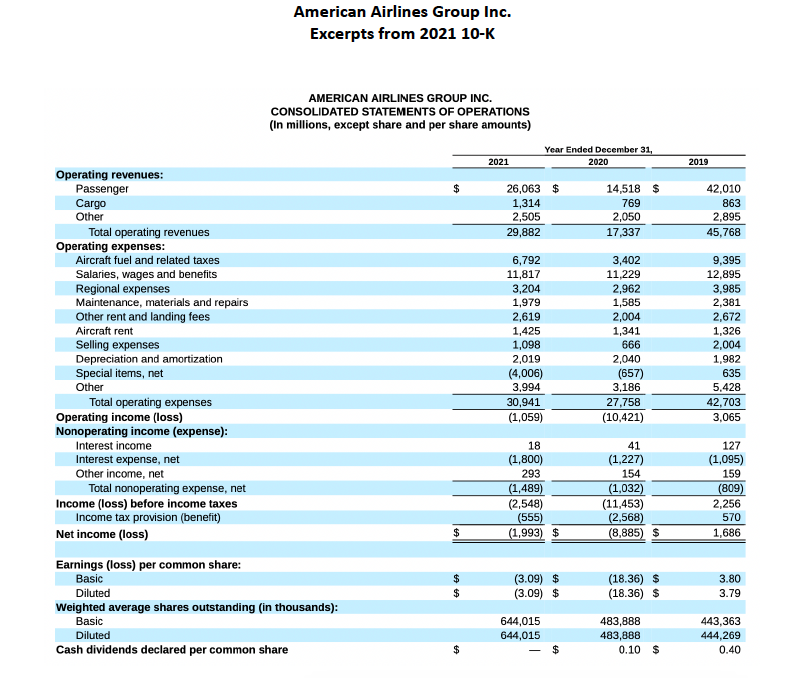

Q2.d. Calculate EBITDA for 2019 (5 points)

Q2.e. Calculate Interest Coverage Ratio: EBITDA/Interest Expense for 2019. (6 points)

