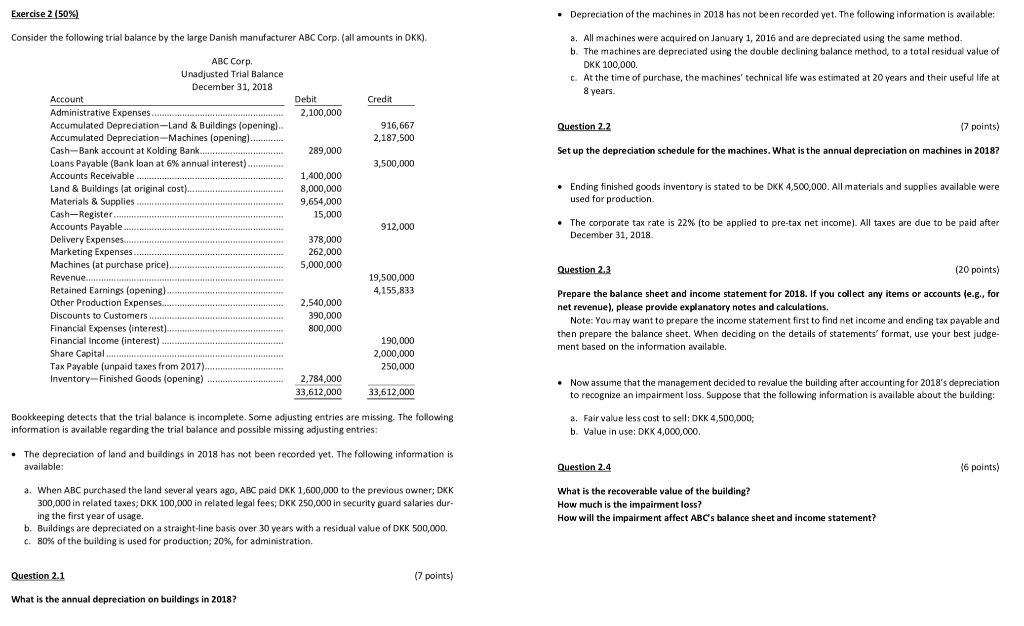

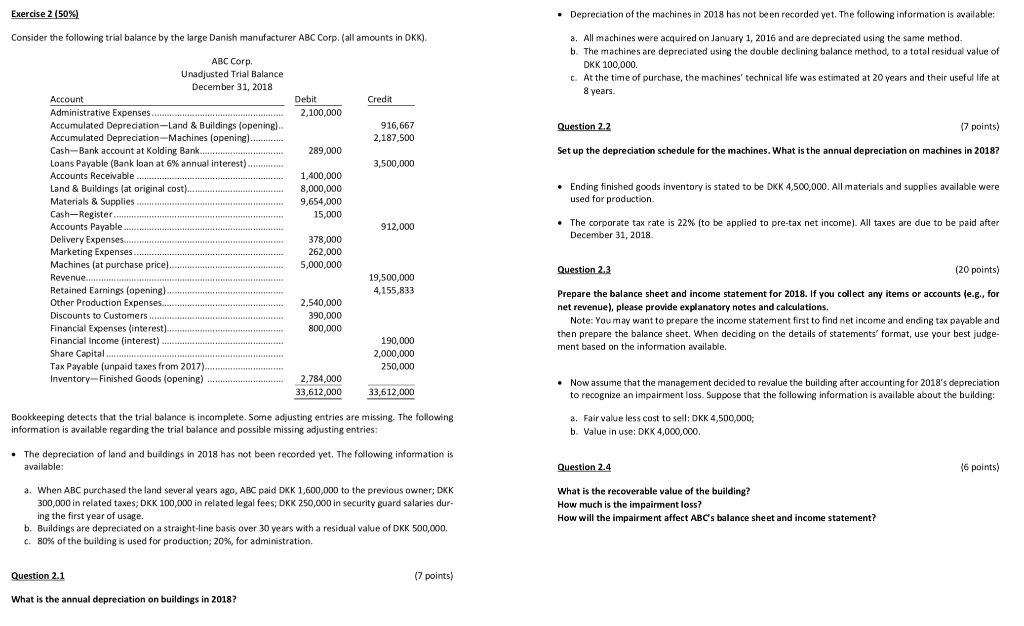

Exercise 2 (50%) Depreciation of the machines in 2018 has not been recorded yet. The following information is available: Consider the following trial balance by the large Danish manufacturer ABC Corp. (all amounts in DKK). a. All machines were acquired on January 1, 2016 and are depreciated using the same method. b. The machines are depreciated using the double declining balance method, to a total residual value of DKK 100,000 c. At the time of purchase, the machines' technical life was estimated at 20 years and their useful life at 8 years Credit Debit 2,100,000 916,667 2.187.500 Question 2.2 (7 points) Set up the depreciation schedule for the machines. What is the annual depreciation on machines in 2018? 289,000 3,500,000 1,400,000 8,000,000 9,654,000 15,000 Ending finished goods inventory is stated to be DKK 4,500,000. All materials and supplies available were used for production ABC Corp. Unadjusted Trial Balance December 31, 2018 Account Administrative Expenses... Accumulated Depreciation-Land & Buildings (opening). Accumulated Depreciation-Machines (opening)... Cash-Bank account at Kolding Bank Loans Payable (Bank loan at 6% annual interest)....... Accounts Receivable. Land & Buildings (at original cost)..... Materials & Supplies Cash Register.. Accounts Payable........ Delivery Expenses..... Marketing Expenses...... Machines (at purchase price). Revenue.... Retained Earnings (opening)..... Other Production Expenses......... Discounts to Customers............ Financial Expenses interest)........... Financial Income (interest)........... Share Capital............ Tax Payable (unpaid taxes from 2017)..... Inventory-Finished Goods (opening) ......... 912,000 The corporate tax rate is 22% to be applied to pre-tax net income). All taxes are due to be paid after December 31, 2018 378,000 262,000 5,000,000 Question 2.3 (20 points) 19,500,000 4,155,833 2,540,000 390,000 800,000 Prepare the balance sheet and income statement for 2018. If you collect any items or accounts (e.g., for net revenue), please provide explanatory notes and calculations. Note: You may want to prepare the income statement first to find net income and ending tax payable and then prepare the balance sheet. When deciding on the details of statements format, use your best judge- ment based on the information available. 190,000 2,000,000 250,000 2,784,000 33,612,000 33,612,000 Now assume that the management decided to revalue the building after accounting for 2018's depreciation to recognize an impairment loss. Suppose that the following information is available about the building: Bookkeeping detects that the trial balance is incomplete. Some adjusting entries are missing. The following information is available regarding the trial balance and possible missing adjusting entries a. Fair value less cost to sell: DKK 4,500,000, b. Value in use: DKK 4,000,000 The depreciation of land and buildings in 2018 has not been recorded yet. The following information is available: Question 2.4 16 points) a. When ABC purchased the land several years ago, ABC paid DKK 1,600,000 to the previous owner; DKK 300,000 in related taxes; DKK 100,000 in related legal fees; DKK 250,000 in security guard salaries dur- ing the first year of usage. b. Buildings are depreciated on a straight-line basis over 30 years with a residual value of DKK 500,000. C. 80% of the building is used for production, 20%, for administration What is the recoverable value of the building? How much is the impairment loss? How will the impairment affect ABC's balance sheet and income statement? Question 2.1 (7 points) What is the