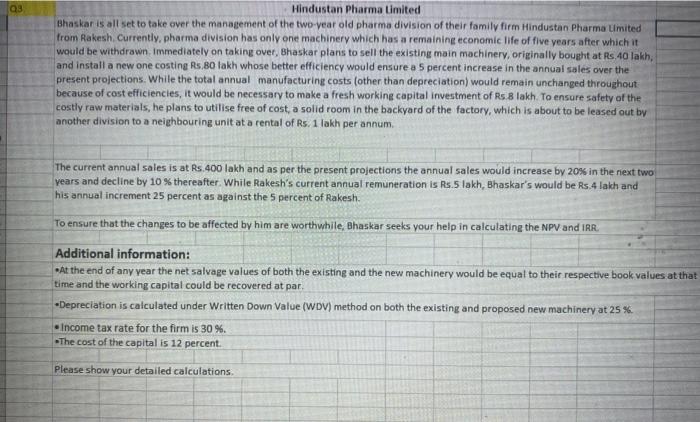

Q3 Hindustan Pharma Limited Bhaskar is all set to take over the management of the two-year old pharma division of their family firm Hindustan Pharma Limited from Rakesh Currently, pharma division has only one machinery which has a remaining economic life of five years after which it would be withdrawn. Immediately on taking over, Bhaskar plans to sell the existing main machinery, originally bought at Rs. 40 lakh, and install a new one costing Rs 80 lakh whose better efficiency would ensure a 5 percent increase in the annual sales over the present projections. While the total annual manufacturing costs (other than depreciation) would remain unchanged throughout because of cost efficiencies, it would be necessary to make a fresh working capital investment of Rs 8 lakh. To ensure safety of the costly raw materials, he plans to utilise free of cost, a solid room in the backyard of the factory, which is about to be leased out by another division to a neighbouring unit at a rental of Rs. 1 lakh per annum The current annual sales is at Rs.400 lakh and as per the present projections the annual sales would increase by 20% in the next two years and decline by 10% thereafter. While Rakesh's current annual remuneration is Rs. 5 lakh, Bhaskar's would be Rs 4 lakh and his annual increment 25 percent as against the 5 percent of Rakesh. To ensure that the changes to be affected by him are worthwhile, Bhaskar seeks your help in calculating the NPV and IRR. Additional information: At the end of any year the net salvage values of both the existing and the new machinery would be equal to their respective book values at that time and the working capital could be recovered at par Depreciation is calculated under Written Down Value (WDV) method on both the existing and proposed new machinery at 25 % Income tax rate for the firm is 30 %. The cost of the capital is 12 percent. Please show your detailed calculations Q3 Hindustan Pharma Limited Bhaskar is all set to take over the management of the two-year old pharma division of their family firm Hindustan Pharma Limited from Rakesh Currently, pharma division has only one machinery which has a remaining economic life of five years after which it would be withdrawn. Immediately on taking over, Bhaskar plans to sell the existing main machinery, originally bought at Rs. 40 lakh, and install a new one costing Rs 80 lakh whose better efficiency would ensure a 5 percent increase in the annual sales over the present projections. While the total annual manufacturing costs (other than depreciation) would remain unchanged throughout because of cost efficiencies, it would be necessary to make a fresh working capital investment of Rs 8 lakh. To ensure safety of the costly raw materials, he plans to utilise free of cost, a solid room in the backyard of the factory, which is about to be leased out by another division to a neighbouring unit at a rental of Rs. 1 lakh per annum The current annual sales is at Rs.400 lakh and as per the present projections the annual sales would increase by 20% in the next two years and decline by 10% thereafter. While Rakesh's current annual remuneration is Rs. 5 lakh, Bhaskar's would be Rs 4 lakh and his annual increment 25 percent as against the 5 percent of Rakesh. To ensure that the changes to be affected by him are worthwhile, Bhaskar seeks your help in calculating the NPV and IRR. Additional information: At the end of any year the net salvage values of both the existing and the new machinery would be equal to their respective book values at that time and the working capital could be recovered at par Depreciation is calculated under Written Down Value (WDV) method on both the existing and proposed new machinery at 25 % Income tax rate for the firm is 30 %. The cost of the capital is 12 percent. Please show your detailed calculations