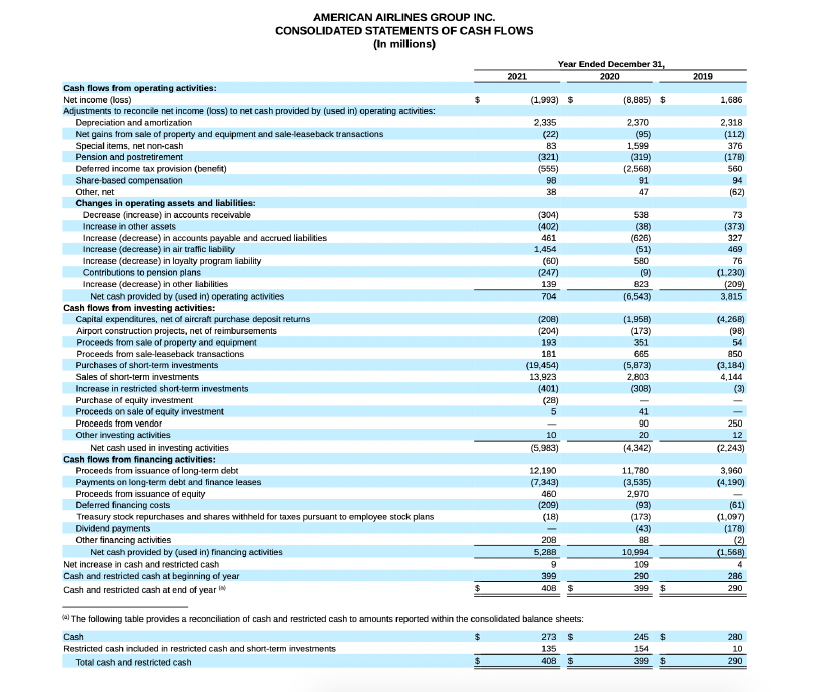

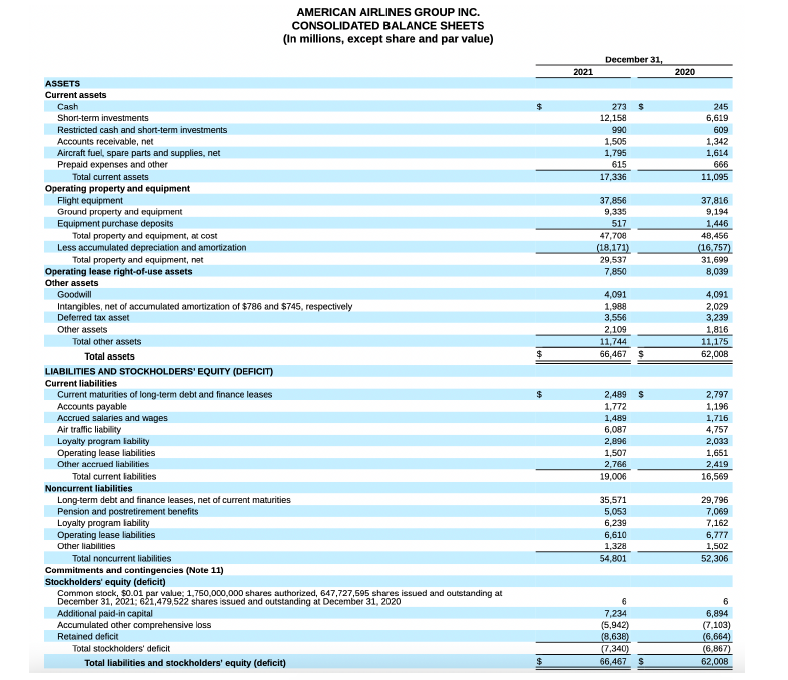

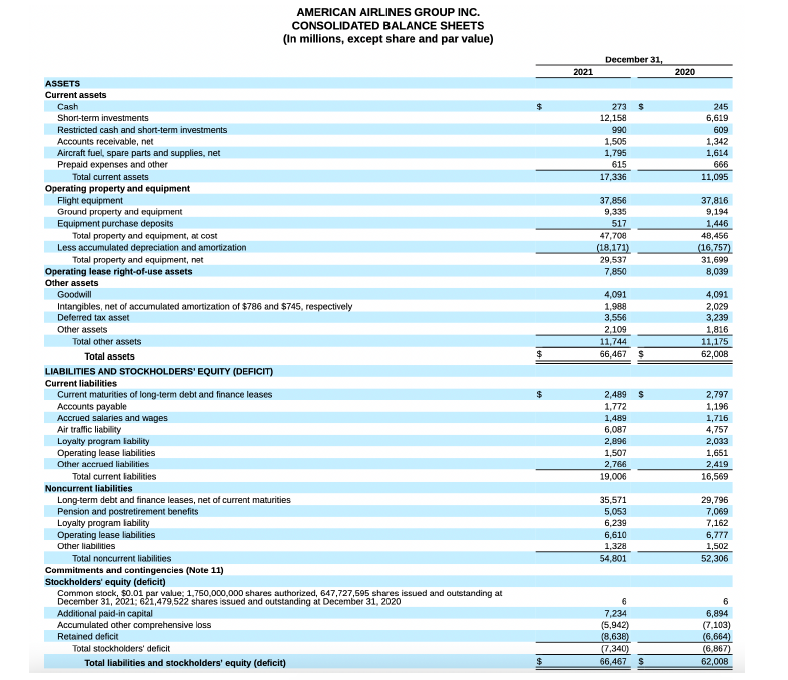

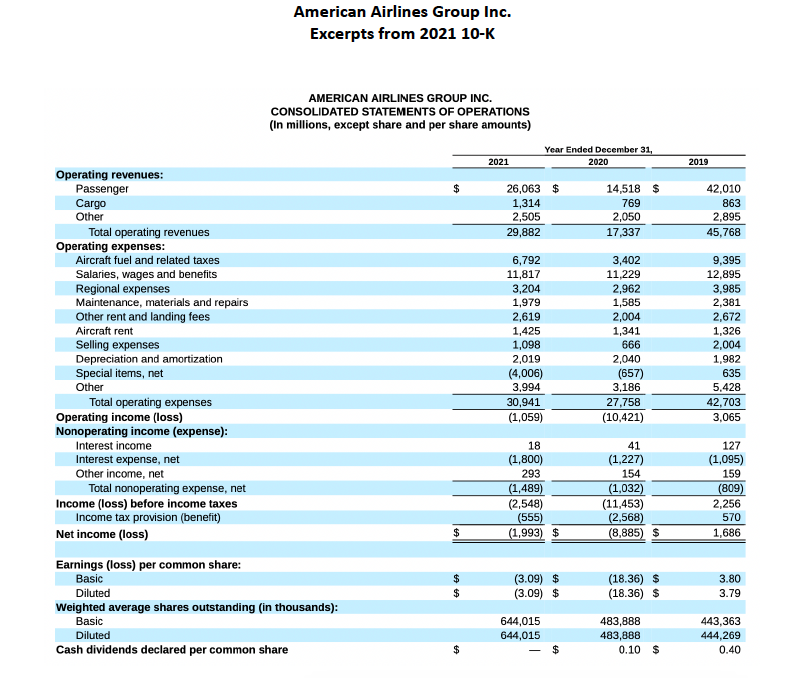

AMERICAN AIRLINES GROUP INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) 2021 Year Ended December 31, 2020 2019 (1.993) $ (8,885) $ 1,686 2,335 (22) 83 (321 (555) 98 3B 2,370 (95) 1,599 (319) (2.568) 91 47 2,318 (112) 376 (178) 560 94 (62) 73 (373) 327 (304) (402) 461 1,454 (60) (247) 139 704 538 (38) (626) (51) 580 (9) 823 (6,543) 469 76 (1.230) (209) 3,815 (1,958) (173) Cash flows from operating activities: Net income (loss) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and amortization Net gains from sale of property and equipment and sale-leaseback transactions Special items, net non-cash Pension and postretirement Deferred income tax provision (benefit) Share-based compensation Other, net Changes in operating assets and liabilities: Decrease increase) in accounts receivable Increase in other assets Increase (decrease in accounts payable and accrued liabilities Increase (decrease) in air traffic liability Increase (decrease in loyalty program liability Contributions to pension plans Increase (decrease) in other liabilities Net cash provided by (used in) operating activities Cash flows from investing activities: Capital expenditures, net of aircraft purchase deposit returns Airport construction projects, net of reimbursements Proceeds from sale of property and equipment Proceeds from sale-leaseback transactions Purchases of short-term investments Sales of short-term investments Increase in restricted short-term investments Purchase of equity investment Proceeds on sale of equity investment Proceeds from vendor Other investing activities Net cash used in investing activities Cash flows from financing activities: Proceeds from issuance of long-term debt Payments on long-term debt and finance leases Proceeds from issuance of equity Deferred financing costs Treasury stock repurchases and shares withheld for taxes pursuant to employee stock plans Dividend payments Other financing activities Net cash provided by (used in) financing activities Net increase in cash and