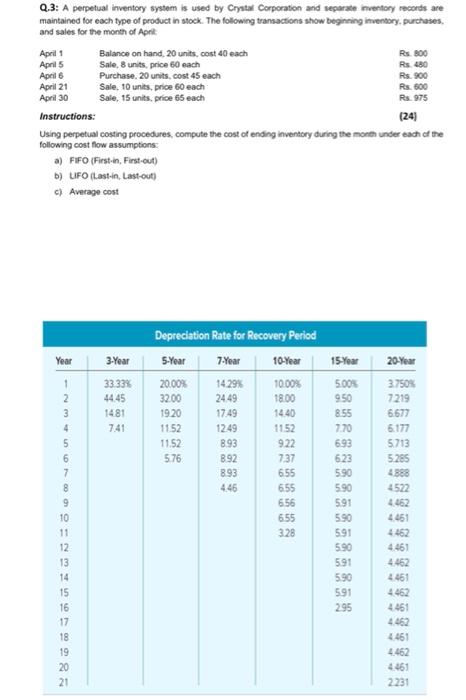

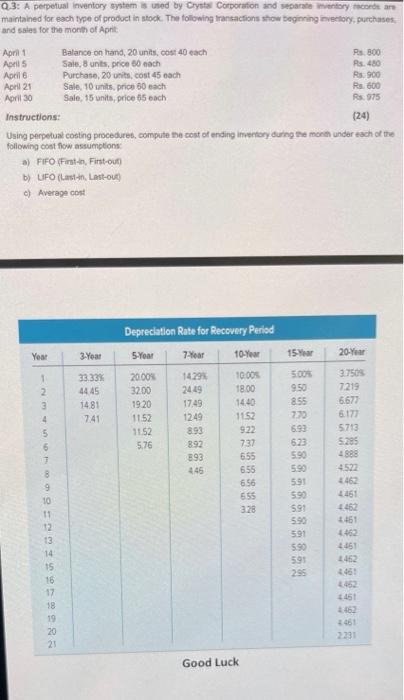

Q.3: A perpetual inventory system is used by Crystal Corporation and separate inventory records are maintained for each type of product in stock. The following transactions show beginning inventory purchases, and sales for the month of April April 1 Balance on hand. 20 units, cost 40 each Rs.800 April 5 Sale, 8 units, price 60 each Rs. 480 April 6 Purchase. 20 units, cost 45 each Rs.900 April 21 Sale, 10 units, price 60 each Rs. 600 April 30 Sale, 15 units, price 65 each Rs. 975 Instructions: (24) Using perpetual costing procedures, compute the cost of ending inventory during the month under each of the following cost flow assumptions a) FIFO (First-in, First-out) b) LIFO (Last-in, Last-out) c) Average cost Year 3-Year 33.33% 44 45 1481 7.41 Depreciation Rate for Recovery Period 5-Year 7 Year 10-Year 20.00% 14.29% 10.00% 32.00 2449 18.00 19.20 17:49 14.40 11.52 1249 11.52 11.52 8.93 922 576 B92 7.37 893 655 446 655 656 6.55 328 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 15 Year 5.00% 950 8.55 7.70 693 623 5.90 590 591 590 591 590 591 590 591 295 20-Year 3.750% 7219 6.677 6.177 5713 5.265 4888 4522 4.461 4462 4.461 4.462 4.461 4462 4461 4462 4461 4.462 4.461 2231 0.3: A perpetual inventory system is used by Crystal Corporation and separate entory records are maintained for each type of product in stock. The following transactions show beginning insory, purchases and sales for the month of April April 1 Balance on hand, 20 units, cost 40 each Rs. 800 April 5 Salents, price 60 each Rs.480 April Purchase, 20 units, cost 45 nach R900 April 21 Sale, 10 units, price 50 each Rs 500 April 30 Sale, 15 units, price 65 each R975 Instructions: (24) Using perpetu conting procedures, compute the cost of ending Inventory during the more under each of the following cost flow assumptions a) FIFO (First First-out) b) UFO (Last-n, Last-out c) Average cost Depreciation Rate for Recovery Period Your 3-Year 5 Your 7-Year 10-Year 15-Year 20-Year 33.33% 44 45 14.81 741 5.00 9.50 8.55 20.000 32.00 19.20 11.52 1152 5.76 14293 2419 17,49 1249 893 892 893 446 10.000 18.00 14.40 1152 922 737 655 6.55 6.56 6.93 623 590 5.90 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 37503 7.219 6677 6.177 5713 5285 1888 4.522 4462 4451 4462 1.161 4462 16 2462 461 655 591 590 591 3.28 590 591 5.90 590 298 45 163 2231 Good Luck