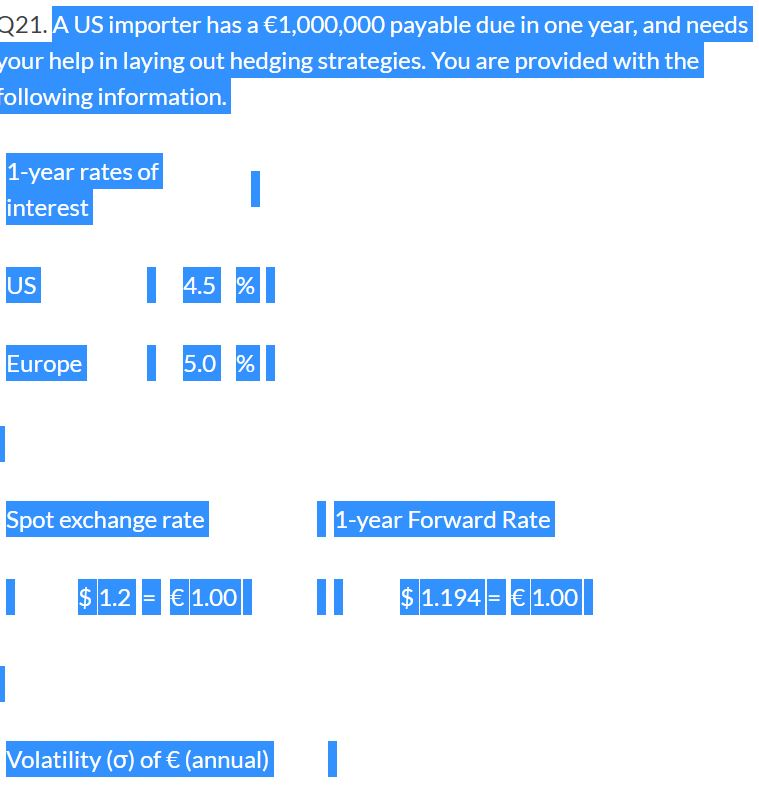

Q21. A US importer has a 1,000,000 payable due in one year, and needs your help in laying out hedging strategies. You are provided with the following information. 1-year rates of interest US 4.5 % Europe 5.0 % Spot exchange rate 1-year Forward Rate $ 1.2 = 1.00 $ 1.194 = 1.00 Volatility () of (annual) 20% (a) The importer is contemplating hedging away this transaction exposure using the forward market or the money market. Before calculating the cost of each, can you tell if one way of hedging will be cheaper (less $ cost to the importer in one year) than the other, and why? (7 points) (b) To convince the importer your conclusion in (a) is correct, show how many $ it has fixed to pay in one year using forward contracts. (3 points) (c) Then show how many $ it has fixed to pay in one year using lending and borrowing in the money market. (8 points) (d) Suddenly, the importer hears about the flexibility of hedging using currency options. But you tell the importer the flexibility comes at a cost. It has to pay for a call option. Now you are charged with the task of valuing an at-the-money call option that expires in one year. Use the same information above and calculate the call price. Note to save you one step, the one-year forward rate (FT) is already given. The normal table is attached below for your reference. (15 points) Normal Table.jpg

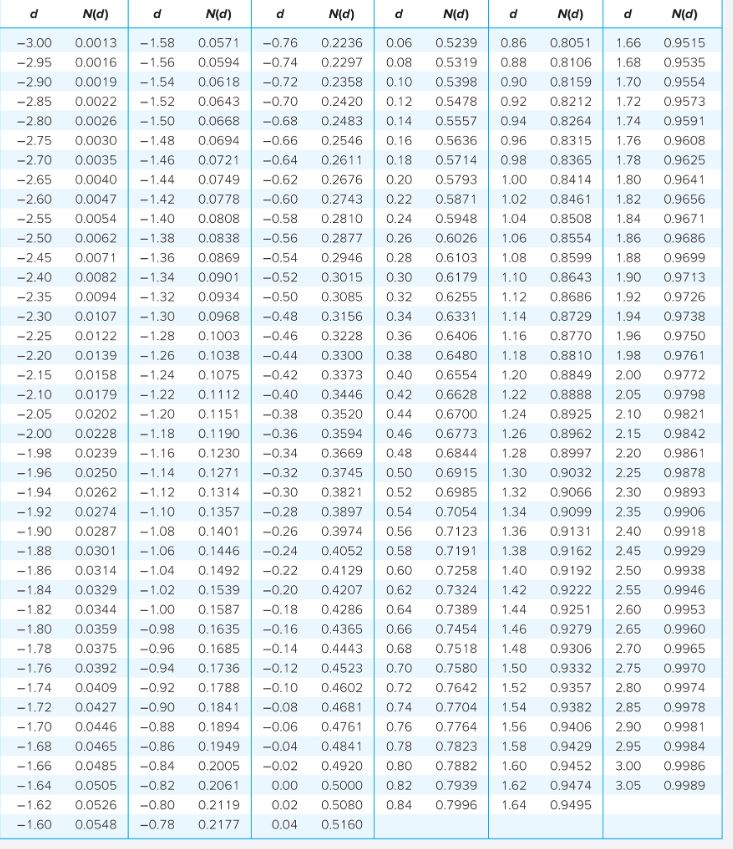

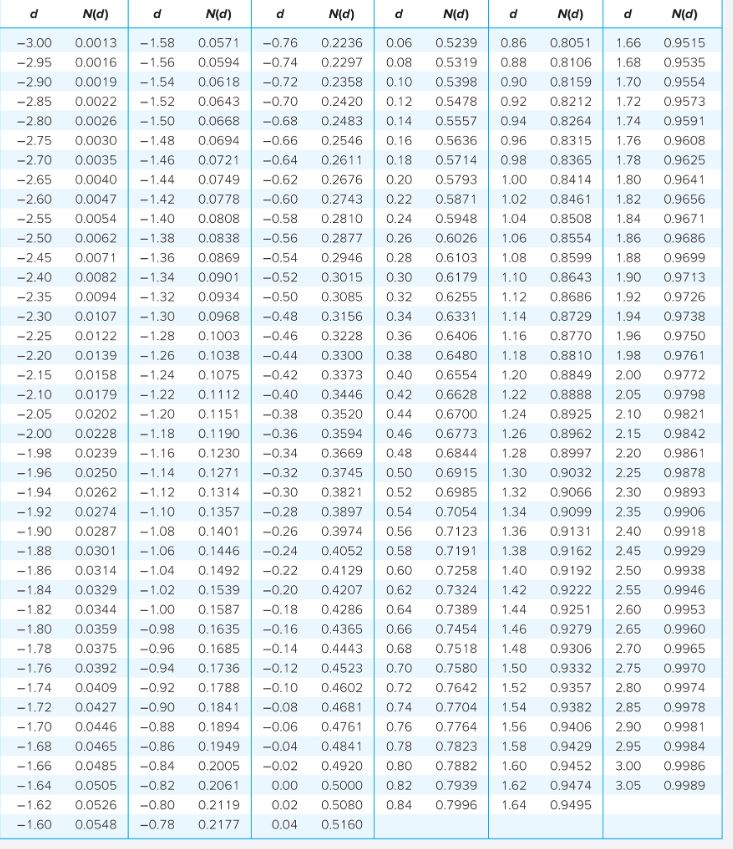