restricted cash Cash and restricted cash at beginning of year Cash and restricted cash at end of year 351 665 (208) (204) 193 181 (19,454) 13,923 (401) (28) 5 (4.268) (98) 54 850 (3,184) 4,144 (3) (5,873) 2.803 (308) 41 90 20 (4,342) 10 (5.983) 250 12 (2.243) 3,960 (4,190) 12,190 (7,343) 460 (209) (18) 11,780 (3,535) 2.970 (93) (173) (43) 38 10,994 208 5,268 9 399 (61) (1,097) (178) (2) (1.568) 4 286 290 109 290 40B $ 399 $ vel The following table provides a reconciliation of cash and restricted cash to amounts reported within the consolidated balance sheets: Cash $ Restricted cash included in restricted cash and short-term investments Total cash and restricted cash 273 135 408 245 154 399 280 10 290 $ $ $ AMERICAN AIRLINES GROUP INC. CONSOLIDATED BALANCE SHEETS (In millions, except share and par value) December 31, 2021 2020 $ 273 12,158 990 1,505 1,795 615 17,336 245 6,619 609 1,342 1,614 666 11,095 37,856 9,335 517 47,700 (18,171) 29,537 7,850 37,816 9,194 1,446 48,456 (16.757) 31,699 8,039 4,091 1,999 3,556 2,109 11,744 66,467 4,091 2,029 3,239 1,816 11,175 62,00B S ASSETS Current assets Cash Short-term investments Restricted cash and short-term investments Accounts receivable, net Aircraft fuel, spare parts and supplies, net Prepaid expenses and other Total current assets Operating property and equipment Flight equipment Ground property and equipment Equipment purchase deposits Total property and equipment, at cost Less accumulated depreciation and amortization Total property and equipment, net Operating lease right-of-use assets Other assets Goodwill Intangibles, net of accumulated amortization of $786 and $745, respectively Deferred tax asset Other assets Total other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) Current liabilities Current maturities of long-term debt and finance leases Accounts payable Accrued salaries and wages Air traffic liability Loyalty program lability Operating lease liabilities Other accrued liabilities Total current labilities Noncurrent liabilities Long-term debt and finance leases, net of current maturities Pension and postretirement benefits Loyalty program lability Operating lease liabilities Other liabilities