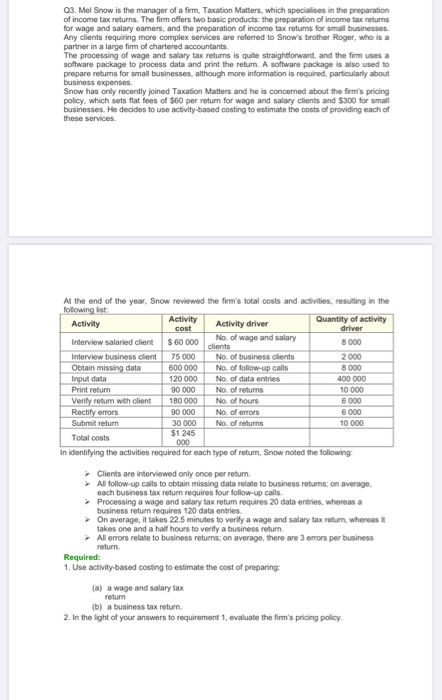

Q3. Mel Snow is the manager of a firm, Taxation Matters, which specialises in the preparation of income tax returns. The firm offers two basic products: the preparation of income tax returns for wage and salary camers, and the preparation of income tax returns for small businesses Any clients requiring more complex services are referred to Snow's brother Roger, who is a partner in a large firm of chartered accountants. The processing of wage and salary tax returns is quite straightforward, and the firm uses a software package to process data and print the return. A software package is also used to prepare returns for small businesses, although more information is required, particularly about business expenses Snow has only recently joined Taxation Matters and he is concerned about the firm's pricing policy, which sets flat fees of $60 per return for wage and salary clients and $300 for small businesses. He decides to use activity-based costing to estimate the costs of providing each of these services At the end of the year, Snow reviewed the firm's total costs and activities, resulting in the following list Activity Activity cost Activity driver Quantity of activity driver Interview salaried client $ 60 000 No. of wage and salary 8 000 clients Interview business client 75 000 No. of business clients 2000 Obtain missing data 600 000 No. of follow-up calls 8 000 Input data 120 000 No. of data entries 400 000 Print return 90 000 No. of returns 10 000 Verify return with client 180 000 No. of hours 6 000 Rectify errors 90 000 No. of errors 6 000 Submit return 30 000 No. of returns 10 000 $1 245 Total costs 000 In identifying the activities required for each type of return, Snow noted the following Clients are interviewed only once per return All follow-up calls to obtain missing data relate to business returns, on average. each business tax return requires four follow-up calls. Processing a wage and salary tax retum requires 20 data entries, whereas a business return requires 120 data entries On average, it takes 225 minutes to verify a wage and salary tax return, whereas takes one and a half hours to verify a business return All errors relate to business returns, on average, there are 3 errors per business return Required: 1. Use activity-based costing to estimate the cost of preparing: (a) a wage and salary tax return (b) a business tax return 2. In the light of your answers to requirement 1, evaluate the firm's pricing policy