d Nld) d -3.00 -2.95 -2.90 -2.85 -2.80 -2.75 -2.70 -2.65 -2.60 -2.55 -2.50 -2.45 -2.40 -2.35 -2.30 -2.25 -2.20 -2.15 -2.10 -2.05 -2.00 -1.98 -1.96 -1.94 -1.92 -1.90 -1.88 -1.86 -1.84 -1.82 -1.80 -1.78 -1.76 -1.74 -1.72 -1.70 -1.68 -1.66 -1.64 0.0013 0.0016 0.0019 0.0022 0.0026 0.0030 0.0035 0.0040 0.0047 0.0054 0.0062 0.0071 0.0082 0.0094 0.0107 0.0122 0.0139 0.0158 0.0179 0.0202 0.0228 0.0239 0.0250 0.0262 0.0274 0.0287 0.0301 0.0314 0.0329 0.0344 0.0359 0.0375 0.0392 0.0409 0.0427 0.0446 0.0465 0.0485 0.0505 0.0526 0,0548 -1.58 -1.56 -1.54 -1.52 -1.50 -1.48 -1.46 -1.44 -1.42 -1.40 -1.38 -1.36 -1.34 -1.32 -1.30 -1.28 -1.26 -1.24 -1.22 -1.20 -1.18 - 1.16 -1.14 -1.12 -1.10 -1.08 -1.06 -1.04 -1.02 -1.00 -0.98 -0.96 -0.94 -0.92 -0.90 -0.88 -0.86 -0.84 -0.82 -0.80 -0.78 (d) 0.0571 0.0594 0.0618 0.0643 0.0668 0.0694 0.0721 0.0749 0.0778 0.0808 0.0838 0.0869 0.0901 0.0934 0.0968 0.1003 0.1038 0.1075 0.1112 0.1151 0.1190 0.1230 0.1271 0.1314 0.1357 0.1401 0.1446 0.1492 0.1539 0.1587 0.1635 0.1685 0.1736 0.1788 0.1841 0.1894 0.1949 0.2005 0.2061 0.2119 0.2177 dN(d) La -0.76 0.2236 0.06 -0.74 0.2297 0.08 -0.72 0.2358 0.10 -0.70 0.2420 0.12 -0.68 0.2483 0.14 -0.66 0.2546 0.16 -0.64 0.2611 0.18 -0.62 0.2676 0.20 -0.60 0.2743 0.22 -0.58 0.2810 0.24 -0.56 0.2877 0.26 -0.54 0.2946 0.28 -0.52 0.3015 0.30 -0.50 0.3085 0.32 -0.48 0.3156 0.34 -0.46 0.3228 0.36 -0.44 0.3300 0.38 -0.42 0.3373 0.40 -0.40 0.3446 0.42 -0.38 0.3520 0.44 -0.36 0.3594 0.46 -0.34 0.3669 0.48 -0.32 0.3745 0.50 -0.30 0.3821 0.52 -0.28 0.3897 0.54 -0.26 0.3974 0.56 -0.24 0.4052 0.58 -0.22 0.4129 0.60 -0.20 0.4207 0.62 -0.18 0.4286 0.64 -0.16 0.4365 0.66 -0.14 0.4443 0.68 -0.12 0.4523 0.70 -0.10 0.4602 0.72 -0.08 0.4681 0.74 -0.06 0.4761 0.76 -0.04 0.4841 0.78 -0.02 0.4920 