Total noncurrent liabilities Commitments and contingencies (Note 11) Stockholders' equity (deficit) Common stock, $0.01 par value: 1,750,000,000 shares authorized, 647,727,595 shares issued and outstanding at December 31, 2021; 621,479,522 shares issued and outstanding at December 31, 2020 Additional paid-in capital Accumulated other comprehensive loss Retained deficit Total stockholders' deficit Total liabilities and stockholders' equity (deficit) $ 2,489 1,772 1,489 6,087 2,896 1,507 2,766 19,006 2,797 1,196 1,716 4,757 2,033 1,651 2,419 16,569 35,571 5,053 6,239 6,610 1,328 54,801 29,796 7,069 7,162 6,777 1,502 52,306 6 7,234 (5,942) (8,638) (7,340) 66,467 6 6,894 (7.103) (6,664) (6,867) 62,008 $ American Airlines Group Inc. Excerpts from 2021 10-K AMERICAN AIRLINES GROUP INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share and per share amounts) Year Ended December 31, 2020 2021 2019 26,063 $ 1,314 2,505 29,882 14,518 $ 769 2,050 17,337 42,010 863 2,895 45,768 Operating revenues: Passenger Cargo Other Total operating revenues Operating expenses: Aircraft fuel and related taxes Salaries, wages and benefits Regional expenses Maintenance, materials and repairs Other rent and landing fees Aircraft rent Selling expenses Depreciation and amortization Special items, net Other Total operating expenses Operating income (loss) Nonoperating income (expense): Interest income Interest expense, net Other income, net Total nonoperating expense, net Income (loss) before income taxes Income tax provision (benefit) Net income (loss) 6,792 11,817 3,204 1,979 2,619 1,425 1,098 2,019 (4,006) 3,994 30,941 (1,059) 3,402 11,229 2,962 1,585 2,004 1,341 666 2,040 (657) 3,186 27,758 (10,421) 9,395 12,895 3,985 2,381 2,672 1,326 2,004 1,982 635 5.428 42,703 3,065 18 (1,800) 293 (1,489) (2,548) (555) (1,993) $ 41 (1,227) 154 (1,032) (11,453) (2,568) (8,885) $ 127 (1,095) 159 (809) 2,256 570 1,686 $ (3.09) $ (3.09) $ (18.36) $ (18.36) $ 3.80 3.79 Earnings (loss) per common share: Basic Diluted Weighted average shares outstanding (in thousands): Basic Diluted Cash dividends declared per common share 644,015 644,015 483,888 483,888 0.10 $ 443,363 444,269 0.40 $ $