annual depreciation on buildings in 2018? Exercise 2 (50%) Depreciation of the machines in 2018 has not been recorded yet. The following information is available: Consider the following trial balance by the large Danish manufacturer ABC Corp. (all amounts in DKK). a. All machines were acquired on January 1, 2016 and are depreciated using the same method. b. The machines are depreciated using the double declining balance method, to a total residual value of DKK 100,000 c. At the time of purchase, the machines' technical life was estimated at 20 years and their useful life at 8 years Credit Debit 2,100,000 916,667 2.187.500 Question 2.2 (7 points) Set up the depreciation schedule for the machines. What is the annual depreciation on machines in 2018? 289,000 3,500,000 1,400,000 8,000,000 9,654,000 15,000 Ending finished goods inventory is stated to be DKK 4,500,000. All materials and supplies available were used for production ABC Corp. Unadjusted Trial Balance December 31, 2018 Account Administrative Expenses... Accumulated Depreciation-Land & Buildings (opening). Accumulated Depreciation-Machines (opening)... Cash-Bank account at Kolding Bank Loans Payable (Bank loan at 6% annual interest)....... Accounts Receivable. Land & Buildings (at original cost)..... Materials & Supplies Cash Register.. Accounts Payable........ Delivery Expenses..... Marketing Expenses...... Machines (at purchase price). Revenue.... Retained Earnings (opening)..... Other Production Expenses......... Discounts to Customers............ Financial Expenses interest)........... Financial Income (interest)........... Share Capital............ Tax Payable (unpaid taxes from 2017)..... Inventory-Finished Goods (opening) ......... 912,000 The corporate tax rate is 22% to be applied to pre-tax net income). All taxes are due to be paid after December 31, 2018 378,000 262,000 5,000,000 Question 2.3 (20 points) 19,500,000 4,155,833 2,540,000 390,000 800,000 Prepare the balance sheet and income statement for 2018. If you collect any items or accounts (e.g., for net revenue), please provide explanatory notes and calculations. Note: You may want to prepare the income statement first to find net income and ending tax payable and then prepare the balance sheet. When deciding on the details of statements format, use your best judge- ment based on the information available. 190,000 2,000,000 250,000 2,784,000 33,612,000 33,612,000 Now assume that the management decided to revalue the building after accounting for 2018's depreciation to recognize an impairment loss. Suppose that the following information is available about the building: Bookkeeping detects that the trial balance is incomplete. Some adjusting entries are missing. The following information is available regarding the trial balance and possible missing adjusting entries a. Fair value less cost to sell: DKK 4,500,000, b. Value in use: DKK 4,000,000 The depreciation of land and buildings in 2018 has not been recorded yet. The following information is available: Question 2.4 16 points) a. When ABC purchased the land several years ago, ABC paid DKK 1,600,000 to the previous owner; DKK 300,000 in related taxes; DKK 100,000 in related legal fees; DKK 250,000 in security guard salaries dur- ing the first year of usage. b. Buildings are depreciated on a straight-line basis over 30 years with a residual value of DKK 500,000. C. 80% of the building is used for production, 20%, for administration What is the recoverable value of the building? How much is the impairment loss? How will the impairment affect ABC's balance sheet and income statement? Question 2.1 (7 points) What is the annual depreciation on buildings in 2018