0.80 0.00 0.5000 0.82 0.02 0.5080 0.84 0.04 0.5160 Nid) d N(d) d d) 0.52390.86 0.8051 1.66 0.9515 0.5319 0.88 0.8106 1.68 0.9535 0.5398 0.90 0.8159 1.70 0.9554 0.5478 0.92 0.8212 1.72 0.9573 0.5557 0.94 0.8264 1.74 0.9591 0.5636 0.96 0.8315 1.76 0.9608 0.5714 0.98 0.8365 1.78 0.9625 0.5793 1.00 0.8414 1.80 0.9641 0.5871 1.02 0.8461 1.82 0.9656 0.5948 1.04 0.8508 1.84 0.9671 0.6026 1.06 0.8554 1.86 0.9686 0.61031.08 0.8599 1.88 0.9699 0.6179 1.10 0.8643 1.90 0.9713 0.6255 1.120.8686 1.92 0.9726 0.6331 1.14 0.87291.94 0.9738 0.6406 1.16 0.8770 1 .96 0.9750 0.64801.18 0.8810 1.98 0.9761 0.6554 1.20 0.8849 2.00 0.9772 0.6628 1.22 0.8888 2.05 0.9798 0.6700 1.24 0.8925 2.10 0.9821 0.6773 1.26 0.8962 2.15 0.9842 0.6844 1.28 0.8997 2.20 0.9861 0.6915 1.30 0.9032 2.25 0.9878 0.6985 1.32 0.9066 2.30 0.9893 0.7054 1.34 0.9099 2.35 0.9906 0.7123 1.36 0.9131 2.40 0.9918 0.7191 1.38 0.9162 2.45 0.9929 0.7258 1.400.9192 2.50 0.9938 0.7324 1.42 0.9222 2.55 0.9946 0.7389 1.44 0.9251 2.60 0.9953 0.7454 1.46 0.9279 2.65 0.9960 0.7518 1.48 0.9306 2.70 0.9965 0.7580 1.50 0.9332 2.75 0.9970 0.7642 1.52 0.9357 2.800.9974 0.7704 1.54 0.9382 2.85 0.9978 0.7764 1.56 0.9406 2.90 0.9981 0.7823 1.58 0.9429 2.95 0.9984 0.7882 1.60 0.9452 3.00 0.9986 0.7939 1.62 0.9474 3.05 0.9989 0.7996 1.64 0.9495 -1.60 221. A US importer has a 1,000,000 payable due in one year, and needs your help in laying out hedging strategies. You are provided with the Following information. 1-year rates of interest US i 4.5 % Europe Europe | 5.0 %1 Spot exchange rate 1-year Forward Rate I $ 1.2 1.00 11 $ 1.194 = 1.00|| Volatility (o) of (annual)