Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information of Ahmed relates to the 2023 year of assessment: Income He earned a salary of R480 000. Net rentals of R60 000

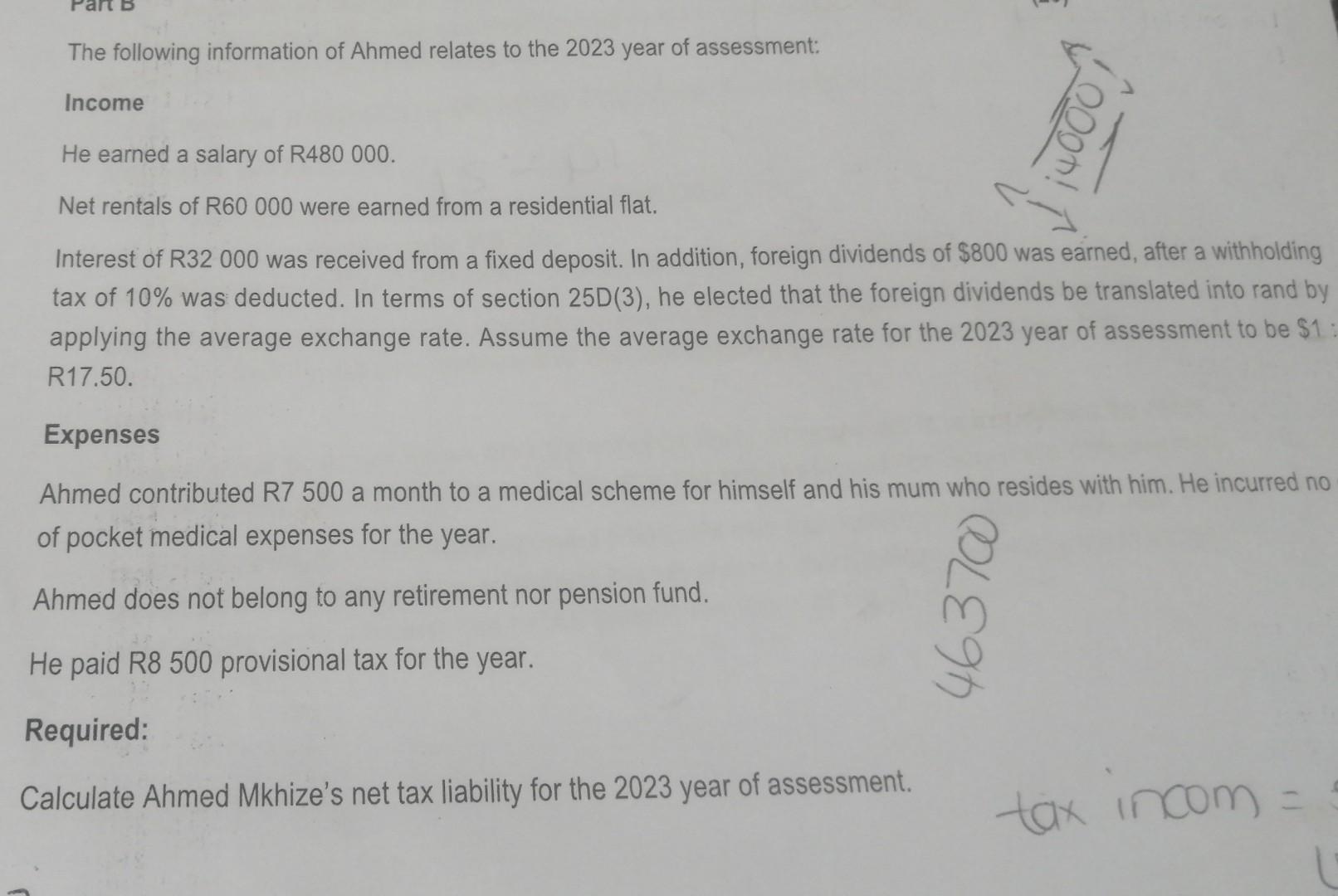

The following information of Ahmed relates to the 2023 year of assessment: Income He earned a salary of R480 000. Net rentals of R60 000 were earned from a residential flat. Interest of R32 000 was received from a fixed deposit. In addition, foreign dividends of $800 was earned, after a withholding tax of 10% was deducted. In terms of section 25D(3), he elected that the foreign dividends be translated into rand by applying the average exchange rate. Assume the average exchange rate for the 2023 year of assessment to be $1 R17.50. Expenses Ahmed contributed R7 500 a month to a medical scheme for himself and his mum who resides with him. He incurred no of pocket medical expenses for the year. Ahmed does not belong to any retirement nor pension fund. He paid R8 500 provisional tax for the year. Required: Calculate Ahmed Mkhize's net tax liability for the 2023 year of assessment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started