Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3. The traditional manufacturing overhead allocation method is appropriate when the manufacturing overhead is relatively small. In this method, the entire factory overhead is treated

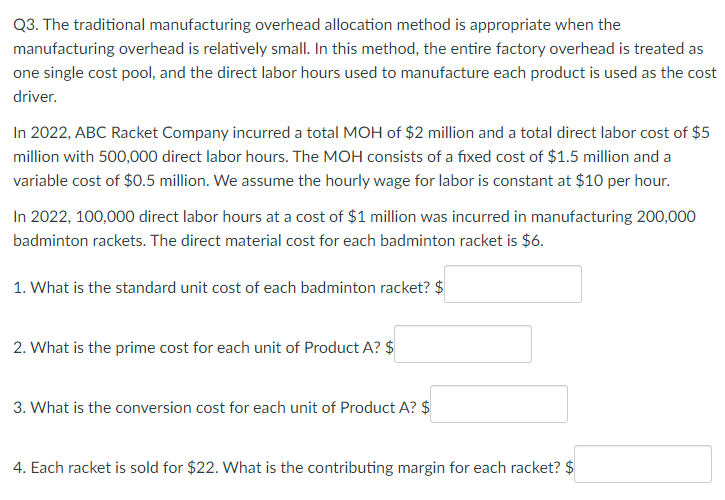

Q3. The traditional manufacturing overhead allocation method is appropriate when the manufacturing overhead is relatively small. In this method, the entire factory overhead is treated as one single cost pool, and the direct labor hours used to manufacture each product is used as the cost driver. In 2022, ABC Racket Company incurred a total MOH of $2 million and a total direct labor cost of $5 million with 500,000 direct labor hours. The MOH consists of a fixed cost of $1.5 million and a variable cost of $0.5 million. We assume the hourly wage for labor is constant at $10 per hour. In 2022, 100,000 direct labor hours at a cost of $1 million was incurred in manufacturing 200,000 badminton rackets. The direct material cost for each badminton racket is $6. 1. What is the standard unit cost of each badminton racket? \$ 2. What is the prime cost for each unit of Product A ? \$ 3. What is the conversion cost for each unit of Product A ? \$ 4. Each racket is sold for $22. What is the contributing margin for each racket? \$

Q3. The traditional manufacturing overhead allocation method is appropriate when the manufacturing overhead is relatively small. In this method, the entire factory overhead is treated as one single cost pool, and the direct labor hours used to manufacture each product is used as the cost driver. In 2022, ABC Racket Company incurred a total MOH of $2 million and a total direct labor cost of $5 million with 500,000 direct labor hours. The MOH consists of a fixed cost of $1.5 million and a variable cost of $0.5 million. We assume the hourly wage for labor is constant at $10 per hour. In 2022, 100,000 direct labor hours at a cost of $1 million was incurred in manufacturing 200,000 badminton rackets. The direct material cost for each badminton racket is $6. 1. What is the standard unit cost of each badminton racket? \$ 2. What is the prime cost for each unit of Product A ? \$ 3. What is the conversion cost for each unit of Product A ? \$ 4. Each racket is sold for $22. What is the contributing margin for each racket? \$ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started