Answered step by step

Verified Expert Solution

Question

1 Approved Answer

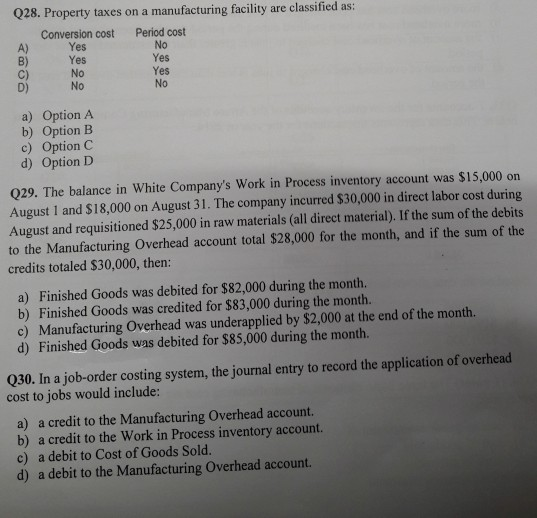

Q28. Property taxes on a manufacturing facility are classified Conversion cost Yes Yes No No Period cost No Yes Yes No A) B) C) D)

Q28. Property taxes on a manufacturing facility are classified Conversion cost Yes Yes No No Period cost No Yes Yes No A) B) C) D) a) Option A b) Option B c) Option C d) Option D Q29. The balance in White Company's Work in Process inventory account was $15,000 orn August 1 and $18,000 on August 31. The company incurred $30,000 in direct labor cost during August and requisitioned $25,000 in raw materials (all direct material). If the sum of the debits to the Manufacturing Overhead account total $28,000 for the month, and if the sum of the credits totaled $30,000, then: a) Finished Goods was debited for $82,000 during the month. b) Finished Goods was credited for $83,000 during the month. c) Manufacturing Overhead was underapplied by $2,000 at the end of the month. d) Finished Goods was debited for $85,000 during the month. Q30. In a job-order costing system, the journal entry to record the application of overhead cost to jobs would include: a) a credit to the Manufacturing Overhead account. b) a credit to the Work in Process inventory account. c) a debit to Cost of Goods Sold. d) a debit to the Manufacturing Overhead account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started