Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete the FWT and SWT columns of the payroll register for TCLH Industries. Note that although the Voluntary Withholdings column will require additional updating in

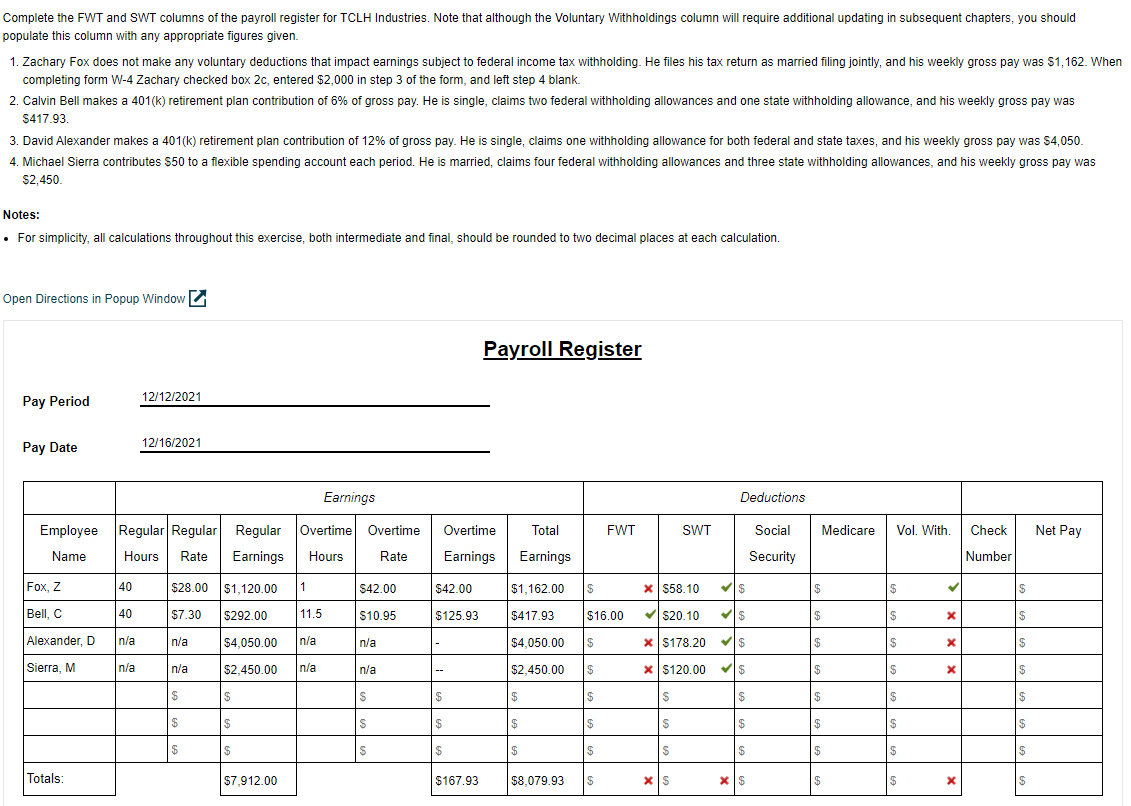

Complete the FWT and SWT columns of the payroll register for TCLH Industries. Note that although the Voluntary Withholdings column will require additional updating in subsequent chapters, you should populate this column with any appropriate figures given.

Zachary Fox does not make any voluntary deductions that impact earnings subject to federal income tax withholding. He files his tax return as married filing jointly, and his weekly gross pay was $ When completing form W Zachary checked box c entered $ in step of the form, and left step blank.

Calvin Bell makes a k retirement plan contribution of of gross pay. He is single, claims two federal withholding allowances and one state withholding allowance, and his weekly gross pay was $

David Alexander makes a k retirement plan contribution of of gross pay. He is single, claims one withholding allowance for both federal and state taxes, and his weekly gross pay was $

Michael Sierra contributes $ to a flexible spending account each period. He is married, claims four federal withholding allowances and three state withholding allowances, and his weekly gross pay was $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started