Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Q3 & Q4 share the same info) On Jan 1, Year 1, Norwegian Co. signed a 10 year lease for a piece of equipment. The

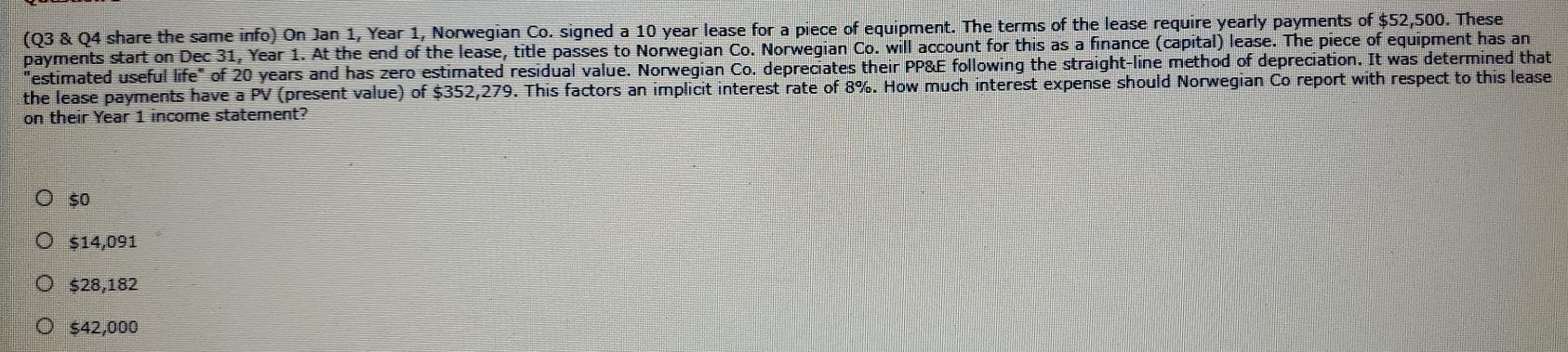

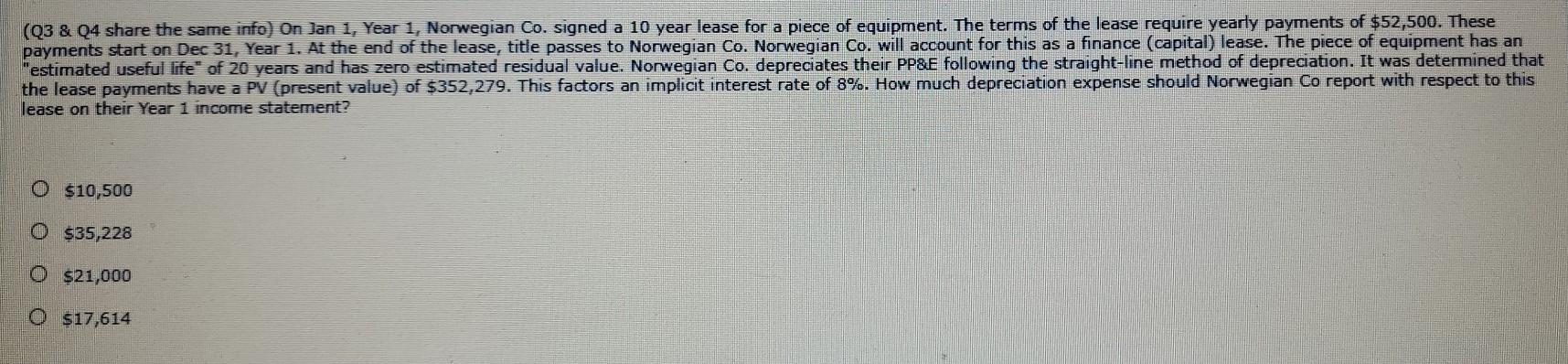

(Q3 & Q4 share the same info) On Jan 1, Year 1, Norwegian Co. signed a 10 year lease for a piece of equipment. The terms of the lease require yearly payments of $52,500. These payments start on Dec 31, Year 1. At the end of the lease, title passes to Norwegian Co. Norwegian Co. will account for this as finance (capital) lease. The piece of equipment has an "estimated useful life of 20 years and has zero estimated residual value. Norwegian Co. depreciates their PP&E following the straight-line method of depreciation. It was determined that the lease payments have a PV (present value) of $352,279. This factors an implicit interest rate of 8%. How much interest expense should Norwegian Co report with respect to this lease on their Year 1 income statement? O so 0 $14,091 O $28,182 O $42,000 (Q3 & Q4 share the same info) On Jan 1, Year 1, Norwegian Co. signed a 10 year lease for a piece of equipment. The terms of the lease require yearly payments of $52,500. These payments start on Dec 31, Year 1. At the end of the lease, title passes to Norwegian Co. Norwegian Co. will account for this as a finance (capital) lease. The piece of equipment has an "estimated useful life of 20 years and has zero estimated residual value. Norwegian Co. depreciates their PP&E following the straight-line method of depreciation. It was determined that the lease payments have a PV (present value) of $352,279. This factors an implicit interest rate of 8%. How much depreciation expense should Norwegian Co report with respect to this lease on their Year 1 income statement? 0 $10,500 O $35,228 O $21,000 O $17,614

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started